Build an Investor-Ready Real Estate Financial Model

Build an Investor-Ready Real Estate Financial Model

Learn to build a powerful real estate financial model with our guide on underwriting, waterfall analysis, and risk assessment for your next investment deal.

Domingo Valadez

Jan 11, 2026

Blog

At its core, a real estate financial model is just a spreadsheet. But in practice, it’s the engine that powers every successful deal. This is where you forecast an investment property's financial performance, projecting everything from cash flows to key return metrics like IRR and equity multiple. It's the tool that helps sponsors and investors alike analyze a deal from acquisition all the way to a profitable exit.

Why Your Deal Lives or Dies by Its Financial Model

Before a single dollar gets raised, before the first document is signed, your deal’s entire viability rests on one thing: the real estate financial model. Forget thinking of it as just a spreadsheet for crunching numbers. It's the living, breathing narrative that validates your investment thesis, builds trust with your partners, and ultimately convinces investors to get on board.

A well-built model elevates a simple pro forma from a static document into a powerful tool for underwriting, assessing risk, and raising capital. It becomes the definitive lens through which everyone involved—from your GP partners to your LPs—will view the asset's entire lifecycle.

The Model as a Storytelling Tool

Your financial model tells the story of the investment. It doesn't just present the final numbers; it painstakingly shows how you arrive at them. Each tab and every calculation methodically lays out your strategy and assumptions, building a business plan that is both transparent and defensible.

This narrative is absolutely critical for a few key reasons:

- Investor Confidence: Nothing screams professionalism and diligence like a well-structured model. When an investor can clearly follow your logic from purchase price to projected returns, their confidence in you and your ability to execute skyrockets.

- Risk Mitigation: The very act of building the model forces you to think through all the "what ifs." What happens if vacancy ticks up by 2%? What if our rent growth projections are too optimistic? A dynamic model lets you stress-test these scenarios so you're not caught flat-footed by market shifts.

- Strategic Alignment: The model is your team's single source of truth. It ensures every general partner is aligned on the business plan, from the capex budget for renovations down to the target exit cap rate.

Navigating a Recovering Market

In the current market, there's no room for error—precision is everything. We're seeing renewed strength in global real estate investment, with transaction volumes hitting $739 billion over the past year. That's a 19% year-over-year increase. This isn't just a random spike; it reflects real investor confidence, especially as property values have climbed for five consecutive quarters. This signals that the market is at a turning point, and accurate modeling is what will separate the winners from the losers. You can find more insights on the current real estate investment landscape on nuveen.com.

A great real estate financial model doesn't just predict the future; it helps you create it. By rigorously testing assumptions and visualizing outcomes, you can identify opportunities and mitigate risks that others might miss.

This renewed activity also means more competition for good deals. A sloppy or inaccurate model will get you laughed out of the room by sophisticated investors and lenders. On the flip side, a detailed, defensible, and transparent model is what transforms a speculative bet into a thoroughly vetted opportunity. It gives you—and your limited partners—the conviction to move forward with confidence. It’s your best tool for proving that your deal isn't just a good idea, it's a smart investment.

Getting Your Assumptions and Inputs Dialed In

Any financial model is only as good as the numbers you feed it. That "garbage in, garbage out" saying isn't just a cliché—in real estate, it's a hard truth that can sink a deal before you even get started. Your first job, long before you open a spreadsheet, is to put on your detective hat. You need to dig deep and piece together all the property-level details, market realities, and financial assumptions that will become the foundation of your analysis.

This goes way beyond just plugging in numbers from an offering memorandum. It’s about building a story you can defend, one where every single assumption can stand up to the tough questions you’ll inevitably get from lenders and investors.

Nailing Down the Property-Level Data

First things first, you have to get intimate with the property itself. What’s its real operational story? The goal here is to gather hard data that gives you a crystal-clear picture of its financial and physical state right now.

You'll need to chase down a few key documents:

- The Unit Mix: Get a detailed breakdown of every unit type—one-bedrooms, two-bedrooms, studios, etc. You need the exact count and the average square footage for each.

