Rule 506 C Guide: Effective Strategies for Capital Raising

Rule 506 C Guide: Effective Strategies for Capital Raising

Learn essential tips and strategies for compliant capital raising with Rule 506 C. Boost your fundraising success today!

Domingo Valadez

May 31, 2025

Blog

Understanding Rule 506(c) And Why It Matters

For companies seeking capital, Rule 506(c) offers a new approach to fundraising. Part of the 2013 JOBS Act, this regulation permits businesses to publicly advertise their private offerings, a practice previously prohibited. This creates an opportunity for companies to reach a wider pool of potential investors.

This means companies can actively market their private offerings instead of relying solely on existing networks. This can open doors to a larger pool of capital and potentially accelerate the fundraising process.

How Rule 506(c) Opens Up Fundraising

Rule 506(c) provides several advantages compared to traditional fundraising methods. It expands a company's reach, potentially reducing fundraising timelines. Companies can use online platforms, social media, and other digital channels to promote their offerings to a larger audience.

The ability to publicly advertise can also create more competition among investors. This can result in better terms for the company. This wider reach can also help build brand awareness, even during a private placement.

Rule 506(c) of Regulation D, enacted by the SEC in 2013 as part of the Jumpstart Our Business Startups Act (JOBS Act), significantly altered private securities offerings. It permitted issuers to engage in general solicitation and advertising, a practice previously prohibited under Rule 506(b). This change aimed to improve capital raising and broaden investor access by allowing public promotion of private placements, provided all purchasers are verified accredited investors. Learn more about Rule 506(c) here. This advantage, however, comes with the important requirement of investor verification.

The Importance of Accredited Investor Verification

While Rule 506(c) provides marketing freedoms, it requires that all investors be accredited. This means companies must implement thorough verification procedures. These processes involve confirming investors meet specific income or net worth requirements.

Maintaining proper verification is essential for compliance and avoiding legal problems. Businesses might use third-party verification services or collect documentation directly from investors.

Strategic Considerations for Using Rule 506(c)

Using Rule 506(c) requires careful strategic planning. Companies should consider their target investor profile, the size and complexity of their offering, and their internal resources. Factors such as existing investor networks and marketing capabilities also play a crucial role.

Understanding the details of Rule 506(c) is key to maximizing its potential. This evaluation helps companies decide if the benefits of public advertising outweigh the additional work involved in investor verification.

Mastering Accredited Investor Verification Without The Headaches

Successfully navigating Rule 506(c) offerings relies on one key element: accredited investor verification. This essential process, while crucial for compliance, doesn't have to be a major obstacle. In fact, proper verification can simplify fundraising and protect your offering.

Understanding the Importance of Verification

The ability to generally solicit investors under Rule 506(c) comes with the responsibility of ensuring all participants are truly accredited. This protects both the investor and the issuer. Verifying investor status mitigates legal risks and ensures compliance with securities regulations.

Streamlining the Verification Process

Several methods exist for verifying accredited investor status. One common approach involves collecting income and net worth documentation directly from investors. However, many issuers choose to partner with third-party verification services specializing in this area. These services can significantly lessen the administrative burden and provide an added layer of assurance.

Leveraging Recent SEC Updates to Simplify Compliance

Adhering to Rule 506(c) doesn't need to be overly complicated. The SEC has simplified the process, making it more accessible. The 2025 update, for example, introduced simplified criteria. This includes minimum investment commitments of $200,000 for individuals or $1 million for entities, along with representations of accredited status without the issuer possessing contrary knowledge. These measures aim to reduce compliance costs and encourage wider Rule 506(c) usage. Learn more about these updates here. They offer practical ways to demonstrate "reasonable steps" toward verification.

Maintaining Investor Relationships Throughout Verification

While compliance is paramount, it shouldn’t compromise investor relationships. Open communication and transparency throughout the verification process are essential. Clearly explaining the requirements and providing timely updates can foster trust and create a positive investor experience.

Building Efficient Workflows for Verification Documentation

Efficiently managing verification documentation is crucial for smooth fundraising. A secure system for collecting, storing, and tracking investor information streamlines the verification process and reduces administrative work. Using technology and automation can further enhance these workflows. This simplifies compliance and strengthens investor relationships.

