A Complete Guide to Limited Real Estate Partnership Investing

A Complete Guide to Limited Real Estate Partnership Investing

Discover how a limited real estate partnership works. Our guide explains the structure, legal documents, tax benefits, and risks for GPs and LPs.

Domingo Valadez

Jan 12, 2026

Blog

A limited real estate partnership is a powerful way for real estate experts and investors to team up. At its core, it’s a business structure where an active General Partner (GP) finds and manages a property, while passive Limited Partners (LPs) provide the necessary funding.

The GP handles everything—from scouting the deal to managing the day-to-day operations—and takes on all the legal and financial risk. In return, the LPs contribute capital for a piece of the profits, but their personal risk is capped at the amount they invested. It’s a win-win that allows sponsors to tackle bigger projects and gives investors a ticket to high-value real estate without the management headaches.

What Is a Limited Real Estate Partnership

Imagine you're trying to fund a major sea expedition. You've got the experienced captain—the General Partner—who knows the waters, can navigate any storm, and has a clear map to the treasure. This captain is the one steering the ship, managing the crew, and making all the critical decisions.

But a captain needs a ship and supplies. That’s where the Limited Partners come in. They are the wealthy backers who believe in the captain's vision and provide the capital to fund the voyage. They don't swab the decks or steer the ship; they simply put up the money in exchange for a share of the treasure when the journey is over.

This exact dynamic is the backbone of real estate syndication, creating a mutually beneficial relationship that makes large-scale deals possible.

The Two Core Roles Explained

Every limited real estate partnership hinges on the distinct responsibilities of its two members. Getting this right is the key to the whole operation.

- The General Partner (GP): Also called the sponsor, this is the hands-on expert driving the project. They do all the heavy lifting: finding the property, conducting due diligence, arranging loans, and executing the business plan to increase its value. With great power comes great responsibility—their liability is unlimited, meaning their personal assets are on the line if things go south.

- The Limited Partner (LP): These are the passive investors who bring the cash to the table. Their role is purely financial. LPs have zero management duties, and their liability is strictly limited to their initial investment. This shield protects their personal wealth from any partnership debts or lawsuits.

Here’s a simple breakdown of how they compare.

General Partner (GP) vs Limited Partner (LP) At a Glance

Ultimately, this structure lets the expert do what they do best, while the investor provides the fuel to make it happen, with clear boundaries protecting each party.

A partnership is a powerful vehicle that allows investors to pool their capital together to buy assets they couldn't afford on their own. It grants sponsors the ability to control large, valuable properties with a relatively small portion of their own capital.

Why This Model Dominates Real Estate

So, why is the limited partnership structure so common in real estate? It’s all about leverage and access.

For a skilled operator (the GP), it’s a way to scale their business far beyond what their personal bank account would allow. For investors (the LPs), it unlocks the door to institutional-grade deals—think large apartment complexes or prime commercial buildings—that are normally out of reach for individuals.

A key part of understanding what is a distressed property and how to invest is knowing that these are often prime targets for partnership ventures, as they require both deep expertise and significant capital. At the end of the day, this framework perfectly aligns the sponsor's skill with the investor's money to chase opportunities that neither could capture alone.

How These Real Estate Partnerships Are Structured

While the idea of a General Partner and a group of Limited Partners seems simple, the reality is a carefully engineered legal and financial setup. Think of it like building a house. The GP and LP roles are the blueprint, but the legal structure is the foundation and framing—it's what holds everything together and protects everyone involved.

For most modern limited real estate partnerships, the go-to foundation is the Limited Liability Company (LLC). While you might still see traditional Limited Partnerships (LPs), the LLC brings one huge advantage to the table: it extends liability protection to the General Partner, too.

This structure creates a distinct legal entity that owns the property. By doing so, it shields the GP’s personal assets from business debts or lawsuits, offering the same protection the LPs have always had. The LLC essentially acts as a central vault for the entire project, creating a clean, clear pathway for capital to flow from investors straight to the asset.

The Flow of Capital and Operations

From the moment an investor commits capital to the day they receive their first distribution, the process follows a logical and transparent path. This cycle is designed to make sure every dollar is accounted for.

- Entity Formation: First things first, the GP establishes the LLC. This company will be the legal owner of the real estate and will have its own dedicated bank account, completely separate from anyone's personal funds.

