Apartment Building Syndication: The Complete Guide to Profitable Real Estate Deals

Apartment Building Syndication: The Complete Guide to Profitable Real Estate Deals

Master apartment building syndication with proven strategies that drive measurable results. Learn from industry veterans how to evaluate, structure, and profit from multifamily real estate investments.

Domingo Valadez

Feb 17, 2025

Blog

Understanding The Foundations of Successful Syndication

Apartment building syndication enables investors to jointly purchase larger properties by combining their resources. Success in syndication requires understanding the key components: the essential roles, legal requirements, and effective communication practices. Getting these fundamentals right creates the foundation for profitable deals.

Key Roles in Apartment Building Syndication

Several critical players work together to make syndications successful:

- The Sponsor (Syndicator/General Partner): Acts as the lead manager who finds properties, arranges financing, manages renovations, and oversees the investment. The sponsor carries primary responsibility for the project's performance and outcomes.

- The Investors (Limited Partners): Provide the capital funding and participate as limited partners. Their liability is restricted to their investment amount. They receive income and appreciation benefits without handling daily operations.

- Property Management Company: Handles on-site operations like maintenance, tenant relations, and rent collection. This allows the sponsor to concentrate on investment strategy and returns.

- Lenders: Supply the debt financing needed to purchase properties. Their loan terms and interest rates directly impact the deal's financial success. Getting competitive financing is essential for profitability.

Legal and Structural Considerations

The legal framework for apartment syndications includes several key elements:

- Legal Structure: Most syndications use limited partnerships or LLCs for tax benefits and liability protection.

- Private Placement Memorandum (PPM): This document details the investment opportunity, including property information, financial projections, and risk factors.

- Securities Regulations: Because syndications typically involve security sales, they must comply with federal and state securities laws.

- Operating Agreement: Defines the roles, responsibilities, and profit-sharing between sponsors and investors. This agreement guides how the syndication operates.

Communication and Transparency: The Cornerstone of Success

Regular, open communication between sponsors and investors builds trust and alignment. Sponsors should provide consistent updates on:

- Property performance metrics like occupancy rates and income

- Market conditions and trends

- Any challenges or changes to plans

- Financial reports and distributions

Clear communication helps prevent misunderstandings and keeps investors confident in the investment. When sponsors maintain transparency about both successes and setbacks, it creates strong long-term partnerships essential for syndication success.

Navigating Market Dynamics and Economic Influences

Success in apartment building syndication requires a deep understanding of market forces and economic factors. Smart investors don't just look at today's conditions - they analyze trends and adjust their approach based on where the market is heading. This forward-thinking mindset helps them spot promising opportunities early.

Understanding Economic Signals

Key economic indicators shape real estate investment decisions by providing insights into market shifts. For example, population changes significantly impact housing needs - when young professionals move into an area in large numbers, rental demand typically rises. Similarly, job growth in a region tends to boost housing demand.

Interest rates play a major role in apartment syndication success. When rates go up, borrowing becomes more expensive, which can affect property values and profits. For instance, higher rates often lead to increased capitalization rates, potentially reducing property values. Learn more about how economic factors impact real estate syndication here. Understanding these relationships helps investors make better choices.

Responding to Market Shifts

Top syndicators modify their strategies as market conditions change. This flexibility helps them handle market ups and downs while finding new opportunities. In times of high interest rates, they might focus on properties with strong cash flow and ways to improve operations. When rates are expected to drop, they often look for properties they can upgrade in growing areas.

Practical Approaches to Market Analysis

Successful investors use proven methods to find hidden opportunities and avoid common mistakes. They examine deeper factors that drive market trends, not just surface-level data. A key tool is comparative market analysis - studying similar properties nearby to determine fair prices and spot chances to increase income.

Understanding local conditions is essential. Knowledge of zoning rules, regulations, and development plans reveals potential growth areas or challenges ahead. By studying these elements, syndicators can make smarter investment choices and find promising locations. This combination of careful analysis and market knowledge sets apart the most successful apartment building syndicators.

Mastering Essential Performance Metrics

Good understanding of performance metrics is key to making smart choices in apartment building syndication. These metrics help turn raw numbers into clear insights that guide investment decisions.