General Solicitation Strategies That Actually Attract Investors

Rule 506(c) offerings allow for general solicitation, a significant advantage when seeking investment. However, the ability to advertise doesn't guarantee success. Attracting accredited investors requires a strategic approach. This section explores how to craft marketing strategies that genuinely resonate with this audience.

Crafting a Compelling Investment Narrative

Attracting investors begins with a clear and compelling narrative. This story should showcase the investment opportunity's strengths and clearly demonstrate its potential returns.

Highlighting a strong management team is crucial. Investors want to see experienced leadership. A unique value proposition sets your opportunity apart. What makes your business different? Finally, defining the market opportunity shows investors the potential for growth.

This narrative must also comply with securities laws. Transparency and accuracy are paramount. Focus on presenting factual information and avoid unsubstantiated claims.

Identifying and Utilizing Effective Marketing Channels

Reaching the right audience requires selecting appropriate marketing channels. Digital marketing, including targeted online advertising and content marketing, can be highly effective. Consider platforms like Google Ads or LinkedIn Ads to reach specific investor demographics.

Industry events also provide valuable networking opportunities. Connecting with investors face-to-face can build rapport and generate interest.

Social media can play a role, but requires careful consideration of compliance guidelines. LinkedIn can be a powerful platform for professional networking under Rule 506(c).

Messaging Strategies for Successful Offerings

Your messaging should resonate with your target investor audience. Understanding their investment goals and preferences is key. Focus on what matters most to them.

Highlighting key value drivers and demonstrating a clear understanding of the market builds investor confidence. Show them you know your industry.

For example, presenting specific financial projections or showcasing relevant industry expertise can attract sophisticated investors. Maintain clear and concise communication throughout the fundraising process to keep investors engaged.

Measuring Marketing Effectiveness

Tracking key metrics helps assess the effectiveness of your general solicitation efforts. Monitoring website traffic, lead generation, and investor conversion rates provides valuable data. Use this data to optimize your campaigns and improve future outreach.

Analyzing investor engagement provides insights into messaging effectiveness. This ongoing analysis is crucial for adapting strategies and achieving fundraising goals under Rule 506(c). It creates a feedback loop for refining your tactics.

Navigating Common Pitfalls and Ensuring Compliance

General solicitation under Rule 506(c) requires careful attention to compliance. One common pitfall is failing to properly verify accredited investor status. This is a critical step.

Another pitfall is making misleading or exaggerated claims in marketing materials. Accuracy is essential. Working with experienced legal counsel is crucial for ensuring all marketing activities comply with relevant regulations. This protects your offering and builds trust.

Rule 506(c) Vs 506(b): Choosing Your Path To Capital Success

Navigating the world of private placements for real estate syndicators requires a thorough understanding of available exemptions. Choosing between Rule 506(c) and Rule 506(b) is a critical decision, significantly impacting your fundraising success. The right choice depends on several factors, including your existing investor network, marketing capabilities, and desired timeline.

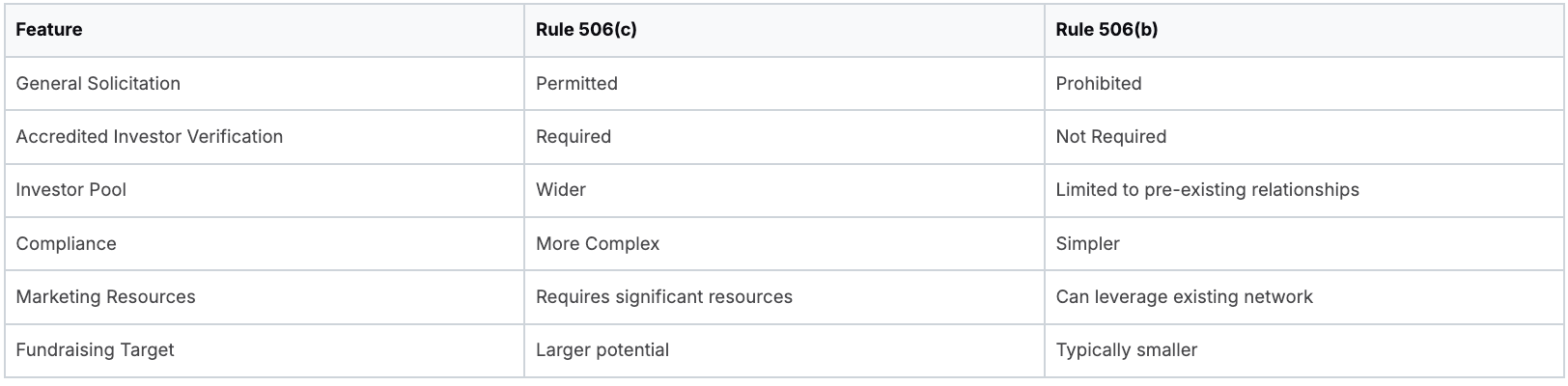

Key Differences Between Rule 506(c) and 506(b)