- The Current Rent Roll: This is probably the single most important document you'll look at. For an income-producing property, a deep understanding of the rent roll is non-negotiable. It’s a live snapshot of every lease, showing who is paying what, when their lease is up, and any concessions they received.

- Historical Operating Statements: You absolutely need the trailing 12 months (T-12) of financials. If you can get your hands on the T-24 or even T-36, that’s even better. More history helps you spot trends, flag any weird one-off expenses, and get a much more accurate feel for future operating costs.

- CapEx History: A list of major repairs and upgrades from the last few years is gold. Knowing the roof was replaced last year, for example, is a massive detail that directly impacts your future capital budget.

Usually, you’ll find all this in the "war room" or data room the seller's broker provides. Your job isn't to just copy and paste; it's to scrutinize, verify, and normalize this information. Don't take anything at face value.

Layering in Market and Financial Assumptions

Once you have the property-specifics locked down, it's time to layer on the market assumptions that will drive your projections. This is where your deep market knowledge and thorough due diligence really come into play. You can’t just use generic, industry-average numbers here.

Your model’s projections will hinge on a handful of core assumptions. Before you start building, it's a good practice to gather all your key inputs in one place. A checklist can be incredibly helpful to make sure you haven't missed anything critical.

Here’s a look at the essential data points you'll need to assemble.

Key Inputs for Your Financial Model

Having this information organized from the start not only streamlines the modeling process but also forces you to think through and justify every single assumption before it gets buried in a complex spreadsheet.

Never just pull a number out of thin air. For every single assumption, you need to be ready to answer the question, "How did you get that number?" with a confident, data-backed response.

For instance, your rent growth figure shouldn't be a gut feeling; it should be directly supported by reports from firms like CoStar or your own analysis of recent rental comps. Similarly, your exit cap rate needs to reflect what similar, stabilized properties in the area have actually sold for recently.

This is what separates a flimsy pro forma from a professional, institutional-quality financial model. Building that defensible narrative around your numbers is how you build trust and get deals done.

Building Your Model for Clarity and Functionality

A great real estate financial model does more than just crunch numbers. It tells the story of the deal. It has to be clear, accurate, and easy for anyone—especially a potential investor—to understand. A messy, disorganized spreadsheet isn't just confusing; it’s a huge red flag that screams "amateur." What you're really building is a scalable, auditable framework you can use again and again, not just a one-off calculation for the deal in front of you.

The best way to achieve this is with a logical, modular structure. Think of it like building with Legos. Each part of the investment's lifecycle gets its own dedicated tab or section. This approach makes the model so much easier to build, to troubleshoot when something looks off, and most importantly, to explain to your partners.

