Accredited Investor Letter Essentials

Accredited Investor Letter Essentials

Master compliance and unlock exclusive opportunities with our accredited investor letter guide.

Domingo Valadez

May 7, 2025

Blog

Understanding The Accredited Investor Letter

An accredited investor letter confirms an individual's or entity's financial status, granting access to unregistered securities offerings. These offerings, exempt from public offering regulations, typically carry higher risks but also the potential for higher returns. The letter acts as a gatekeeper, ensuring only qualified investors access these exclusive opportunities, protecting less financially savvy investors from potentially risky ventures.

Why Is an Accredited Investor Letter Necessary?

Regulations designed to protect investors and maintain market integrity necessitate the accredited investor letter. The Securities and Exchange Commission (SEC) established these rules to ensure participants in complex, less regulated investment opportunities possess sufficient financial sophistication and resources. For instance, should an individual invest in a failing startup, the SEC wants to ensure they can withstand the loss without significant hardship. The accredited investor letter is crucial to achieving this regulatory goal.

This raises the question: who are accredited investors? They are typically high-net-worth individuals, sophisticated investors, or institutions meeting specific SEC financial thresholds. These criteria involve certain income or net worth levels, demonstrating their ability to handle investment risks.

Accredited investors significantly influence the U.S. financial landscape. As of mid-2018, there were approximately 12.5 million to 13.5 million accredited investor households in the United States. These individuals and entities meet specific SEC financial criteria, such as an annual income of at least $200,000 or a net worth exceeding $1 million (excluding their primary residence). They hold a substantial amount of wealth, estimated at about 76% of all U.S. household wealth. This concentration underscores their market influence and their role in supporting early-stage companies through private equity investments. Learn more about accredited investor status here: Exploring Accredited Investor Status.

How the Letter Bridges the Gap

The accredited investor letter bridges investors and issuers, facilitating compliance and access. Issuers of private securities rely on these letters to verify investor eligibility, ensuring adherence to SEC regulations. This streamlines investments, allowing efficient capital raising while maintaining compliance. For investors, the letter opens doors to exclusive investment opportunities with potentially higher returns in the private market. This reciprocal benefit highlights the letter's essential role in the private investment ecosystem.

Verifying Accredited Investor Status

Verifying an individual's accredited investor status is crucial for adhering to SEC regulations. This ensures that only qualified participants engage in specific investment opportunities. This process protects both issuers and investors, building trust and transparency. But what does verification involve?

Methods of Verification

The SEC provides several ways to verify accredited investor status, each with specific documentation requirements. One common method involves reviewing income tax returns, W-2s, and other official IRS documents from the previous two years. This proves consistent income exceeding $200,000 (or $300,000 jointly with a spouse), a key requirement for individual accredited investor status. Also, reviewing bank statements, brokerage account statements, and other asset documentation confirms a net worth exceeding $1 million (excluding the primary residence).

The Role of Professionals

Verification often involves professionals like Certified Public Accountants (CPAs) or attorneys. These individuals have the expertise to analyze financial documents and issue an official accredited investor letter. This letter acts as independent validation, assuring issuers of an investor's qualifications. It states the investor's accredited status, the basis for the determination, and the professional's credentials.

Rule 506(c) and Recent Guidance

Understanding Rule 506(c) of Regulation D is also essential. This rule permits issuers to generally solicit investments, but only if all purchasers are accredited investors. The SEC recently expanded its guidance on verification under this rule, allowing reliance on high minimum investment amounts—$200,000 for individuals and $1 million for entities—combined with written representations. This simplifies verification while maintaining investor protections. Learn more here: SEC Broadens Guidance on Accredited Investor Verification.

Best Practices for Verification

Several best practices can ensure a seamless verification process:

- Maintain organized records: Investors should keep detailed financial records readily accessible for review.

- Consult with professionals: Seeking advice from CPAs or attorneys simplifies the process and ensures accuracy.

- Stay updated on regulations: Keeping current with SEC guidelines is critical for continued compliance.

