How to Secure Funding for Real Estate

How to Secure Funding for Real Estate

Discover how to secure funding for real estate with proven strategies for debt, equity, legal compliance, and building powerful investor relationships.

Domingo Valadez

Dec 1, 2025

Blog

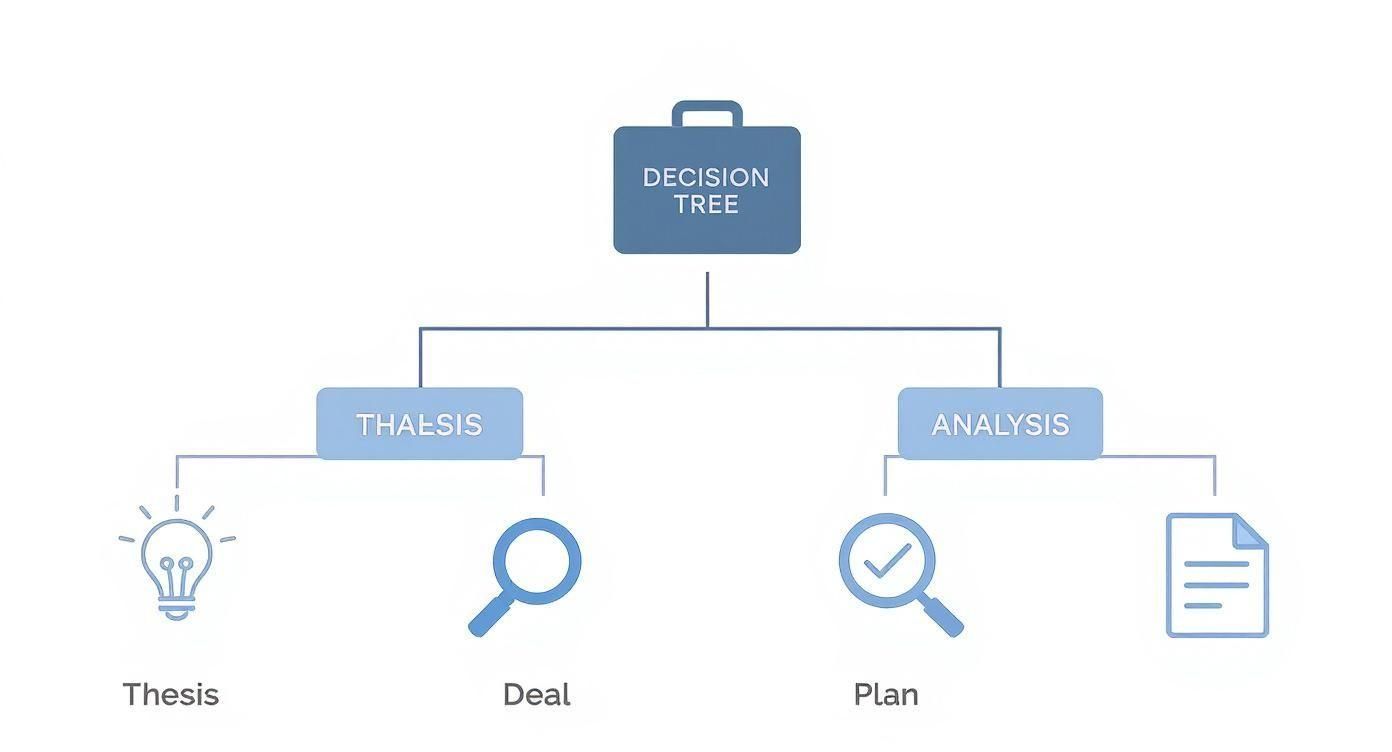

Securing the capital for your real estate deal really boils down to two things: building a bulletproof business plan and structuring a capital stack with the right mix of debt and equity. You have to start with a rock-solid investment thesis and some serious market analysis. Only then can you start matching your project's needs with the right funding sources, whether that’s a traditional bank loan or a pool of private investors.

Building Your Foundation for Real Estate Funding

Getting capital isn't just about asking for money; it's about presenting an investment opportunity that’s too good to pass up. The most successful sponsors know that the real work starts long before you ever sit down with an investor. It’s all about building a foundation that turns a promising "deal" into a professional, data-backed business plan that makes people want to write checks. This is what separates the pros from the people who are always struggling to get funded.