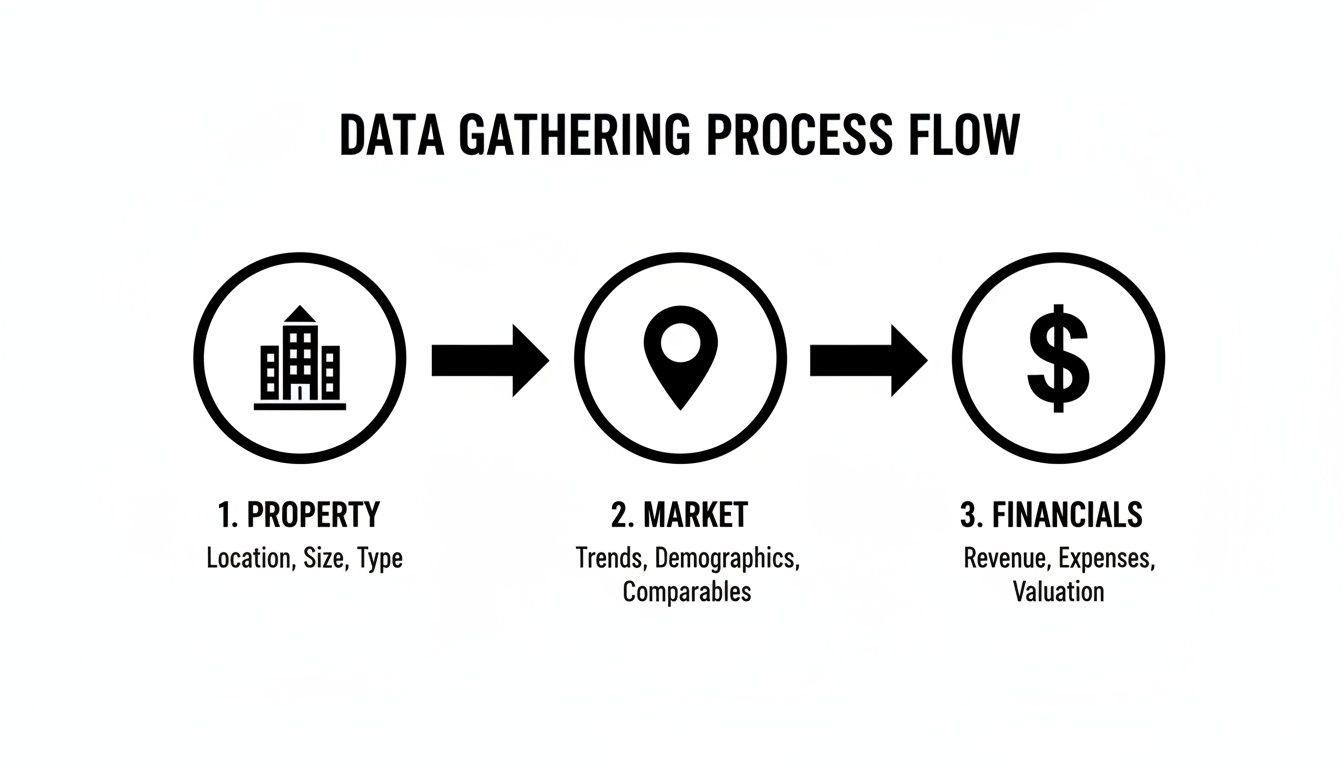

It all starts with gathering and organizing your data inputs—the raw materials for your model.

This flow is critical. A solid model is only as good as the property, market, and financial data it's built on.

The Core Components of an Institutional-Quality Model

Every professional-grade model is built around a handful of essential components. Think of these as the main chapters of your investment story, each detailing a critical phase of the deal from acquisition to exit. Organizing your spreadsheet into these distinct tabs is a non-negotiable best practice.

- Acquisition and Financing: This is ground zero. Here, you'll lay out the "all-in" cost of the deal—purchase price, closing costs, and any upfront capital repairs. You’ll also detail the complete capital stack, showing exactly where the money is coming from (debt vs. equity). All your key financing assumptions, like the loan-to-value (LTV), interest rate, and amortization schedule, live on this tab.

- Operations: This is the engine room. This is where you project the property's cash flows—usually on a monthly or annual basis—over the entire hold period. It includes detailed income line items like rent and other revenue sources, plus a full breakdown of operating expenses like property taxes, insurance, and management fees. Your ongoing Capital Expenditures (CapEx) budget for property improvements is also forecasted here.

- Disposition: This tab calculates the grand finale: the sale of the property. The main event here is calculating the projected sale price, which is typically found by applying a future "exit" cap rate to the final year's Net Operating Income (NOI). It also has to account for all the costs of selling, like broker commissions and closing fees.

- Returns Summary: All roads lead to this tab. It consolidates the key outputs from every other section to paint the final picture of profitability. It pulls the initial equity investment, the periodic cash flows from operations, and the net proceeds from the sale to calculate the deal's core return metrics: the Internal Rate of Return (IRR), Equity Multiple, and Cash-on-Cash Return.

Best Practices for Model Construction

Beyond just setting up the right tabs, how you build the model is just as important. A few simple but powerful habits will drastically cut down on errors and make your model a tool people actually want to use.

A clean, logical layout isn’t just about making things look nice; it’s about making them work. If you're looking to really master this, learning how to build a pro real estate investment analysis spreadsheet from the ground up is an invaluable skill. It empowers you to create models that are both powerful and transparent.

The hallmark of an excellent financial model is that someone with industry knowledge can open it and understand the story of the deal within minutes, without needing you to walk them through it line by line.

