How to Raise Real Estate Capital: The Modern Investor's Complete Guide to Funding Success

How to Raise Real Estate Capital: The Modern Investor's Complete Guide to Funding Success

Transform your real estate investment journey with proven capital raising strategies that deliver results. Learn from successful investors and discover practical approaches to securing funding in today's competitive market.

Domingo Valadez

Feb 8, 2025

Blog

Understanding Today's Real Estate Capital Landscape

Getting funding for real estate projects requires understanding key market forces and trends. Success depends on being able to read market signals and adapt fundraising approaches accordingly. Factors like changing investor preferences and interest rate movements need careful consideration. Past fundraising strategies may not work in the current environment.

Current Investor Preferences and Risk Appetite

Like waves in the ocean, investor sentiment changes over time and affects capital availability. Currently, investors focus heavily on risk-adjusted returns and look for stable investments with long-term growth potential. They also conduct deeper due diligence and want more transparency in deals. Real estate sponsors need solid data and compelling investment narratives to attract capital in this environment.

How Interest Rates Shape the Market

Interest rates significantly impact real estate financing by affecting borrowing costs and potential returns. Higher rates make loans more expensive and can reduce investor interest. However, other economic factors like inflation expectations also play a role. Understanding these complex relationships is essential for successful fundraising.

Recent Fundraising Performance

The real estate sector saw major changes in capital raising recently. 2023 marked an 11-year low for private equity fundraising, with firms raising $138.83 billion across 309 funds. This was down sharply from $236.04 billion across 554 funds in 2021. See the latest statistics on CoStar. These numbers show the challenges of raising capital in the current market.

Finding Success in Today's Market

Effective capital raising now requires flexibility and new approaches. Consider alternative funding sources like debt funds and crowdfunding. Focus on clearly showing the value of your investments and demonstrating market expertise. By understanding investor needs and staying adaptable, you can navigate the market successfully despite its challenges.

Making Real Estate Shine in the Investment Portfolio

Raising capital for real estate requires showing investors how properties fit within their broader investment strategy. Smart investors analyze how real estate works alongside other assets and consider multiple performance metrics. The focus goes beyond basic returns to evaluate the complete investment picture.

Demonstrating Value Beyond Simple Returns

Risk-adjusted returns play a vital role in investment decisions. This metric shows potential gains relative to risk levels - a steady 6% return with low risk may be more appealing than a volatile 12% return. The correlation between real estate and other investments is also key. Properties often move independently from stocks and bonds, providing valuable portfolio diversification.

Looking at historical data helps frame real estate's role. Since 1928, the S&P 500 has averaged 10% annual returns, reaching 12% with dividends included. Real estate typically returns 4-8% per year, slightly above inflation rates. Read more about historical performance comparisons. While stocks show higher growth, real estate offers more stability - an important selling point for raising capital.

Highlighting Real Estate's Unique Strengths

Understanding specific investor priorities is essential. Some focus on cash flow stability from rental income streams. Others value real estate's tax advantages like depreciation deductions. Many see properties as an effective inflation hedge for long-term wealth preservation. The key is showing how real estate enhances overall portfolio performance through these unique benefits.

Crafting a Compelling Investment Narrative

Success in raising real estate capital comes from building a clear story that connects with target investors. This means showing how your strategy matches their goals and risk tolerance. Back your narrative with solid market analysis, detailed financial projections, and open communication about potential concerns. Focus on demonstrating the concrete value and reliability that real estate investments bring to a diversified portfolio.

Mastering the REIT Strategy for Capital Access

Real Estate Investment Trusts (REITs) provide a proven path for raising real estate capital. When used effectively, these investment vehicles give operators access to institutional-level funding. The key is knowing how to properly structure, manage and market REITs to attract investor capital.

REIT Structures and Their Impact on Capital Raising

The choice of REIT structure directly affects fundraising potential. Equity REITs focus on owning income-producing properties and typically appeal to investors seeking steady dividend income. Mortgage REITs provide real estate financing and attract those wanting higher potential returns through interest payments. Hybrid REITs combine both approaches for a balanced strategy. Each structure appeals to different investor profiles and capital sources.