The core difference lies in general solicitation. Rule 506(c) permits it, while 506(b) prohibits it. This means under Rule 506(c), you can broadly advertise your offering, reaching beyond your immediate network. However, this broader reach necessitates stringent accredited investor verification.

Rule 506(b), conversely, restricts marketing. You can only approach individuals with pre-existing, substantive relationships. This limits your potential investor pool but simplifies compliance by removing extensive verification procedures.

When to Consider Rule 506(c)

If you aim for a wider audience, possess strong marketing resources, and are comfortable with the verification process, Rule 506(c) offers advantages. This exemption is particularly beneficial for syndicators with smaller existing networks or those seeking substantial capital quickly. Recent updates have streamlined verification, making compliance more manageable.

Minimum investments of $200,000 for individuals and $1 million for entities, coupled with investor representations, can simplify the process.

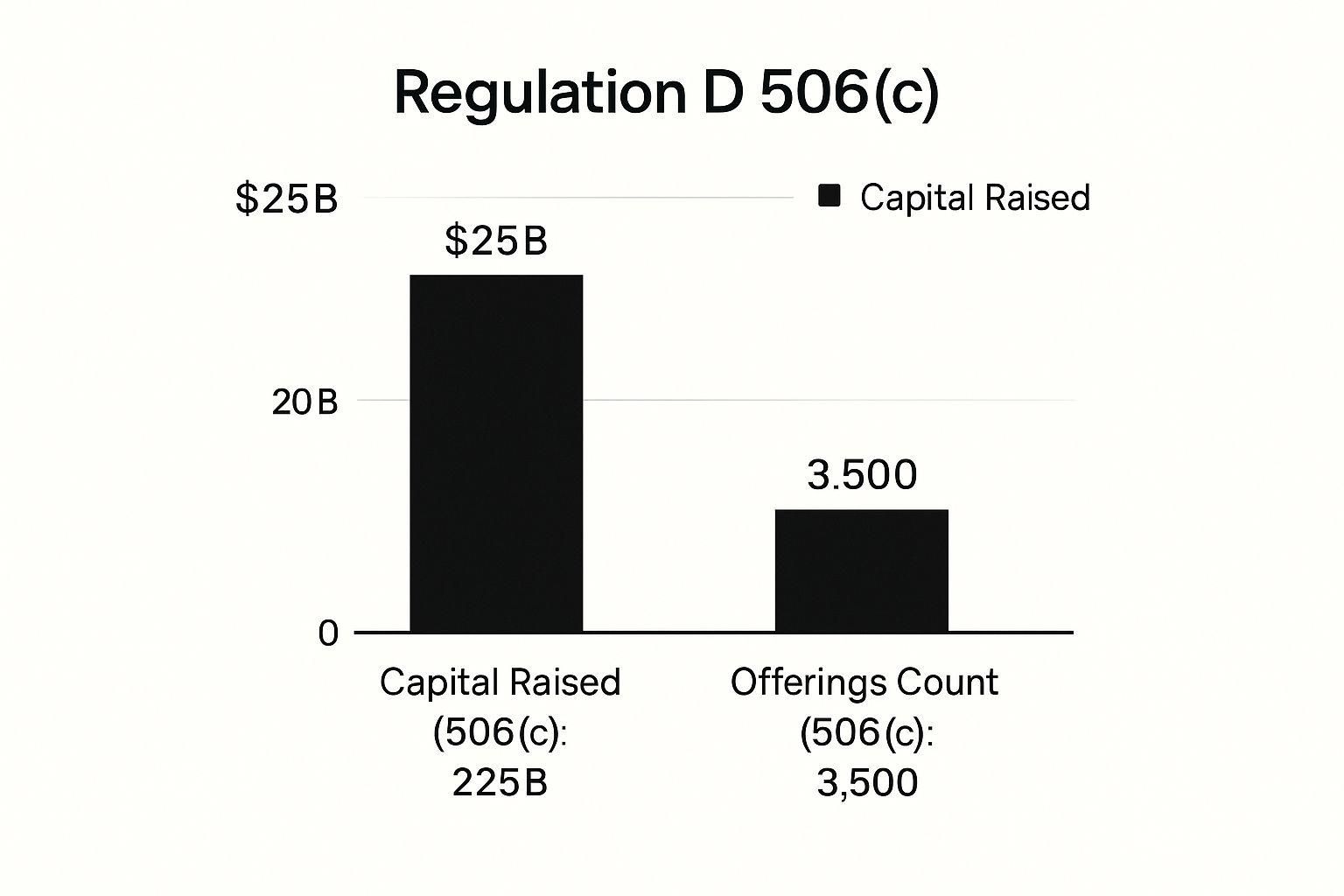

The following infographic illustrates the capital raised and the number of offerings under Rule 506(c):

This data highlights the significant capital raised through Rule 506(c), demonstrating its potential.

When Rule 506(b) Might Be a Better Fit

For syndicators with established investor networks, smaller fundraising targets, or a preference for simplified compliance, Rule 506(b) might be more suitable. This approach allows you to leverage existing relationships and avoid the added time and expense of investor verification under Rule 506(c). For more information, see How to master Rule 506 offerings.

Structuring Your Offering for Success

To understand the key distinctions between these two crucial regulations, let's examine a comparison table:

To help clarify the distinctions between these regulations, the following table summarizes the key features of each:

Rule 506(c) vs Rule 506(b) Comparison

This table highlights the core differences between the two rules, allowing you to assess which aligns better with your fundraising goals.

Regardless of your chosen path, careful planning and execution are essential. Consider the following:

- Target Investor Profile: Define who you are trying to reach.

- Marketing Strategy: Develop a plan to reach your target investors effectively.

- Timeline: Establish a realistic fundraising timeframe.

- Budget: Allocate resources for marketing and compliance.

By carefully weighing these factors, you can make informed decisions aligned with your specific needs, maximizing your chances of fundraising success. A comprehensive understanding of both Rule 506(c) and Rule 506(b) is essential for strategic decision-making in the private placement market.