One of the most important principles is to strictly separate your assumptions from your calculations. All your inputs—things like rent growth assumptions, vacancy rates, or your exit cap rate—should be grouped together in one easy-to-find section and clearly labeled. This way, you can tweak an assumption and watch the impact ripple through the entire model instantly, without having to hunt through formulas for some hard-coded number you forgot you entered.

Smart Formatting Makes All the Difference

Good formatting isn't just window dressing; it's a functional necessity. It transforms a confusing wall of numbers into an intuitive tool that guides the user's eye and immediately shows them how the model works.

Try implementing a simple color-coding system to differentiate what's what:

- Blue Font: Use this for all input cells and assumptions. It’s a visual cue that says, "This is a number you can change."

- Black Font: Reserve this for all calculation cells. This tells the user, "Don't touch this cell; it contains a formula."

- Green Font: Use this for any cells that link to other tabs in the workbook. It helps everyone trace the flow of information between sections.

This simple visual language makes your model infinitely easier to audit and use for scenario planning. When an investor asks, "What if rent growth is only 2% instead of 3%?", you know exactly which blue-font cells to adjust. This kind of disciplined approach is what separates a homemade spreadsheet from an institutional-quality model.

Modeling the Equity Waterfall and Investor Payouts

This is where the rubber meets the road. After all the meticulous work modeling operations and forecasting the sale, the equity waterfall is where it all comes together. It’s the engine that converts your property's performance into cold, hard cash for your investors.

Put simply, this is the part of your model that shows exactly how the profits get split between you (the General Partner or GP) and your investors (the Limited Partners or LPs). A clean, easy-to-understand waterfall isn't just a nice-to-have; it's absolutely critical for raising capital. Investors need to see, with zero ambiguity, how and when their money will come back to them.

What Is an Equity Waterfall, Really?

Think of a waterfall as a series of buckets. Cash flows into the first bucket until it's full, then spills over into the next, and so on. Each "bucket" represents a return hurdle that must be cleared before profits can flow to the next tier. This structure is designed to protect your LPs first, while giving you, the GP, a powerful incentive to knock the deal out of the park.

A common four-tier structure looks something like this:

- Tier 1: Return of Capital: First things first, the LPs get their initial investment back. 100% of distributable cash goes to them until they are made whole.

- Tier 2: Preferred Return: Next, the LPs receive their "pref." Until they’ve earned a cumulative preferred return (say, 8% annually on their outstanding capital), they continue to receive all distributable cash.

- Tier 3: The GP Catch-Up: This tier is all about the sponsor. The GP often receives a higher percentage of cash flow here until they've "caught up" to a certain profit split.

- Tier 4: Carried Interest (The "Promote"): Once all the lower hurdles are met, the remaining profit is split. A common arrangement is 80/20, where the LPs get 80% and the GP gets 20% as their performance fee, or "promote."

This tiered system ensures everyone's interests are aligned. LPs get their baseline return before the GP gets the lion's share of the upside.

How to Build It in Your Model

To model this out in Excel or Google Sheets, you’ll want to create a dedicated tab that pulls in two crucial numbers from elsewhere in your workbook: the distributable cash flow from operations and the net proceeds from the sale. These are the two streams of cash that will pour into the top of your waterfall.

Start by setting up a table that tracks the capital accounts for both LPs and the GP. You'll log their initial equity contributions here. Then, column by column (representing each month or year), you'll allocate the cash flow based on the rules you've defined. This is where your logic formulas, especially IF statements, come into play. They’ll check if a hurdle has been met before letting cash spill over to the next tier.

For example, the formula for your Preferred Return tier would first check if the LPs have received all their capital back from Tier 1. If that condition is true, it then calculates the 8% pref owed and allocates the available cash to satisfy it. Any cash left over moves on to be tested against the Tier 3 rules.

For a deep dive into the specific formulas and a step-by-step walkthrough, check out our complete guide to the real estate waterfall model.

Pro Tip: Your waterfall should never be a static calculation. It needs to be a living, breathing part of your model. When you tweak a rent growth assumption on your operations tab, the waterfall should update instantly. That's the mark of a well-built model.