- Capital Contribution: Once the legal agreements are signed, the Limited Partners wire their investment funds directly into the LLC’s bank account.

- Property Acquisition: The GP takes this pooled capital, combines it with financing (like a commercial loan), and purchases the target property. Critically, the title of the asset is held in the name of the LLC, not any individual.

- Asset Management: With the property in hand, the GP gets to work on the business plan—renovating units, raising rents, or bringing in better management to increase the property's value. All income and expenses flow through the LLC's account.

This separation isn't just a formality; it's fundamental. It isolates the project's finances and legal obligations, protecting all the partners involved.

Understanding Pass-Through Taxation

One of the most compelling reasons to use an LLC for a real estate partnership is its tax treatment. Unlike a C-corporation, an LLC benefits from pass-through taxation, which neatly sidesteps the dreaded "double taxation" problem.

With a C-corp, the company pays corporate income tax on its profits. Then, when it pays out dividends to shareholders, those shareholders have to pay personal income tax on that money again. An LLC avoids this completely.

The partnership itself pays no income taxes. Instead, all profits, losses, deductions, and credits are "passed through" directly to the individual partners and reported on their personal tax returns, in proportion to their ownership. This means the income is only taxed once—at the personal level.

This tax efficiency is a huge driver behind this structure's popularity in real estate. The data proves it. According to U.S. tax statistics for 2022, LLCs accounted for 72.7% of all partnerships filed. Even more telling, the real estate and rental sectors made up 50.7% of all partnership entities.

And while traditional limited partnerships only filed 9.6% of all partnership returns, they captured a massive 35.4% of total pass-through income. This shows just how powerful the model is for generating investor returns. You can dive deeper into these figures by reviewing more partnership tax statistics on the IRS website.

A Practical Example: The 100-Unit Apartment Complex

Let's bring this down to earth with a real-world scenario. Imagine a sponsor (the GP) finds a 100-unit apartment building for sale for $10 million. The plan is to buy it, spend $1 million on renovations, and increase rental income over the next five years.

The GP needs to raise $4 million in equity from investors, with the remaining $7 million coming from a bank loan. Here's how it plays out:

- The GP forms a new company, "123 Main Street Apartments, LLC."

- They syndicate the deal, bringing in 25 Limited Partners who each invest between $100,000 and $250,000.

- The LPs' $4 million is wired directly into the LLC's bank account.

- The GP uses that equity plus the $7 million loan to close the $10 million purchase and fund the $1 million renovation budget.

- Over the next five years, the GP manages the property. All rental income goes into the LLC, and all expenses (the mortgage, taxes, maintenance) are paid from it.

- Any net cash flow is distributed to the partners as outlined in the operating agreement, and each partner reports their share of the income (or loss) on their personal tax return.

The Legal Paperwork: Understanding the Core Documents

Jumping into a real estate partnership isn't a handshake affair. It’s a serious financial commitment, and it’s all held together by some pretty dense legal documents. At first glance, they can look like a mountain of legalese, but they're absolutely critical to understand. These papers are your roadmap and your rulebook, spelling out your rights, responsibilities, and protections.

Think of them as the constitution for your investment. They lay out the rules of the road for everyone involved—the sponsor and the investors—and ensure there’s a clear plan for how the partnership will run from day one until the property is sold. Let’s break down the big three you’ll always encounter.

The Private Placement Memorandum (PPM)

The Private Placement Memorandum (PPM) is the first major document you'll receive from the deal sponsor (the General Partner). Its job is to give you a full, unvarnished look at the investment opportunity, warts and all. It’s not a flashy marketing brochure; it's a disclosure document designed to give you all the information you need to make a smart decision.

Inside the PPM, you'll find the business plan, the terms of the investment, bios of the sponsorship team, and—most importantly—an exhaustive list of potential risks. Reading this document from cover to cover is your first and most important step in doing your homework on any deal.

The Operating Agreement

While the PPM outlines the offering, the Operating Agreement is the official rulebook for how the partnership itself will function. This is a legally binding contract that governs the inner workings of the LLC created for the investment. It lays out the precise relationship between the General Partner and all the Limited Partners.

This is arguably the most important document you'll sign. It’s the blueprint for the entire venture, defining how profits are paid out, how major decisions get made, and what happens if the deal hits a rough patch. If you want to see what these look like in practice, checking out a real estate partnership agreement template can give you a feel for the standard clauses and structure.