Global Impact And Market Trends Shaping Private Capital

Understanding where Rule 506(c) fits within the broader capital markets allows issuers to more effectively use its advantages. This section will explore how this regulation has impacted fundraising, especially within the dominant U.S. private placement market, and consider its global reach.

The U.S. as a Leading Force in Private Placements

The United States remains the largest and most active market for private placements globally. This dominance positions the U.S. as a key influencer in the evolution of private capital markets. Rule 506(c) plays a significant role in this landscape, providing a unique framework for capital formation.

This regulation requires all purchasers to be accredited investors. Simultaneously, it removes the disclosure obligations associated with registered offerings. This creates a specialized niche, supporting millions of dollars in capital annually. Businesses that benefit include startups, expanding companies, and private funds. This dynamic environment attracts both domestic and international investors.

Learn more about Rule 506(c) specifics at the SEC.

Cross-Border Implications and Global Responses

Rule 506(c) has influenced capital flows beyond U.S. borders, impacting international investors and prompting other jurisdictions to adapt their regulations. This creates a complex interplay between U.S. regulatory leadership and the global private capital market.

Many international investors actively seek opportunities within the U.S. private placement market, drawn by the potential for high returns. This influx of capital further strengthens the U.S.’s position as a global hub for private investment. Other jurisdictions are observing the U.S. experience with Rule 506(c), potentially adapting similar frameworks to improve their own capital markets.

Technology's Role in Streamlining Access

Technology is reshaping access to private capital. Online platforms and digital tools facilitate investor verification, deal management, and marketing. This increased efficiency and transparency open new opportunities for both issuers and investors.

These advancements streamline the complexities of private placements. They make it easier for companies to connect with potential investors. They also make it easier for investors to participate in private offerings.

Sector-Specific Trends and Industry Applications

Rule 506(c) is used across various sectors, including real estate, technology, and healthcare. Different industries use this regulation to fuel growth and innovation, adapting its application to their specific needs. This diversified usage demonstrates the flexibility of Rule 506(c) as a fundraising tool.