Third-Party Verification Platforms

Technology also plays a vital role. Platforms like Homebase offer automated Know Your Customer (KYC) and accreditation verification services. This streamlines the process for both investors and syndicators. These tools provide a secure and efficient way to manage verification, reducing paperwork and enhancing transparency.

By understanding the verification process and following best practices, investors and issuers can confidently navigate the complexities of private securities offerings and ensure compliance. This protects all parties and creates a stronger investment environment.

How A Letter Aids In Investment Compliance

An accredited investor letter plays a critical role in complying with SEC regulations. It offers verifiable proof of an investor's financial status, a necessity for participating in private securities offerings. This document protects both issuers and investors by ensuring transparency and adherence to legal requirements.

The Importance of Validation by Licensed Professionals

Certified Public Accountants (CPAs) and attorneys are licensed professionals authorized to validate investor credentials and issue accredited investor letters. This independent verification adds a layer of credibility and trust. These professionals have the expertise to assess financial documents like tax returns and asset statements, ensuring investors meet the required criteria. This validation is crucial for maintaining compliance in private investments.

Understanding Validity and Renewal

Accredited investor letters have a limited validity period because financial situations can change, and regulators want to ensure ongoing compliance. These letters, issued by licensed professionals such as CPAs or attorneys, are typically valid for about 90 days. Verifying investor status involves providing financial statements, tax returns, or brokerage account details. The letter includes key information: investor identity, verification method, and the certifying professional’s credentials. Learn more about accredited investor letters here: Accredited Investor Letter Deep Dive. Investors must renew their letters periodically, typically annually or as required by specific investment opportunities. This keeps the information current and accurately reflects the investor's financial status.

Streamlining Compliance for Issuers and Investors

For issuers, valid accredited investor letters simplify the investment process. They can confidently accept investments, knowing participants meet regulatory requirements. This reduces the risk of non-compliance and potential legal problems. You might be interested in: The Ultimate Guide to Real Estate Syndication: Maximizing Investor Returns

Best Practices for Maintaining Compliance

Maintaining compliance requires proactive steps from both investors and issuers.

- Investors: Maintain detailed financial records and work with professionals for timely letter renewals.

- Issuers: Implement clear procedures for verifying investor accreditation and keep updated records of received letters.

By understanding the validity period and professional validation, investors and issuers can ensure continued compliance and create a more secure and transparent investment environment. This diligent approach promotes a healthier and more trustworthy private market.

Key Components Of An Accredited Investor Letter

An accredited investor letter officially documents an individual's or entity's eligibility to participate in unregistered securities offerings. Access to exclusive investment opportunities hinges on this letter, making it crucial for both investors and issuers to understand its core components. This detailed examination will help ensure the letter meets all regulatory requirements.

Investor Information and Declaration

The letter must clearly identify the investor with their full legal name, residential address, and contact information. A formal declaration of accredited status is also vital. This affirms the investor understands their status and its implications for investment decisions. This declaration strengthens the document's legal validity.

Basis of Accreditation

This section details how the investor qualifies as accredited. It references the specific SEC criteria met, either through income or net worth. For income-based qualification, the letter specifies the income level and the years it covers (typically the past two). Net worth qualification requires stating the amount, excluding the primary residence. This clarity eliminates ambiguity.

Supporting Documentation and Verification Method

This section references the supporting documents provided as proof of financial qualifications. These might include tax returns, bank statements, brokerage statements, or other financial records. The letter should also explicitly state how the certifying professional verified this information, such as "review of tax returns" or "examination of bank statements," which promotes transparency.

Certifying Professional's Credentials

The certifying professional's credentials are critical. The letter should include their full name, title (CPA, attorney, etc.), license number, and contact information. This confirms the letter was issued by a qualified and authorized individual, allowing for verification if needed, adding a layer of accountability to the accreditation process.

Date and Signature

The letter requires a clear issuance date to determine its validity, typically around 90 days. A physical or digital signature from the certifying professional is also essential for authentication. Without it, the letter's legal standing is jeopardized.