The Operating Agreement is where the money mechanics are set in stone. It legally defines the distribution waterfall and all sponsor fees, making sure everyone is crystal clear on who gets paid, when, and how.

This agreement dives deep into several key areas:

- Management & Voting Rights: This spells out the GP's authority and control, and it clarifies the rare circumstances under which LPs might have a say.

- Capital Contributions: It specifies exactly how much each partner is investing and outlines the process for "capital calls" if the project ever needs more funding down the line.

- Distribution Waterfall: This section contains the specific formula for how cash flow from rent and profits from a sale are split among all the partners.

- Fees: Here you'll find a transparent breakdown of every fee the GP can earn, like acquisition fees, asset management fees, and so on.

The Subscription Agreement

Finally, we have the Subscription Agreement. This is basically your official application to join the partnership. When you sign it, you are formally "subscribing" to buy a certain number of shares or units in the company.

This is the document that contractually binds you to the terms you've already reviewed in the PPM and Operating Agreement. You’ll state the exact amount you’re investing and confirm that you meet any necessary qualifications, like being an accredited investor.

Once the sponsor countersigns your Subscription Agreement, it’s official—you are a Limited Partner in the deal. This final signature locks in the legal framework, turning a promising opportunity into your official, legally recognized stake in the property. Together, these three documents build a secure and transparent foundation for the partnership.

How Investors and Sponsors Get Paid

So, how does everyone actually make money in one of these deals? The financial engine of a limited real estate partnership is something called the distribution waterfall. It’s a fancy term for a simple concept: a tiered system that dictates who gets paid what, and when.

Forget a simple 50/50 split. A waterfall is a structured sequence designed to align the interests of the General Partner (GP) with their Limited Partners (LPs). Think of it like a series of buckets stacked on top of each other. The profits pour into the top bucket first, and only when it’s full does the money spill over into the next one down the line. This structure is brilliant because it ensures investors get their initial capital back, plus a predetermined minimum return, before the sponsor starts earning their big performance bonus. It's a key mechanism for building trust.