It all begins with your investment thesis. This isn’t some vague idea—it’s the story of your strategy. For example, maybe your thesis is to acquire B-class multifamily properties in specific Sun Belt markets where you've identified clear job growth and demographic shifts. Having that sharp focus shows you’ve done your homework and have a clear vision.

From Market Analysis to Financial Models

With your thesis in hand, the next step is to prove it with rigorous market analysis. You have to dig deeper than the surface-level stuff. Don’t just say a city is growing; analyze submarket vacancy rates, pull detailed rental growth comps, and understand the local economic engines. This is how you show your thesis is grounded in reality, not just wishful thinking.

All that data then feeds directly into your financial models. A bulletproof pro forma is absolutely essential. It needs to clearly lay out every assumption, your sources and uses of funds, detailed cash flow projections, and the key return metrics investors care about, like IRR and Equity Multiple. Trust me, sophisticated investors will try to poke holes in your numbers, so your model has to be transparent, logical, and built to withstand a serious cross-examination.

A great deal with a weak business plan will struggle to find funding. A good deal with an institutional-quality plan and presentation will almost always attract capital. Preparation is your greatest competitive advantage.

Understanding the Capital Stack

Every real estate deal is paid for with a mix of debt and equity. We call this the capital stack. Think of it like a layered cake of financing, where each layer comes with a different level of risk and a different potential return.

Before we dive into the specific sources, it's crucial to understand these two fundamental pillars of capital. They are the building blocks of every real estate transaction, from a simple duplex to a massive commercial development.

Learning how to secure funding is really about learning how to assemble these two components creatively. A well-structured deal is one that works for both your lenders and your equity partners, and getting that balance right is what sets the stage for a successful raise.

Getting Creative: A Sponsor's Guide to Capital Sources

Every real estate deal is a unique puzzle, and how you piece together the financing—the capital stack—is often what separates a good deal from a great one. You can't just apply the same formula to every project. Your job as a sponsor is to know the entire menu of funding options so you can strategically match the right capital to your specific asset, maximizing returns while keeping risk in check.

Think of the capital stack as more than just a list of loans and investors. It’s a strategic game. Knowing when to use cheap senior debt, when to plug a gap with a mezzanine loan, or when a JV partnership is smarter than syndicating to a hundred small investors is crucial. Each decision you make here will ripple through the entire project, impacting your control, your timeline, and ultimately, your profits.

Before you even think about money, though, you need a rock-solid foundation. It all starts with your investment thesis and a meticulously crafted business plan.

As this shows, successful fundraising isn’t just about making calls; it’s the end result of rigorous homework and a compelling strategy.

The Foundation: Anchoring Your Deal with Debt

For the vast majority of real estate deals, the financing journey starts with senior debt. This is the biggest and cheapest piece of the puzzle, secured by a first-position lien on the property. It’s the bedrock of your capital stack.

You’ll typically find senior debt in a few places:

* Commercial Banks & Credit Unions: These are your go-to for stabilized properties with a proven track record of cash flow. They offer great rates but tend to be more conservative on loan-to-value (LTV) and have pretty strict underwriting criteria.

* Agency Lenders (Fannie Mae & Freddie Mac): If you're in the multifamily space, agency debt is the gold standard. You can lock in long-term, fixed-rate financing on very attractive terms, but be prepared for a long and paperwork-intensive application process.

* Debt Funds: These private players are a lot more nimble and flexible than traditional banks. They're a perfect fit for value-add deals or transitional assets that don’t quite fit the neat boxes required by conventional lenders.

The trick is to make sure your loan aligns perfectly with your business plan. A short-term bridge loan from a debt fund is great for a quick renovation, whereas a 10-year, fixed-rate agency loan is what you want for a long-term hold.

The Mezzanine Layer: Bridging the Gap

What happens when senior debt and your own equity aren't enough to get the deal done? This is where the middle of the capital stack comes in, giving you creative ways to fill that funding gap without giving away too much of the upside.

Mezzanine debt is a powerful hybrid of debt and equity. It’s a loan that sits behind the senior mortgage and is secured by your ownership interest in the LLC, not the property itself. Yes, it’s more expensive than your bank loan, but it’s almost always cheaper than bringing in more equity partners.