Addressing Common Pitfalls

Several issues can arise with accredited investor letters, potentially hindering investment opportunities. Incomplete information, missing signatures, or outdated letters are common. A poorly stated basis of accreditation can also cause confusion. Meticulous preparation and review by both investors and issuers are essential to avoid these problems. Double-checking all details ensures a smooth and compliant investment process. Using a platform like Homebase can help streamline this and avoid common errors.

By understanding and adhering to these key components, you can ensure your accredited investor letter fulfills its purpose, facilitating compliant access to private investments. This benefits both investors seeking exclusive deals and issuers raising capital efficiently.

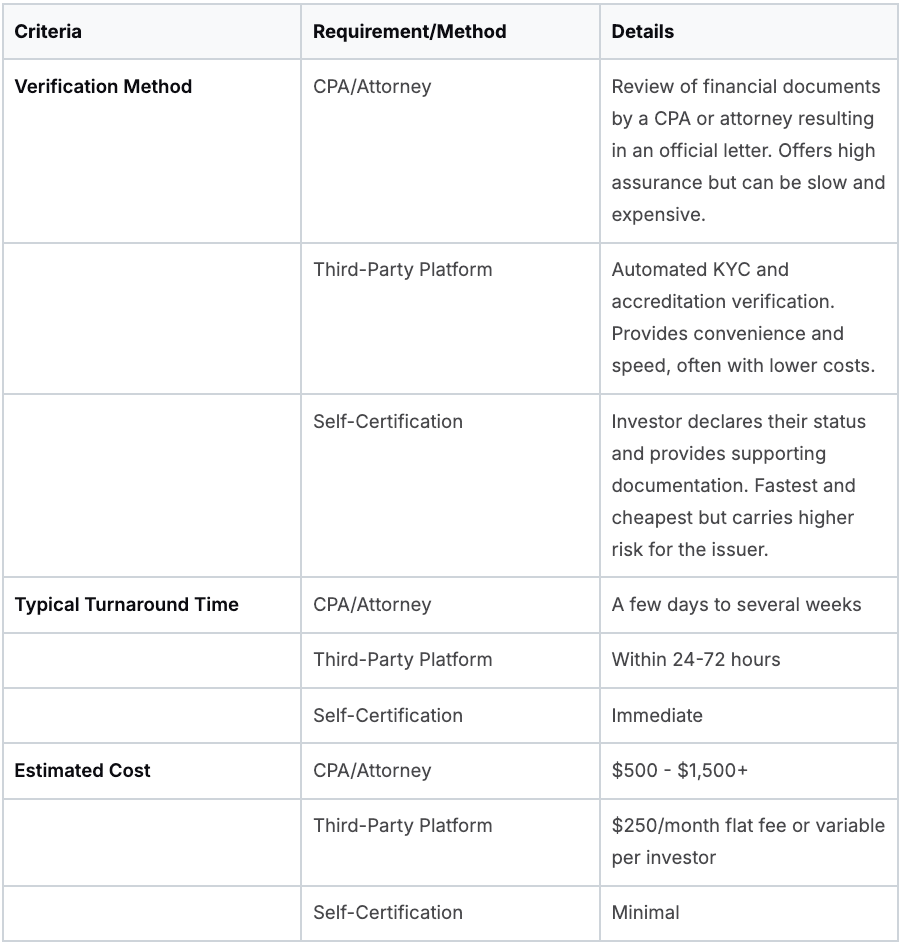

Comparisons And Statistics On Accredited Investor Letters

After exploring the importance and components of accredited investor letters, it's essential to compare the different verification approaches. This empowers both investors and issuers to make informed decisions. Understanding the nuances of each method streamlines the investment process and ensures compliance.

Comparing Verification Methods

Several methods exist for verifying accredited investor status, each with varying costs, turnaround times, and levels of detail. These differences can significantly impact the efficiency and effectiveness of the investment process.

Let's compare some key options:

- Verification by CPA or Attorney: This traditional method involves a Certified Public Accountant (CPA) or attorney reviewing financial documents and issuing an accredited investor letter. It offers a high level of assurance but can be more time-consuming and costly. Turnaround times can range from a few days to several weeks, depending on the professional's workload. Costs typically vary but can range from a few hundred to over a thousand dollars.