For example, in real estate, Rule 506(c) has facilitated the growth of real estate crowdfunding platforms. This allows individual investors to participate in larger real estate projects. In the technology sector, it has helped startups secure funding for research and development. In healthcare, it supports companies seeking capital for clinical trials and product development. These evolving trends signal future opportunities and challenges for issuers participating in the global private capital market.

Compliance Best Practices That Protect Your Offering

Maintaining compliance isn't just about ticking boxes; it's the foundation of successful Rule 506(c) offerings. This means establishing systems that ensure your offering remains compliant throughout the entire fundraising process. This involves meticulous documentation, a close working relationship with securities attorneys, and efficient record-keeping.

Essential Documentation Practices

Proper documentation is crucial. Maintaining organized records of all investor communications, verification procedures, and offering materials is essential. This not only streamlines the process, but also provides a clear audit trail, demonstrating your dedication to compliance. It’s like creating a comprehensive history of your offering.

Effective Collaboration With Securities Attorneys

Working closely with experienced securities attorneys is indispensable. Their expertise helps guarantee that your offering structure, marketing materials, and verification procedures comply with all regulations. They are your trusted guides through the complex world of securities law.

Implementing Robust Record-Keeping Systems

Efficient record-keeping systems are vital. A well-organized system, whether digital or physical, helps you manage the substantial documentation required for a Rule 506(c) offering. This includes investor information, verification records, and all offering-related communication. This system should be secure, easy to access, and designed for simple retrieval.

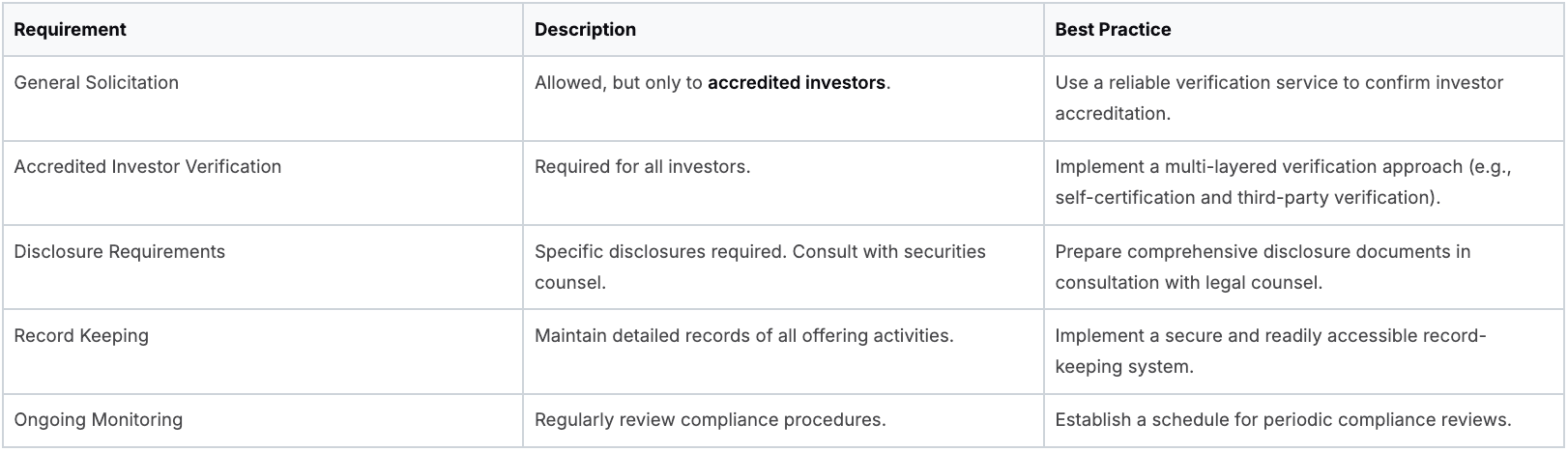

To help ensure comprehensive compliance when undertaking a Rule 506(c) offering, consider the following checklist:

Rule 506(c) Compliance Checklist

Essential compliance requirements and best practices for successful Rule 506(c) offerings

This checklist offers a starting point for managing your Rule 506(c) compliance. Remember to consult with experienced legal counsel for guidance tailored to your specific offering.

Common Compliance Mistakes and Their Solutions

Even with the best intentions, errors can occur. One common oversight is inadequate investor verification. A solution is adopting a multi-layered approach, combining self-certification with third-party verification services. This provides a thorough check on accredited investor status.