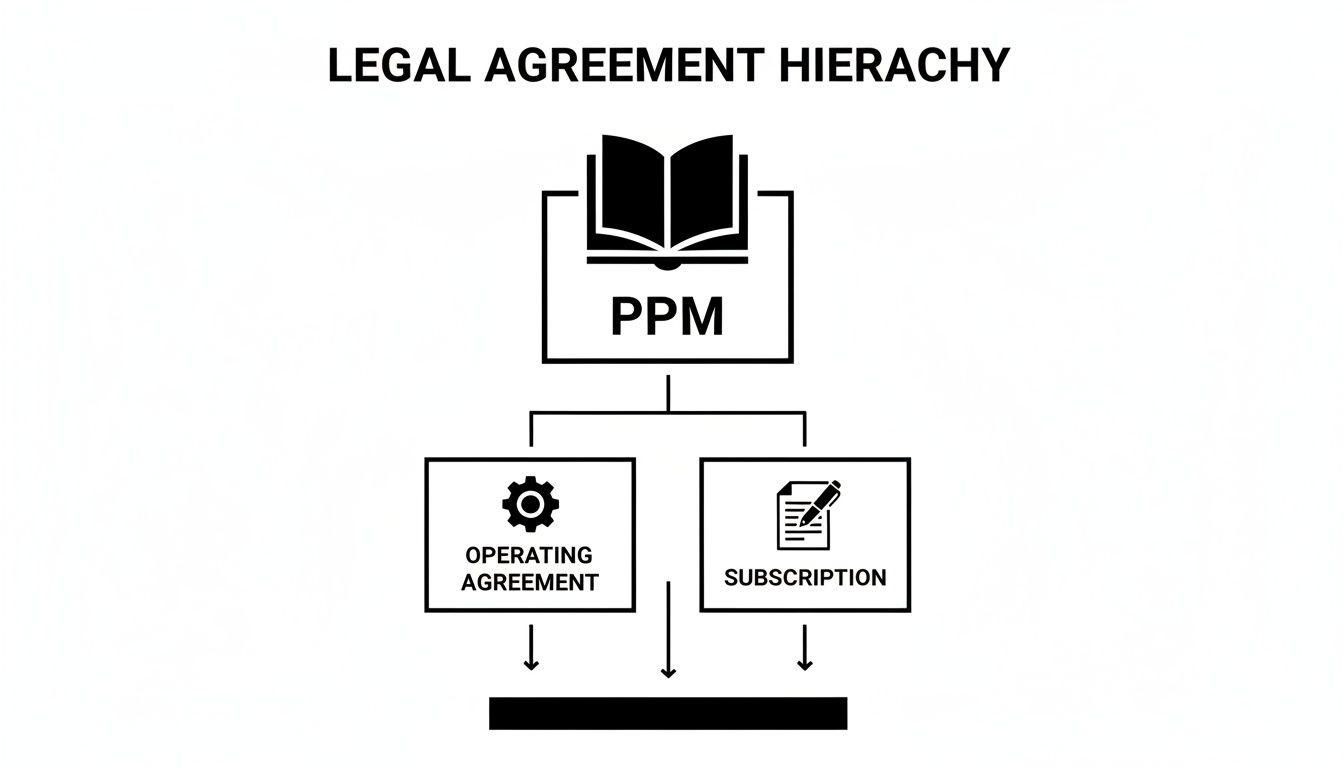

The entire payment structure is governed by a hierarchy of legal documents. The Private Placement Memorandum (PPM) gives the 30,000-foot view, while the Operating Agreement gets into the nitty-gritty rules of the partnership.

As you can see, these documents work together. The PPM lays out the investment thesis, the Operating Agreement defines the rules of the game (including the waterfall), and the Subscription Agreement is the document an investor signs to officially join the deal.

Starting with the Preferred Return

The first and most important bucket in almost every waterfall is the preferred return, or "pref." This is the first hurdle. It’s a promise that LPs will receive a set percentage return on their investment before the GP sees a dime of the profits.

A typical preferred return in the industry is 6-8% annually. Let's say you invest $100,000 into a deal with an 8% pref. This means you are first in line to receive $8,000 from distributable cash flow each year. Now, it's not a guarantee—the property has to perform—but it does accrue. If profits are lean one year, that unpaid amount rolls over and must be paid out before the GP can ever get to their share.

Moving Through the Hurdles and Promote

Once the LPs have been paid their full preferred return, the waterfall cascades to the next tiers. This is where the GP’s performance fee, known as carried interest or the promote, kicks in. The profit split usually isn’t static; it changes at different performance levels, rewarding the GP more as the deal becomes more successful for everyone.

The promote is the GP’s reward for hitting a home run. It’s the ultimate alignment tool, making sure their financial success is directly tied to the success they deliver to their investors.

An Example of a 4-Tier Distribution Waterfall

To make this tangible, let's look at a common waterfall structure. The splits and hurdles can vary, but the logic remains the same: investors get paid first, and the sponsor's reward grows as they outperform the initial projections.

This tiered approach ensures that as the deal's performance improves, both the LPs and the GP share in the upside, but always in a pre-defined and orderly way.

A Waterfall Example in Action

Let’s put some real numbers to it. Imagine a partnership raises $1 million from LPs. A few years later, they sell the property and generate $2 million in total profit after all costs are paid. The deal's Operating Agreement specifies an 8% preferred return (we’ll assume $240,000 has accrued over the hold period) and a 70/30 final split after the LPs get their capital and pref back.

Here’s how the cash would flow:

- Return of Capital: First, $1,000,000 of the proceeds goes right back to the LPs. They are now whole on their initial investment.

- Preferred Return: Next, $240,000 of the profit is paid to the LPs to satisfy the cumulative 8% pref.

- Remaining Profit: This leaves $760,000 in profit on the table ($2,000,000 total profit - $1,000,000 capital - $240,000 pref).

- Promote Split: This remaining $760,000 is now split 70/30:LPs receive $532,000 (70%).The GP receives $228,000 (30%) as their promote.

In the end, the LPs walk away with a total of $1,772,000 ($1M capital + $240k pref + $532k profit share). It’s a fantastic return, and the GP is handsomely rewarded for executing the business plan successfully. This transparent, tiered structure is the bedrock of a well-managed limited real estate partnership.

The Benefits and Risks for All Partners

Every real estate partnership is a delicate balance of risk and reward. Both the Limited Partner (LP) and the General Partner (GP) come to the table with different goals and different things on the line. Getting a handle on this dynamic is non-negotiable if you're thinking about jumping into a deal, whether you're the one writing the check or the one running the show.