Key Metrics for Evaluating Syndication Investments

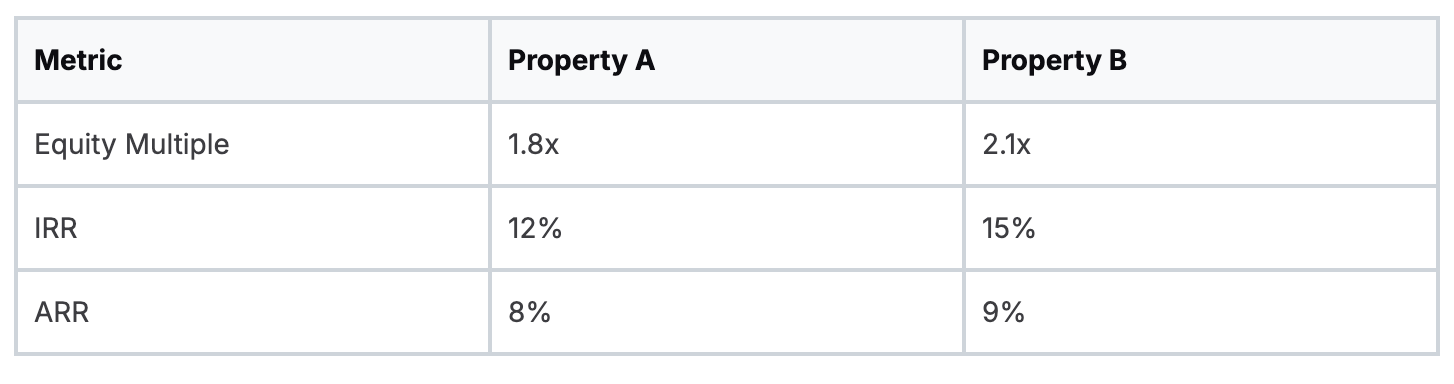

Smart investors use several key metrics to properly assess investment opportunities. Equity Multiple, Internal Rate of Return (IRR), and Annual Rate of Return (ARR) are essential tools. For example, a 2x equity multiple shows that investors double their initial investment by the end of the term - providing a quick way to assess potential returns.

IRR shows profitability as a percentage while factoring in the time value of money. ARR gives a simple yearly profit calculation. These numbers help separate good deals from risky ones by showing expected returns and possible issues. See the complete data in this recent industry research.

Presenting Performance Metrics Effectively

Clear communication of these metrics helps build investor trust and attract funding. Using visual elements like charts and graphs makes the numbers easier to understand. When investors can grasp both the benefits and risks, they make more confident decisions.

Frameworks for Comparison and Risk Identification

A structured approach to comparing different properties helps spot potential problems early. This sample comparison table shows how to evaluate properties side by side:

These comparison tools help simplify complex information and lead to better investment choices. Strong understanding of metrics reduces risk and improves chances of good returns. Learn more about analyzing deals in our property analysis guide.

Mastering these core metrics sets skilled syndicators apart from others. Using these evaluation tools helps investors succeed in apartment building syndication.

Optimizing Revenue and Cash Flow Performance

Creating solid financial performance is essential for successful apartment building syndication. Top property managers focus on specific methods to improve performance and generate strong investor returns by finding the right mix of income growth and cost control.

Rental Rate Optimization

Setting optimal rental rates requires a data-driven approach. Managers need to study their local market, analyze competitor pricing, and adjust rates based on supply and demand. Regular market analysis helps keep rents competitive while maximizing income potential. Smart strategies like offering different price tiers based on unit features and location can boost overall revenue. Flexible lease terms and targeted incentives also help attract and keep quality tenants.

Expense Management in Apartment Building Syndication

Managing costs effectively is just as important as growing income. Successful operators carefully track all operating expenses to find savings opportunities. This includes getting better vendor contracts, making energy-efficient upgrades, and improving maintenance processes. Simple changes like LED lighting or water-saving fixtures can reduce utility bills significantly. However, managers must maintain service quality and property condition to keep residents satisfied.

Value-Add Implementations

Smart property improvements can increase both income and asset value. Managers look for upgrades that residents want and will pay more for. These range from refreshing unit interiors and common areas to adding new amenities like fitness centers or improving security. Well-planned improvements help justify higher rents. In the apartment market, inflation impacts rental growth - 7.1 percent rent increases were projected for 2023, with high-demand properties able to raise rates further. Learn more about market trends here. Through strategic upgrades and effective management, properties can achieve higher net operating income and better returns for investors.