Another frequent mistake is inconsistent record-keeping. Regularly auditing your system and implementing standardized procedures can address this. This practice guarantees all necessary information is accurately recorded and readily retrievable.

Ongoing Compliance Monitoring

Compliance isn't a one-time activity; it's an ongoing process. Regularly monitoring your offering's compliance status is crucial. This proactive approach helps you identify and resolve potential issues early, mitigating risks. It’s similar to conducting regular maintenance to ensure smooth operation.

Handling Unexpected Challenges

Unforeseen circumstances can arise. For instance, a key investor’s financial situation might change, impacting their accredited status. Having established protocols for handling such situations is critical. This might involve reviewing verification procedures or modifying offering terms. Preparedness for contingencies protects your offering from unexpected events.

Cost-Effective Compliance Strategies

Compliance doesn't have to be excessively expensive. Using technology, such as automated verification services and digital document management, can significantly reduce costs. These tools streamline processes and minimize administrative overhead. This allows you to maintain strong compliance without exceeding your budget.

Staying up-to-date on regulatory changes and seeking expert guidance when necessary are critical for protecting your offering and ensuring its success. This diligence will help you navigate the complexities of Rule 506(c) with confidence.

Future Of Rule 506(c) And Strategic Planning For Success

Staying ahead of the regulatory curve is critical for developing adaptable capital raising strategies. This means understanding emerging trends in Rule 506(c) usage and anticipating regulatory developments. Technology continues to be a crucial element in streamlining the private placement process.

Emerging Trends and Regulatory Developments

The private placement landscape is constantly changing. One notable trend is the increasing use of technology for investor verification and deal management. This improves efficiency and can lower compliance costs.

Another key trend is the potential for changes to the accredited investor definition. Staying informed about these potential shifts is vital for issuers. Further, exploring how Rule 506(c) integrates with other exemptions can unlock new opportunities. For example, the SEC’s 2025 update on verification guidelines simplified criteria, including minimum investment commitments combined with investor representations.

Building Sustainable Capital Raising Strategies

A proactive approach is essential for positioning your company for long-term fundraising success. Building and nurturing strong investor relationships is paramount. This builds trust and can facilitate multiple funding rounds.

Leveraging data and analytics can also enhance results. Analyzing investor behavior and market trends offers valuable insights. Creating scalable processes is also crucial. This involves designing systems that can adapt as your business and fundraising needs evolve.

Technology's Impact on Private Placements

Technology provides numerous advantages for private placements under Rule 506(c). Automated verification services streamline the process, ensuring compliance while saving valuable time.

Digital deal rooms offer greater transparency and security. They provide a centralized platform for sharing information and communicating with investors. Data analytics tools offer valuable insights into investor behavior and market trends. This facilitates data-driven decision-making, potentially improving fundraising results.

Strategic Planning for Long-Term Success

Successfully navigating Rule 506(c) requires careful planning to maintain compliance while maximizing its benefits. This includes a clear understanding of existing regulations.

Staying informed about potential regulatory changes is equally important. Shifts in the accredited investor definition or new integration opportunities with other exemptions could significantly impact your strategy.

Developing strong relationships with experienced legal counsel is also vital. Legal counsel can offer expert guidance on navigating the intricacies of securities law, ensuring your offering remains compliant.

Building Investor Relationships for Future Funding

Long-term fundraising success extends beyond a single offering. Cultivating enduring investor relationships is essential. Open and consistent communication fosters trust, which can be invaluable for securing future funding.

Regularly updating investors on your company's progress and demonstrating transparency strengthens these relationships. This can create a network of loyal investors who are more likely to participate in subsequent funding rounds.

By understanding the evolving landscape of private placements, utilizing technology, and building robust investor relationships, companies can position themselves for long-term fundraising success under Rule 506(c). This proactive approach allows them to adapt to market fluctuations and capitalize on new opportunities.

Ready to simplify and streamline your real estate syndication process? Homebase offers an all-in-one platform to manage your deals, investors, and fundraising efficiently. Learn more and explore how Homebase can help you achieve your real estate investment goals by visiting https://www.homebasecre.com/.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Definition rent roll: A Practical Guide for Real Estate Investors

Blog

Definition rent roll explained: discover what the term definition rent roll means and how to use this key document for due diligence and portfolio growth.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.