For LPs, it's all about getting access to great deals and solid returns. For GPs, it's about scaling their vision and expertise. The whole structure is designed to get these two sides pulling in the same direction, but what each partner gains—and what they risk—is fundamentally different. Let's pull back the curtain on what that looks like.

What’s In It For The Limited Partners (LPs)?

For a passive investor, the beauty of a limited partnership is its hands-off nature. You get the potential for real estate wealth without the headaches of midnight maintenance calls or chasing down rent checks.

The Upside for LPs:

- Passive Income: This is the big one. LPs collect their share of the cash flow from rent and, hopefully, a nice chunk of the profits when the property is sold—all without lifting a finger on the day-to-day operations.

- Liability Protection: Your personal assets are safe. The absolute most you can lose is the money you put into the deal. That’s it.

- Access to Bigger Deals: Most of us can't go out and buy a 100-unit apartment building or a prime commercial complex on our own. LPs can pool their money to get a piece of institutional-grade properties they could never touch otherwise.

- Smart Diversification: Spreading your capital across different assets, cities, and sponsors is a classic way to reduce risk. Many investors weigh the pros and cons of Real Estate vs Stock Market, and syndications offer a compelling way to add direct property ownership to a portfolio.

Of course, this passivity doesn't come for free. There are some serious trade-offs to consider.

The core bargain for a Limited Partner is simple: you trade control for convenience and liability protection. You are trusting the GP entirely with your capital.

The Downside for LPs:

- No Control: Once your money is in, you're just along for the ride. LPs have zero say in how the project is run. You’re completely reliant on the GP’s skill and honesty.

- It’s Not a Liquid Investment: This isn't like selling a stock. Your capital is locked up for the life of the project, which is often 5-10 years. You can't just cash out when you feel like it.

- Sponsor Risk: The investment lives or dies with the GP. A great sponsor can work magic, but a bad one can lose your entire investment. Your due diligence on the person running the deal is everything.

What’s In It For The General Partners (GPs)?

For the sponsor, a partnership is the engine for growth. It allows them to take down massive assets and build a business around their expertise, using other people's capital to make it happen.

The Upside for GPs:

- Control Large Assets: A GP can acquire and manage multi-million dollar properties while putting up only a small fraction of the total cash required. It’s the ultimate form of leverage.

- Major Earning Potential: Sponsors earn fees for finding the deal (acquisition fee) and running it (asset management fee). But the real prize is the "promote"—a disproportionately large cut of the profits if they deliver a home-run project.

That incredible upside is matched by an equally incredible amount of responsibility and personal risk. When a deal goes south, the GP feels it the most. This pressure cooker environment got even hotter in 2023 when rising interest rates caused LP investments to drop by a staggering 28.7% to $40.30 billion, making a GP’s job tougher than ever. You can read more about these investment trends on S&P Global.

The Downside for GPs:

- Unlimited Liability: The buck stops here. If the partnership is a simple GP/LP structure, the GP is personally on the hook for all partnership debts. Even when using an LLC, sponsors almost always have to sign personal guarantees on the loan.

- Reputational Damage: A failed project is more than a financial loss; it’s a black mark on a sponsor's track record. It can make raising money for the next deal incredibly difficult, if not impossible.

- Fiduciary Duty: This is a big legal and ethical line. GPs have a sworn duty to act in the best interest of their investors. Breaching that trust can lead to lawsuits and ruin a career.

Using Technology to Manage Your Partnership

The bones of the limited real estate partnership haven't changed much over the years, but how the pros manage them certainly has. Gone are the days of clunky spreadsheets, chasing down wet signatures, and sending out mass email updates that get lost in spam folders. Today’s top syndicators know that technology is the key to running a professional, scalable operation.

Think about it. Can you imagine trying to manage 25, 50, or even 100 investors with a messy patchwork of Excel files, scattered email threads, and a separate e-signature tool? It’s an administrative black hole that sucks up a General Partner's most critical resource: time. This old-school approach not only creates headaches for you but also makes you look disorganized to the very people trusting you with their capital.

This is where dedicated investor portals come in, creating a single, reliable hub for the entire partnership.

Centralizing the Investor Experience

A good investor management platform is mission control for the entire deal, from the first pitch to the final payout. For a GP, this is a game-changer. Instead of juggling a dozen different tools, you have one place to manage everything, which builds immense credibility and trust with your investors.