Preferred equity is another fantastic tool. It isn't a loan; it's an equity investment that gets paid before you and your common equity investors. "Pref" investors typically earn a fixed return before any profits are distributed to anyone else.

Think of it this way: if your senior loan gets you 70% of the way, mezzanine debt or preferred equity can push you up to 80-85%, which dramatically lowers the amount of common equity you have to raise from investors.

The Engine: Powering the Deal with Equity Partnerships

Equity is what it’s all about—it's the true ownership stake. How you structure this part of the raise really defines your role as the sponsor and the trajectory of your business.

Joint Ventures (JVs) mean teaming up with a single, large capital partner, like a family office or an institutional group. This is a great path for bigger deals, giving you access to serious capital and instant credibility. The trade-off? You’ll likely give up some control and have to navigate a more complex partnership agreement.

Real Estate Syndication is the classic model of pooling money from a group of individual investors to buy an asset. As the sponsor, or General Partner (GP), you find and manage the deal. Your investors, the Limited Partners (LPs), provide the bulk of the equity. This is how most sponsors scale their operations beyond what their own checkbook would allow.

And right now, investors are eager to put capital to work. Global private real estate transaction volumes hit $739 billion over the last year, a 19% jump year-over-year. That’s a clear signal that capital is on the move, creating a fantastic opportunity for well-prepared sponsors. You can dive deeper into this real estate investment recovery with Nuveen's latest analysis.

The Specialists: Alternative & Situational Financing

Finally, don't forget about the niche players who solve very specific, often time-sensitive, problems.

Hard money loans are short-term loans from private lenders that are based purely on the asset's value. They’re expensive—think high interest rates and points—but they can close in days, not weeks. They are perfect for a quick fix-and-flip or for tying up a property that needs a lot of work before it can qualify for permanent financing.

Real estate crowdfunding platforms have also carved out a real niche. These online portals connect you with a vast network of accredited investors, opening up another channel to raise equity. It's a different way to syndicate, but it comes with its own set of platform fees and rules you'll have to navigate.

Crafting an Institutional-Grade Pitch Deck

You can have the best deal in the world, but if your presentation is weak, it's dead in the water. I’ve seen it happen time and again. Securing funding isn't just about spreadsheets and cap rates; it's about telling a compelling story that makes an investor feel confident handing you their capital.

This is where your pitch deck and investment memorandum come in. Think of the deck as the visual, high-level story and the memo as the deep-dive, data-driven proof. Together, they have one job: to anticipate and answer every single question a skeptical investor could possibly throw at you. Sloppy materials signal a sloppy operator, and that's the fastest way to get a "no."

The Anatomy of a Winning Pitch Deck

Your deck has to be sharp, visually clean, and brutally efficient. An investor should get the gist of the entire opportunity in a 10-minute skim. Every slide needs to earn its place, logically building the case for why this deal, right now, is a must-have.

Here are the non-negotiable slides you need to nail:

- The Executive Summary: This is your hook. Seriously, you have maybe two slides to grab them. Clearly state the opportunity, the asset, the market, your plan, and the projected returns. If this doesn't get them excited, nothing else you've prepared will matter.

- The Problem & Solution: Frame the opportunity in a way that resonates. The "problem" might be a lack of updated B-class apartments in a submarket seeing a surge in tech jobs. Your property is the clear "solution."

- Market Deep Dive: Don't just say "the population is growing." That's lazy. Show them the story the data tells. I want to see submarket vacancy trends, rent growth comps, and the specific economic drivers that make your thesis work.

- The Asset & Business Plan: This is the "how." Use great photos, simple floor plans, and a clear timeline to show exactly how you're going to take this property from A to B and increase its value.

- The Team: At the end of the day, investors are betting on you just as much as the property. Your team slide needs to scream credibility. Highlight relevant experience, past wins, and what makes you the right crew to execute this plan.

While real estate is its own beast, it's incredibly helpful to understand the pitch deck from a VC's perspective because the core principles of clarity, narrative, and persuasion are universal.

Building a Bulletproof Financial Pro Forma

This is where the gloves come off. Your financial model is the heart of the offering, and investors will try to rip it apart. It has to be transparent, logical, and—most importantly—built on conservative assumptions.