Implementing Thorough Due Diligence Practices

Successful apartment building syndication depends heavily on conducting thorough due diligence. The process goes far beyond basic property inspection. The most successful syndicators carefully assess every aspect - from physical condition to financial health to legal compliance.

Evaluating Physical Assets

The physical state of a property forms the foundation of its value. A detailed inspection helps identify structural problems and maintenance needs early on. Working with qualified inspectors to conduct structural surveys and environmental assessments helps avoid costly surprises later. Early detection of issues like water damage is essential for keeping tenants happy and maintaining property value.

Scrutinizing Market Conditions

The local market environment plays a major role in property success. Key factors include employment rates, population trends, and competing properties in the area. Smart syndicators use comparative market analyses to check if a property's price aligns with market realities. This involves studying similar nearby properties, tracking rent patterns, and monitoring planned developments that could affect future value.

Analyzing Financial Statements

A deep dive into financial records is essential. This means examining past income statements, operating costs, and projected earnings. Pay close attention to rent rolls, maintenance expenses, and debt obligations. Finding discrepancies in financial records early helps avoid bad deals. Careful financial review often reveals ways to add value through cost reduction or strategic upgrades.

Assessing Legal Considerations

Legal issues can quickly derail an investment. Review all zoning requirements, permits, and check for any legal disputes or property liens. Understanding local rental laws is critical since they affect how you can operate the property. A thorough legal review helps ensure compliance and prevents future problems that could hurt returns.

Proven Investigation Techniques and Real-World Examples

Successful due diligence relies on tested methods and learning from actual cases. Many syndicators create detailed due diligence checklists to ensure nothing gets overlooked. These lists serve as step-by-step guides covering every important aspect of property evaluation.

In conclusion, strong due diligence skills help protect investments while finding hidden opportunities for growth. Syndicators who consistently apply careful due diligence practices make better investment decisions. By examining each aspect of a potential investment thoroughly, investors safeguard their capital and maximize property potential.

Planning Strategic Exits for Maximum Returns

A clear exit strategy is essential for success in apartment building syndication. The ability to determine the optimal time and method for selling directly impacts investor returns and risk management. This requires thorough analysis and understanding of available options.

Identifying Optimal Exit Timing

The best syndicators carefully track market indicators and cycles to pick the right moment to sell. Prime selling opportunities often come after completing property improvements and boosting net operating income (NOI), or during periods when buyer demand exceeds available inventory. Understanding these patterns helps secure better returns.

Exploring Exit Strategies in Apartment Building Syndication

Common exit approaches include:

- Traditional Sale: Selling on the open market offers the potential for strong returns but requires proper property preparation and transaction management.

- 1031 Exchange: This method lets investors defer capital gains taxes by moving proceeds into another similar property. Many use this to keep building their portfolios tax-efficiently.

- Refinancing: Getting a new loan at better terms can improve cash flow without selling. This works well when the sales market is soft.

- Partial Sale: Selling a portion of ownership provides some liquidity while maintaining future upside potential. This balances immediate returns with long-term gains.

Managing Investor Expectations and Executing Smooth Transitions

Clear communication about exit plans from day one builds trust with investors. The Private Placement Memorandum (PPM) should spell out the intended strategy. Regular updates help investors understand exit timing decisions. Proper documentation and prompt distribution of proceeds ensure smooth closings and happy investors for future deals.

Building Flexibility into Your Exit Plan

Markets can shift unexpectedly, so smart syndicators maintain flexible exit strategies. This means having backup plans ready and monitoring conditions to protect returns. Worst-case scenario planning helps identify and prepare for potential challenges. The goal is making informed decisions that serve investor interests in any market.

Ready to improve your apartment syndication process? Homebase provides a complete platform for managing deals, investors and exits. Their tools help you focus on growth rather than administrative tasks. Learn more about streamlining your syndication business with Homebase.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Founder's Guide to Real Estate Partnership Agreements

Blog

Build airtight real estate partnership agreements. Our guide covers key clauses, LLC vs. LP structures, and negotiation tactics for successful syndications.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.