Compliance and Investor Relations: Building Trust and Credibility

Success requires careful attention to both regulatory compliance and investor communications. Key practices include detailed record-keeping, accurate reporting, and clear investor updates. Regular performance reports and prompt responses to inquiries demonstrate professionalism. Strong governance and transparency help build investor confidence and make fundraising easier.

Positioning Your REIT Offering in a Competitive Market

Standing out requires a clear value proposition focused on your REIT's strengths and expertise. Important elements include proven market knowledge, an experienced management team, and well-defined investment strategy. According to Nareit, US REITs raised $23.3 billion from secondary offerings in Q3 2024, showing strong investor demand. With proper positioning and execution, REITs provide reliable access to institutional capital for real estate ventures.

Creating Investment Packages That Close Deals

Getting investors interested in real estate deals requires a well-crafted investment package. The key is understanding what experienced investors look for and delivering materials that meet their needs. Beyond just having a solid project, you need to present it in a way that builds trust and makes investors eager to participate.

Essential Components of a Winning Investment Package

A great investment package tells a complete story about your opportunity. It should cover not just what the investment is, but why it makes sense and how you'll execute it successfully.

- Clear Investment Summary: Your main document should detail the property, market analysis, financial projections, and team qualifications. This forms the foundation of your pitch.

- Professional Presentation Materials: Create clean, visually appealing slide decks and one-page overviews that highlight key points. These quick reference materials support your detailed documents.

- Detailed Financial Models: Include realistic projections showing returns, cash flows, and sensitivity analyses. Make sure your numbers are solid and can stand up to scrutiny.

Addressing Investor Concerns Head-On

Smart investors will look closely at potential downsides. Build trust by addressing concerns before they come up. Show that you've thought through risks and have plans to handle them.

- Risk Management: Outline specific risks and your strategies to minimize them, from market changes to operational issues.

- Backup Plans: Document your alternate approaches if things don't go as planned. This shows you're prepared for various scenarios.

- Direct Communication: Be upfront about challenges and keep investors informed. Honesty builds lasting relationships.

Showcasing Your Edge and Expertise

In a competitive market, you need to clearly explain what makes your deal special. This means highlighting your unique advantages and proving your team can deliver results.

- Track Record: Share your team's past successes, relevant experience, and deep market knowledge. Give investors confidence in your abilities.

- Exit Plan: Spell out how investors will get their money back, whether through sale, refinance, or other means. Give them a clear timeline.

- Growth Opportunities: Point out specific ways to improve the property's performance through renovations, better management, or repositioning.

Structuring Deals for Success

The way you organize the investment greatly affects its appeal. A good structure makes roles, responsibilities, and profit-sharing crystal clear.

- Investment Structure: Define the legal setup, ownership stakes, and how profits will be divided.

- Aligned Interests: Create terms that benefit both sponsors and investors when the project succeeds. Consider performance bonuses for exceeding goals.

- Clear Oversight: Set up straightforward reporting and decision-making processes. This keeps everyone informed and accountable throughout the project.

A carefully built investment package addressing these key areas significantly improves your chances of raising capital. Remember that being thorough and transparent makes investors more likely to commit their funds.

Building Your Capital Raising Network

Getting real estate investors requires developing meaningful relationships, not just collecting contact information. A robust network of potential investors forms the foundation for sustainable funding success. This goes beyond superficial connections to establishing yourself as someone who delivers consistent value to investors.

The Power of Connection: Online vs. Offline Networking

Your investor network should be diverse, like a well-balanced investment portfolio. At industry events and conferences, face-to-face meetings build personal rapport and accelerate deal flow. Meanwhile, platforms like LinkedIn and real estate forums expand your reach and allow ongoing engagement through content sharing. The best results come from combining both in-person and digital networking approaches.

Building Authentic Relationships: More Than Just Transactions

Just as buildings need solid foundations, fundraising success depends on genuine investor relationships. Take time to understand each investor's specific goals - some prioritize steady cash flow while others seek long-term appreciation. Active listening helps you present opportunities that align with their objectives, positioning you as a trusted advisor rather than just a capital seeker. Read also: How to master real estate capital raising strategies.