These platforms are designed to handle the tedious but crucial tasks that bog down a deal:

- Effortless Subscriptions: Investors can review offering documents and sign subscription agreements securely online. No more printing, scanning, or mailing.

- Accreditation Checks: The system can manage the process of verifying an investor’s accreditation status, keeping you compliant.

- A Single Hub for Communication: All performance reports, project updates, and K-1 tax documents live in one secure portal. Your investors always know where to find what they need.

- Simplified Distributions: When it's time to pay out returns, you can send ACH payments to all your LPs in just a few clicks, complete with clear reporting.

An investor portal shifts the relationship from a series of clunky administrative hurdles to a smooth, professional experience. It’s like having a dedicated investor relations department that works around the clock.

Gaining an Edge in a Competitive Market

In the current climate, efficiency and investor confidence are everything. While global real estate deal values bounced back in 2024 to $707 billion, LP confidence is still a mixed bag. This makes it more important than ever to use tools that make it easy for investors to say "yes" and commit their capital.

Platforms like Homebase give sponsors professional deal rooms, live commitment tracking, and automated distributions—all features that help you stand out when fundraising is tough. You can learn more about the state of private markets in this global report from McKinsey.

At the end of the day, using technology to manage your limited real estate partnership isn't just a nice-to-have; it's essential for growth. It frees you from the administrative grind so you can focus on what really matters: finding great deals and executing your business plan. For your LPs, it provides the secure, transparent, and professional experience they expect from a sophisticated operator. This is how you scale.

Frequently Asked Questions

When you're diving into the world of real estate partnerships, a few questions always seem to pop up. Let's tackle some of the most common ones that investors have, breaking down the key concepts you'll need to grasp.

What Is a Typical Minimum Investment?

There’s no one-size-fits-all answer here. The minimum buy-in for a limited partnership can range from $25,000 on the lower end all the way up to $100,000 or more for bigger, institutional-quality deals.

Ultimately, the General Partner (GP) decides on the minimum investment. They'll base it on factors like the total amount of cash needed for the project and how many investors they want to bring on board. A sponsor looking for a smaller circle of high-net-worth partners might set a higher minimum, whereas a deal on a crowdfunding site might have a lower bar to attract a wider pool of people.

Can I Sell My Partnership Stake Early?

For the most part, no. A stake in a real estate partnership is a classic illiquid investment. That's just a fancy way of saying you can't cash it out quickly and easily like you would a stock on the New York Stock Exchange.

When you invest, you're really committing your capital for the entire project timeline, which is typically projected to be 5 to 10 years. The partnership's operating agreement will almost certainly have strict rules preventing you from selling your share. While you might find a rare exception with the GP's express permission, you should go into every deal assuming your money is tied up until the property is sold.

Think of it this way: your investment is tied directly to a physical building. You can't just sell your piece of the foundation on a whim. The partnership relies on that capital to execute the business plan over the long term.

What Happens If the GP Performs Poorly?

As a Limited Partner (LP), you have very little say once the deal is funded. This is the big trade-off. In exchange for passive involvement and limited liability, you hand over the reins to the GP, who has full operational control according to the operating agreement.

So, if the GP mismanages the property or the business plan goes sideways, your options are few and far between. This is exactly why upfront due diligence on the sponsor is the single most important task for any potential LP. Before you even think about wiring money, you need to vet their track record, their communication habits, and their reputation in the industry. The success of your investment is riding almost entirely on their skill and integrity.

How Are Partnership Investments Taxed?

Real estate partnerships offer a huge tax advantage thanks to something called pass-through taxation. The partnership itself, which is usually set up as an LLC, doesn't pay any corporate income tax.

Instead, all the financial outcomes—profits, losses, depreciation, and any tax credits—are "passed through" directly to the individual partners. Every year, the GP will send you a Schedule K-1 tax form. This document breaks down your share of the partnership's finances for the year, and you simply report those numbers on your personal tax return. This setup neatly avoids the double taxation that hits C-corporations.

Ready to stop wrestling with spreadsheets and start scaling your real estate syndication? Homebase provides an all-in-one platform to manage your deals, investors, and distributions with professional ease. See how you can streamline your next capital raise by checking out the Homebase platform.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Your Guide to Partnering with a Real Estate Syndication Company

Blog

Learn how a real estate syndication company turns passive investors into property owners. This guide covers deal structures, returns, and how to vet sponsors.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.