- Third-Party Verification Platforms: Platforms like Homebase offer automated Know Your Customer (KYC) and accreditation verification services, significantly speeding up the process. These services offer greater convenience and cost-effectiveness, particularly for repeat investments. Turnaround times are generally much faster, sometimes within 24 hours. Costs are usually lower than using individual professionals, often involving a flat fee or a per-investor fee.

- Self-Certification with Supporting Documentation: In some cases, issuers may permit self-certification, where investors declare their accredited status and provide supporting documentation directly. This method is faster and less expensive but carries greater risk for the issuer if documentation is incomplete or inaccurate.

To further clarify these differences, let's look at the following table:

Accredited Investor Letter Comparison: This table compares various formats and approaches to the accredited investor letter, including verification methods, typical turnaround times, and cost factors.

As the table illustrates, third-party platforms offer a compelling balance of speed, cost, and security, making them an attractive option in many scenarios.

Selecting the Right Method

The best verification method depends on individual circumstances and priorities. For investors making frequent private investments, a third-party platform offers efficiency and cost-effectiveness. For one-time investments, or for those with more complex financial situations, using a CPA or attorney might provide greater peace of mind. This flexibility allows investors to tailor their approach to their specific needs. For issuers, a platform like Homebase can streamline the onboarding of multiple investors, increasing scalability and reducing the administrative burden. This allows issuers to focus on managing their investments, not paperwork. By considering the comparisons and statistics presented, both investors and issuers can confidently navigate the accredited investor verification process and ensure successful, compliant investment experiences. This knowledge promotes a more transparent and secure private investment landscape.

Future Perspectives And Final Thoughts

The accredited investor letter, a cornerstone of private investment, stands poised for potential transformation. As regulatory environments and market demands evolve, the verification process may also change, impacting investor access to private offerings. For example, advancements in technology, like blockchain-based solutions, could offer enhanced security and efficiency for verifying accredited investor status.

This could lead to faster processing times and reduced costs for both investors and issuers. Furthermore, future regulations could adjust the financial criteria for accredited investor status, potentially expanding or contracting the pool of eligible investors. These shifts could reshape the private investment landscape, creating new opportunities and challenges for all involved.

Adapting to Change in the Investment Landscape

Investors and issuers must stay informed about these potential changes. This requires actively monitoring regulatory updates from the SEC and other relevant authorities. For investors, staying current ensures continued access to potentially lucrative private investment opportunities.

For issuers, it is essential for maintaining compliance and avoiding legal pitfalls. A proactive approach allows both investors and issuers to capitalize on emerging trends and effectively navigate the evolving regulatory environment.

Key Takeaways and Recommendations

This overview of the accredited investor letter has underscored several key points:

- Importance of Verification: The accredited investor letter is crucial for ensuring compliance with SEC regulations and safeguarding investors.

- Role of Professionals: Certified Public Accountants (CPAs) and attorneys are essential in validating investor credentials and issuing accredited investor letters.

- Key Components: A comprehensive letter includes specific details, ranging from investor information to the certifying professional's credentials.

- Comparison of Methods: Multiple verification methods exist, each with its own set of benefits and drawbacks.

To successfully participate in private investments, investors and issuers should:

- Maintain Organized Records: Keeping meticulous financial records streamlines the verification process.

- Consult with Experts: Seek expert advice from CPAs or attorneys when dealing with complex scenarios.

- Utilize Technology: Explore platforms like Homebase for more efficient, automated verification processes.

- Stay Informed: Monitor regulatory updates and market trends to adapt to the changing investment landscape.

By understanding and implementing these principles, investors and issuers can unlock the potential of private investments while maintaining compliance and mitigating risks.

Ready to simplify your real estate syndication process and manage your investors more easily? Explore Homebase today! We offer a comprehensive platform for streamlining fundraising, investor relations, and deal management for a flat fee of $350/month.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Syndicator's Guide to Commercial Real Estate Valuation

Blog

Master commercial real estate valuation with our syndicator's guide. Learn the income, sales, and cost approaches to build investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.