Why a Solid Waterfall Matters Now More Than Ever

Nailing your investor payout model is non-negotiable in today's market. We're seeing some encouraging signs—for instance, US all-property total returns hit 3.7% in the first three quarters of 2025. With capital values stabilizing and the prospect of lower interest rates on the horizon, we're at a pivotal moment.

Sponsors who can clearly and transparently communicate return potential will be the ones who win the deals. A professionally constructed waterfall is your best tool for building that trust. It shows investors you have a fair, well-defined plan for making them money. Ultimately, it connects every single assumption in your model directly to the one metric that matters most to them: their final return.

How to Stress-Test and Audit Your Model

A static financial model is a fragile thing. It’s a snapshot of a perfect world where every single one of your assumptions holds true. But out in the real world of property investing, the only thing you can be sure of is that nothing ever goes exactly to plan.

If you want to truly understand a deal’s risk profile and earn investor trust, you have to push your model to its limits. This is where stress-testing comes in. It’s all about building dynamic functionality to see how the deal holds up when things get tough. We're moving beyond a single "base case" to analyze what happens in a worst-case scenario and, just as importantly, a best-case one. This isn't just some academic exercise; it's a critical part of underwriting that prepares you for market swings and sharp questions from potential investors.

Building Dynamic Scenarios into Your Model

First things first, you need to isolate your most sensitive assumptions—the variables that will have the biggest impact on your returns if they shift. From my experience, these are almost always the big four:

- Exit Capitalization Rate: A tiny move here can cause a massive swing in your sale price and overall profit. It's often the most sensitive input of all.

- Rent Growth: Being too aggressive on rent growth is one of the most common mistakes I see. What if rents are flat for a year or two?

- Operating Expense Ratio: Unexpected jumps in property taxes, insurance, or a major repair can eat into your cash flow faster than you think.

- Vacancy Rate: What happens if that anchor tenant leaves and it takes you six months to find a replacement?

Instead of hard-coding these numbers throughout your spreadsheets, create a dedicated "Assumptions" or "Scenarios" tab. This will be your control panel. Here, you can set up simple drop-down menus or input cells to toggle between different cases, like "Worst," "Base," and "Best." Then, every single formula in your model that uses these assumptions needs to link directly back to this central panel.

With this setup, you can see how a higher exit cap rate ripples through your IRR and equity multiple with just a single click.

The Power of Sensitivity Analysis

While scenario analysis is great for testing a whole set of assumptions at once, sensitivity analysis gives you a more granular view. It’s designed to show how a key metric, like the IRR, reacts when two key variables change at the same time. The easiest way to do this is with a data table in Excel or Google Sheets.

For instance, you could build a table with the Exit Cap Rate running along the top axis (in 0.25% increments) and the Average Rent Growth running down the side axis (in 0.50% increments). The table automatically calculates the IRR at each intersection of these two variables.

This immediately shows you the deal’s breaking points. You might discover that the project still works with a higher exit cap rate, but only as long as your rent growth stays above 2%.

This kind of two-variable analysis is incredibly powerful when you're talking to investors. It proves you've not only thought about the key risks but have actually quantified their potential impact on returns.

Your Final Pre-Flight Audit Checklist

Before that model ever gets attached to an investor email, you have to do a thorough audit. It’s non-negotiable. A single formula error or an unbalanced statement can completely tank your credibility. Think of this as your final pre-flight check.

Run through this practical checklist to catch common—and costly—mistakes:

- Check Your Sources and Uses: Does the total of your "Sources" (all your debt and equity) perfectly match your "Uses" (purchase price, closing costs, upfront reserves)? If this is off by even a dollar, the whole model is broken.

- Trace Key Formulas: Pick a couple of critical outputs, like the Year 1 NOI or the final IRR. Use the "Trace Precedents" tool in Excel to follow the logic all the way back to the original inputs. This is the fastest way to find broken links or formulas pointing to the wrong cells.

- Hunt for Hard-Coded Numbers: Scan your calculation tabs for any numbers that have been typed directly into a formula (besides simple things like 12 for months or 365 for days). Every major assumption belongs on your inputs tab, not buried in a formula.

- Review the Balance Sheet (if you have one): Does it balance to zero every single year? This is a classic accounting check that confirms the model’s internal integrity.