A rock-solid pro forma clearly breaks down these key areas:

- Sources & Uses: This is a simple but critical table. Where is every dollar coming from (debt, investor equity, your own skin in the game) and where is it all going (purchase price, closing costs, renovation budget, reserves)? No ambiguity allowed.

- Cash Flow Projections: Lay out a 5-10 year forecast showing income, vacancy, operating expenses, and the resulting Net Operating Income (NOI). Every single assumption must be footnoted and defensible. Why 3% vacancy? Why 5% for repairs? You better have an answer.

- Key Return Metrics: The model has to spit out the numbers investors actually care about: the Internal Rate of Return (IRR), Equity Multiple (EM), and Cash-on-Cash Return (CoC). Make these front and center.

A rookie mistake I see all the time is using overly optimistic assumptions. A seasoned investor will sniff out "rosy" rent growth or underestimated expenses in a heartbeat. It kills your credibility instantly. Always, always under-promise and over-deliver.

The final gut-check for your model is the sensitivity analysis. Show what happens to returns if the exit cap rate moves up, or if rental rates dip. Proving the deal still holds up in a less-than-perfect world builds a massive amount of trust.

Assembling Your Due Diligence Vault

Beyond the fancy deck and the detailed spreadsheet, you need a full library of supporting documents. This is the third-party validation that backs up everything you're claiming. Having this "deal room" ready from day one shows you're a pro.

Your due diligence vault should be stocked with:

- Third-Party Reports: The appraisal, the environmental site assessment (ESA), and the property condition report. These are the independent expert opinions.

- Market Studies: A detailed report from a firm like CoStar or a local market expert that confirms your analysis of the area.

- Key Legal Documents: Have the draft operating agreement and subscription agreement ready so an investor's attorney can get right to work.

- Sponsor Background: This includes detailed bios and, most importantly, a track record of your past deals. If you can share performance data, even better.

Getting these documents organized before you even start pitching keeps the momentum going. When an investor says, "I'm interested," you don't want to spend the next two weeks pulling everything together. You want to send them a link and move toward closing.

Building Your Capital Network and Investor Trust

Your pitch deck is polished and your financial model is bulletproof. But a great deal is just an idea without the capital to close it. The real work begins now: building a network of investors who actually trust you with their money. This isn't about collecting business cards at a mixer; it's about strategically building genuine, long-term relationships.

Successful capital raising is almost never about cold calls. It starts with your immediate circle—your personal and professional network. These are the folks who already know your character, respect your work ethic, and are most likely to take your call. Start by mapping out who you know, not just who you think has deep pockets.

This initial group often includes former colleagues, mentors, and the professionals you already work with, like your accountant or attorney. The goal isn't to hit them up for money right away. Instead, share what you're working on and ask a simple question: "Who do you know that might be interested in this type of real estate investment?" A single warm introduction is worth a hundred cold emails, every time.

Expanding Your Reach Beyond Your Inner Circle

Once you've tapped into your immediate network, it's time to branch out. Industry events are invaluable, but only if you go in with a game plan. Don't just show up and hope for the best. Go with a clear intention to add value and make a handful of meaningful connections.

Here’s a practical strategy I’ve used for years at industry conferences:

- Pre-Event Recon: Before you even book your flight, scan the speaker list. Identify three to five people you absolutely need to meet. Dig into their background and come up with a thoughtful question tied to their expertise.

- The Approach: After their panel, skip the generic "great presentation" line. Walk up with your specific, well-researched question. This immediately shows you've done your homework and you respect their time.

- The Follow-Up: This is crucial. Send a concise email within 24 hours. Reference your conversation and suggest a brief call to continue the discussion.

This targeted approach turns a crowded, chaotic event into a high-leverage networking opportunity. You're no longer just another face in the crowd; you're a prepared professional building a real connection.

The golden rule of networking has always been to give before you ask. Offer an introduction, share a useful piece of market intel, or send over a helpful resource. Trust is built on a foundation of mutual value, not a one-sided ask for capital.

Digital Networking and Attracting Inbound Interest

In this day and age, your online presence is just as critical as your in-person one. A well-optimized LinkedIn profile isn't just a nice-to-have; it's your digital handshake and a magnet for inbound investor interest.