Creating Value Before Asking for Capital

Think of networking like planting seeds before harvest time. Share valuable market insights and connect investors with relevant opportunities before requesting funding. This establishes your expertise and credibility. When you do seek capital, investors are more likely to seriously consider your projects because you've already demonstrated your value.

Maintaining Engagement and Staying Top-of-Mind

Regular communication keeps your network engaged. Share updates through newsletters, blog posts, social media, and personal emails. Focus on providing relevant market intelligence and insights that benefit your investors. This ongoing value exchange strengthens relationships beyond individual deals.

Strategies for Effective Communication and Relationship Management

Success requires both speaking and listening skills:

- Regular Updates: Keep investors informed about market conditions and your activities, even between capital raises

- Personal Touch: Customize communications based on each investor's interests and goals

- Quick Response: Answer questions promptly and make yourself available for discussions

- Share Knowledge: Provide analysis and research that helps investors make better decisions

Consistently delivering value transforms fundraising from transactional to collaborative. Focus on building lasting partnerships where both sides benefit from shared success.

Navigating Legal and Regulatory Requirements

Building a successful real estate investment requires you to understand and follow the proper legal frameworks. Having the right regulatory approach helps you both attract investors and protect your business interests - it's not just about finding promising deals.

Understanding Securities Regulations and Offering Types

When raising capital for real estate, your investment offering typically falls under securities regulations. The two main types are private placements and public offerings. Private placements focus on accredited investors with simpler disclosure requirements. Public offerings can reach more investors but face stricter oversight and disclosure rules. The best choice depends on your project size, target investors, and expansion strategy.

Essential Disclosure Requirements: Transparency is Key

Investors need clear information to make smart decisions. Disclosure requirements ensure they get key details about financial performance, risks, and the management team's background. The Private Placement Memorandum (PPM) serves as the main document outlining investment specifics. Good disclosures protect both parties and build trust.

Practical Approaches to Maintaining Compliance

Following the rules consistently matters during fundraising and beyond. Success requires careful attention to:

- Legal Support: Partner with lawyers who specialize in securities and real estate law to structure offerings correctly and handle complex requirements

- Documentation: Keep organized records of investor communications, transactions, and agreements to protect against disputes

- Regular Reviews: Check compliance procedures often and update them as regulations or business needs change

Building a Scalable Compliance System

As you grow, managing compliance gets more complex. Create a system that can expand with your business by including:

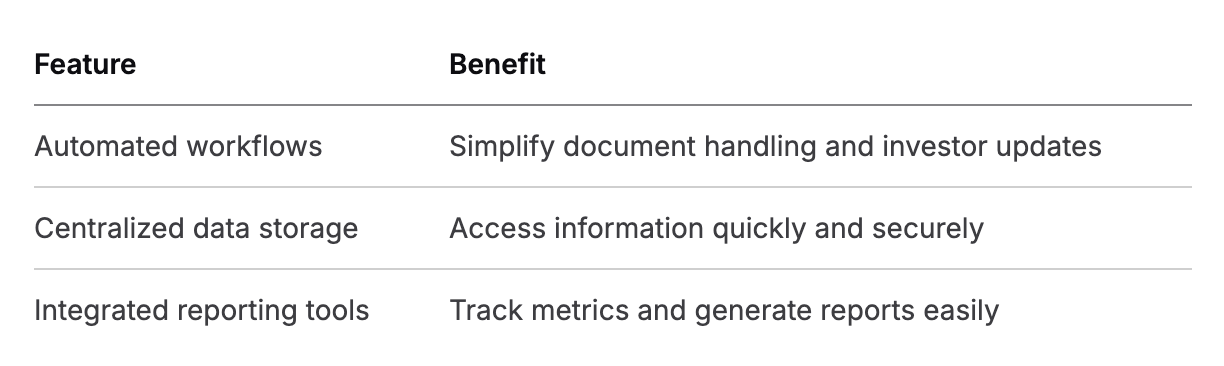

Need help managing real estate syndication and maintaining compliance? Homebase offers an all-in-one platform for deal management, investor relations, and regulatory requirements. Visit their website to learn how they can help scale your business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Explore definition hurdle rate: A Guide for Real Estate Syndicators

Blog

Learn definition hurdle rate: discover how it protects investors, aligns incentives, and guides real estate syndication with practical examples.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.