- Perform a "Sanity Check": Step away from the screen and just look at the big picture. Do the numbers feel right? If your model for a Class B apartment building is spitting out a 40% IRR, you’ve probably made a mistake. Always gut-check your results against real-world industry benchmarks.

Turning Your Model into a Capital-Raising Machine

You've spent hours grinding away, building and auditing your financial model. Now, it's time for the payoff. That spreadsheet isn't just a collection of numbers anymore; it's the single most powerful tool you have for raising capital. It’s how you turn a complex project into a compelling story that gets investors to write checks.

The secret is knowing which numbers to pull out and how to frame them. Your model is the engine that proves your investment thesis, showing investors a clear, logical path from acquisition to exit. It’s not enough to just state a 2.0x equity multiple; you have to show them how you get there.

Crafting a Narrative That Connects with Investors

Let's be honest, investors see a lot of deals. To make yours stand out, you need to present your model’s outputs clearly and concisely in your pitch deck or offering memorandum. Don't overwhelm them. Instead, focus on the handful of metrics that LPs truly care about.

Make sure these key data points are impossible to miss:

- Project-Level Returns: What are the unlevered and levered IRR and Equity Multiple for the deal itself?

- Partnership-Level Returns: This is the big one. What is the net IRR and Equity Multiple an investor will see after all fees and the sponsor promote?

- Annual Cash-on-Cash Return: Investors love seeing what kind of cash flow they can expect to hit their bank account each year.

- Sources and Uses Table: This is all about transparency. It gives a simple, clean summary of where the money is coming from and where it's going.

Visuals are your best friend here. A simple bar chart showing projected Net Operating Income (NOI) growth is far more effective than a wall of numbers in a table. The goal is to make the information as easy to digest as possible.

When it comes to fundraising, your model's main job is to build trust. If an investor can easily trace the path from your purchase price assumptions to their final payout, their confidence in you skyrockets.

This story becomes even more powerful when you tie it to the bigger picture. For instance, you could point to the massive supply-demand imbalance in the global housing market, which currently needs 6.5 million new units. You can then use your model to demonstrate exactly how this macro tailwind directly benefits your specific project. It shows you've done your homework. For more on this, check out these global housing trends on hines.com.

Ultimately, the numbers from your model set the stage for your entire relationship with your investors. By sharing transparent updates on how the property is performing against your original projections, you build the trust and credibility you'll need to fund your next deal, and the one after that.

Common Questions I Hear About Financial Modeling

Even with the best template in hand, you're going to have questions as you start digging into your own real estate model. Let's tackle a couple of the most common ones I get, because getting these right can save you from major headaches down the road.

What's the Single Biggest Mistake People Make?

Hands down, the most common and costly mistake is relying on overly optimistic assumptions that aren't grounded in reality. I see it all the time: projecting aggressive rent growth that completely ignores local comps or plugging in a super low exit cap rate that assumes the market will be red-hot when it's time to sell.

A deal can look like a home run in a spreadsheet, but it will fall flat on its face if the numbers aren't achievable in the real world.

My advice is simple: always build your "base case" on conservative, defensible data. You can always model more aggressive scenarios to see the potential upside, but your primary underwriting should be built on what you can prove, not what you hope for.

Should I Start with a Template or Build My Own Model?

If you're just starting out, grab a quality template. There’s no need to reinvent the wheel. A good template gives you a proven, logical structure and helps you see exactly how the different pieces—from operations and financing to the final returns—all fit together.

That said, your ultimate goal should be to get so comfortable with your model that you could build one from scratch if you had to. Once you reach that level of understanding, you can easily tweak the model for any unique deal structure and answer tough investor questions without breaking a sweat.

Ready to streamline your syndication from fundraising to distributions? At Homebase, we've built an all-in-one platform to eliminate the busywork so you can focus on what matters: closing more capital and building stronger investor relationships. Learn more about how Homebase can help you scale your business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Capital Raising Meaning A Sponsor’s Guide to Real Estate Investing

Blog

This guide demystifies the capital raising meaning for real estate sponsors. Learn to navigate syndication, structure deals, and attract investors.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.