Your profile needs to clearly state your investment thesis and showcase your track record. Don't just let it sit there, either. Regularly share your insights about the markets or asset classes you focus on. This positions you as a thoughtful expert, not just another operator with a deal. When you consistently provide value online, you'll be surprised how many potential investors start coming to you. Learning how to effectively connect with potential investors and build trust online is a powerful skill that can fill your pipeline.

Hosting Small Briefings to Generate Commitment

As your network starts to grow, think about hosting small, invitation-only investor briefings. These can be virtual webinars or intimate in-person events like a breakfast or happy hour. The goal here isn't a hard sell—it's education and relationship-building.

An effective briefing agenda is simple:

* A quick market update on your area of focus.

* A case study from a past or current deal that went well.

* Plenty of time for a Q&A to foster an open dialogue.

This low-pressure environment lets potential investors see how you think and operate. It moves the relationship forward organically. So when you do have a live deal, you're not approaching strangers. You’re just presenting a new opportunity to a group of informed, engaged people who already get your strategy and, more importantly, are starting to trust you. That repeatable process is the key to building a robust capital network that supports you for years to come.

Understanding the Legal Rules of Raising Capital

Raising capital from private investors is a huge step. While it's an exciting part of scaling your real estate business, it also means you're stepping into a highly regulated arena. Let me be blunt: ignorance of securities law is not an excuse. Getting this wrong can lead to crippling fines or even getting banned from raising capital altogether.

Before you even think about accepting a single dollar, you need a solid grasp of the legal framework set by the Securities and Exchange Commission (SEC). This isn't about you becoming a securities attorney overnight. It's about being a smart sponsor who knows enough to hire qualified legal counsel and protect yourself, your investors, and the deal itself. Trust me, trying to cut corners with boilerplate documents or skipping legal advice is one of the costliest mistakes you can make.

Regulation D: Your Gateway for Private Deals

For most of us in the real estate syndication world, Regulation D of the Securities Act of 1933 is where we live. It’s a set of rules that provides exemptions, allowing us to raise private capital without the insane cost and complexity of a full-blown public offering.

Within Regulation D, the two paths you'll almost always encounter are Rule 506(b) and Rule 506(c). Picking the right one is one of the first, most important decisions you'll make with your attorney, because it completely dictates who you can raise from and how you can talk about your deal.

- Rule 506(b): This is the classic "friends and family" model. You can bring in money from an unlimited number of accredited investors and up to 35 sophisticated, non-accredited investors. The catch? You are strictly forbidden from any form of general solicitation or advertising. That means no public social media posts about the deal, no website announcements, no email blasts to a purchased list. You absolutely must have a pre-existing, substantive relationship with every single person you pitch.

- Rule 506(c): Born from the JOBS Act, this rule lets you advertise your deal publicly. You can post on LinkedIn, run targeted ads, and talk about it openly. The trade-off is huge: you can only accept capital from verified accredited investors. And you, the sponsor, have to take "reasonable steps" to actually verify their status—a much higher standard than just having them check a box on a form.

The difference between these two isn't just a minor detail; it fundamentally shapes your entire capital-raising strategy. For a much deeper look at how these rules work in practice, check out our guide on Rule 506 of Regulation D.

Your Essential Legal Document Toolkit

Once you've decided on your exemption, your securities attorney will get to work drafting the legal backbone of your offering. These documents are far from a formality. They are the binding contracts that spell out the rights, responsibilities, and risks for everyone involved.

There are three documents at the core of every deal:

- Private Placement Memorandum (PPM): Think of this as the ultimate disclosure document. It covers every conceivable detail of the investment—the business plan, market analysis, property details, sponsor compensation, conflicts of interest, and a long list of potential risks. Its entire purpose is to give an investor everything they need to make a truly informed decision.

- Operating Agreement: This is the rulebook for the LLC that will own the asset. It defines how the company is managed, outlines voting rights, details the distribution waterfall (how profits get split), and sets procedures for major decisions like a sale or refinance.

- Subscription Agreement: This is the investor's official application to invest in your deal. By signing it, they are stating how much they're investing, confirming their accreditation status, and formally agreeing to the terms you've laid out in the PPM and Operating Agreement.

The number one goal of your legal documents is full and transparent disclosure. The fastest way to get into hot water is to downplay or hide risks. A well-drafted PPM is your best protection because it proves investors knew exactly what they were getting into.

Having this legal and financial structure locked down is what allows you to act decisively when a great opportunity emerges. For example, real estate yields in developed Asia-Pacific markets just hit a ten-year high, creating unique chances for investors who can navigate market corrections. This kind of environment, often paired with strong rental growth, can offer annualized returns far better than what we've seen in recent years. Being prepared lets you capitalize on these moments.

Common Questions on Securing Real Estate Funds

As you shift from planning your deal to actively raising capital, you're going to hit a new wave of practical, in-the-weeds questions. Getting through these final hurdles is all about having clear, direct answers ready. We’ve pulled together some of the most common questions we hear from sponsors to help you navigate the process with confidence and sidestep the usual traps.

How Long Does It Realistically Take to Fund a Deal?

There's no single answer here—the timeline for securing real estate funds is all over the map. A simple residential flip financed with a hard money loan? You could be done in 7 to 14 days. But a larger commercial syndication is a marathon, not a sprint.

For a more typical syndicated deal, you should probably budget anywhere from 60 to 120 days, and sometimes even longer. This window usually breaks down into a few distinct phases:

- Prep Work (2-4 weeks): This is where you finalize your pitch deck, pro forma, and get all your legal documents in order. Whatever you do, don't rush this part.

- Investor Outreach (4-8 weeks): This is the heart of the fundraise. You're actively presenting the deal, answering tough questions, and collecting soft commitments.

- Closing Mechanics (2-4 weeks): Once you hit your funding goal, this final push involves gathering signed subscription documents, getting funds wired to escrow, and completing the legal closing.

The things that will speed this up or slow it down? Your own experience, the current mood of the market, and, most importantly, the quality of your deal.

What Are the Most Common Mistakes Sponsors Make?

Even sponsors who’ve been around the block can make unforced errors during a capital raise. Just knowing what the common tripwires are is half the battle.

Here are the issues we see time and time again:

- Sloppy Financial Models: Nothing kills credibility faster than unrealistic assumptions or basic math errors. You can bet your investors will pick your numbers apart.

- Poor Communication: Once an investor commits, radio silence is your enemy. It creates anxiety and doubt. Consistent, transparent updates are how you build trust and keep the deal moving forward.

- Ignoring Legal Compliance: Trying to cut corners on SEC regulations—like improper advertising or failing to properly verify investor accreditation—is a recipe for disaster.

- No 'Skin in the Game': Sophisticated investors need to see that you believe in the deal enough to put a meaningful amount of your own money on the line. It’s the ultimate sign of alignment.

Can I Raise Money for Real Estate Without a Track Record?

Absolutely, but it’s a much steeper climb. A proven track record is the ultimate shortcut to building trust with investors. When you don't have one, you have to find other ways to build that confidence.

Securing funding for real estate as a new sponsor isn't about faking experience; it's about compensating for the lack of it with an exceptional deal, deep preparation, and strategic partnerships.

If you're just starting out, you need to lean hard on these four strategies:

- Partner up with an experienced co-sponsor. Bringing someone on board who has a solid track record lends their credibility to your deal and can open up a whole new network of investors.

- Find an absolutely bulletproof deal. The numbers have to be so compelling and the business plan so conservative that the asset itself does most of the selling for you.

- Invest a significant chunk of your own capital. Show you’re all in by putting a substantial piece of your own net worth at risk. This speaks volumes when you can’t point to past wins.

- Start with smaller, simpler projects. Build your resume and your investors' confidence by knocking a few smaller deals out of the park before you go after a major acquisition.

At Homebase, we built an all-in-one platform to take the administrative headache out of raising capital and managing investors. You can create professional deal rooms, collect commitments, handle e-signatures on subscription docs, and manage distributions—all in one place. It lets you focus on what you do best: finding great deals and building relationships. Learn more about how you can streamline your next fundraise.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Your Guide to a Winning Property Management Business Plan

Blog

Build a winning property management business plan with our guide for real estate sponsors. Includes templates, financials, and real-world tips for 2026.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.