How to Invest Into Commercial Real Estate A Syndicator's Guide

How to Invest Into Commercial Real Estate A Syndicator's Guide

Learn how to invest into commercial real estate with our guide for syndicators. Discover how to source deals, raise capital, and manage assets like a pro.

Domingo Valadez

Jan 21, 2026

Blog

Before you even think about looking at deals, you need to know exactly what kind of deals you're looking for. Getting crystal clear on your niche is the bedrock of profitable commercial real estate investing. It’s what separates the pros who consistently find great opportunities from the amateurs chasing shiny objects.

Defining Your Niche in Commercial Real Estate

So, what does it mean to have a niche? It means having a laser-focused strategy that guides every decision you make. This isn't just about picking a property type; it's about building an entire business plan around a specific investment thesis. When you’re focused, you build expertise, credibility, and a deal pipeline that others can only dream of.

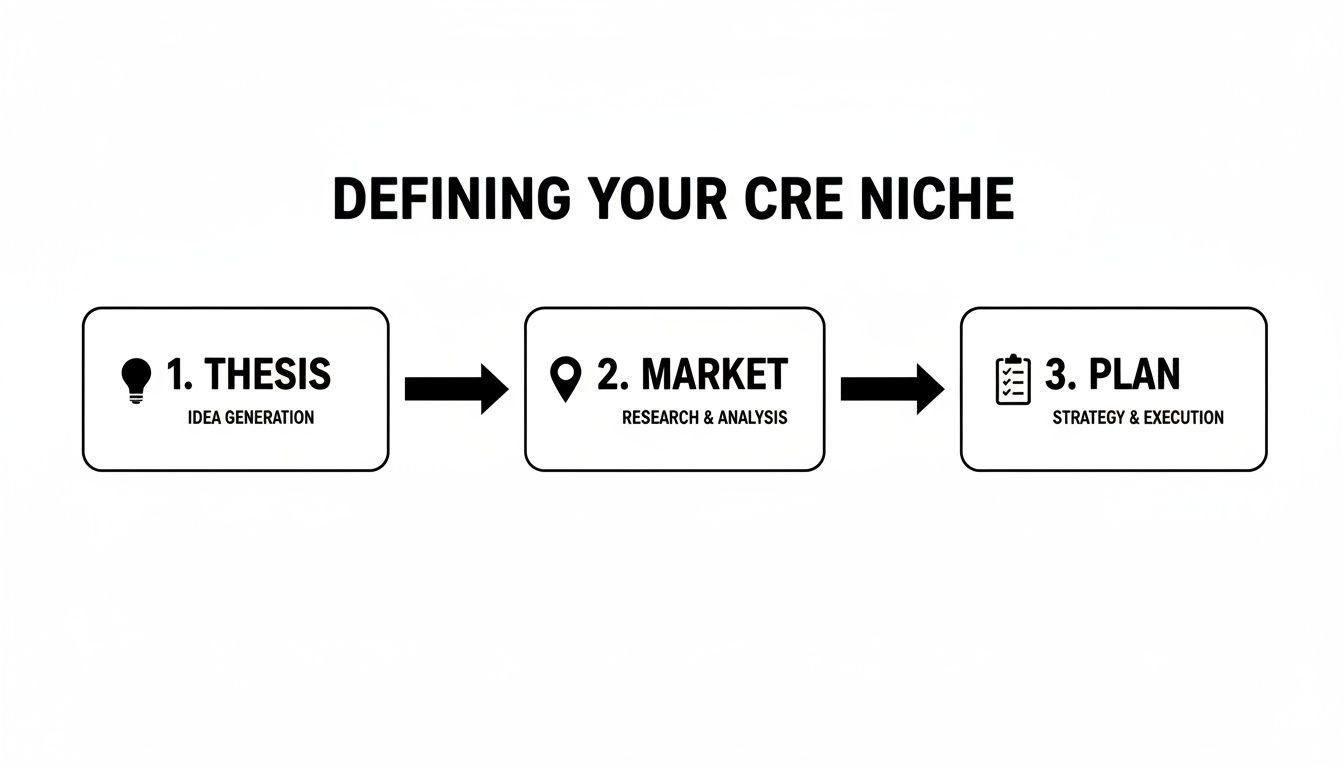

It really boils down to three core components: your thesis, your market, and your plan.

- Investment Thesis: This is your "why." What are you trying to achieve? It’s a clear statement that aligns your financial goals, risk tolerance, and available capital.

- Market Analysis: Once you know what you're looking for, you need to figure out where to find it. This involves deep dives into markets with the right fundamentals—think population growth, job creation, and supply/demand imbalances.

- Property Strategy: This is the "what." Are you chasing stable, cash-flowing multifamily buildings, or are you more interested in higher-risk, higher-reward development projects? Maybe it's a specialty asset class like medical offices or self-storage.

Having this roadmap prevents you from wasting time and money on deals that don’t fit your long-term vision.

Crafting a Robust Investment Thesis

Your investment thesis is your personal business plan. It’s not just a vague idea; it's a concrete framework. Start by answering some tough questions: What are my target returns? What's my ideal holding period? How much capital can I realistically deploy?

For example, a common thesis is to acquire and reposition Class B multifamily properties in sunbelt markets. The goal might be to force appreciation through renovations, stabilize the asset, and then refinance or sell in 5-7 years. This strategy is popular because it offers a blend of cash flow and value-add upside.

Pinpointing High-Potential Markets

With your thesis defined, it's time to go hunting for the right markets. This is where you put on your economist hat and dig into the data. You're looking for places with strong, sustainable growth.

I always tell new investors to focus on a few key metrics:

- Population Growth: Are people moving to this city or away from it? Look for metro areas adding 50,000+ people annually.

- Job Creation: Follow the jobs. Big corporate relocations or expansions in sectors like tech and healthcare are huge green flags.

- Supply Pipeline: What's getting built? If there are 20 new apartment complexes going up, your plan to raise rents might face some stiff competition. You need to understand the supply-side risk.

Once you have this data, you can start ranking markets and zero in on the top two or three that perfectly align with your investment thesis.

This three-step process—Thesis, Market, Plan—is the foundation for a scalable and successful CRE operation.

As you can see, these elements flow into one another. A clear thesis helps you identify the right markets, which then allows you to build a detailed, actionable plan. It’s all about creating a system that makes your investment decisions predictable and data-driven.

Building an Actionable Plan

Now we get tactical. Your plan outlines the how. How will you find deals? How will you vet them? How will you pay for them?

Let's say a sponsor decides their niche is medical office buildings near major hospital systems. Their plan would involve building relationships with the top five healthcare real estate brokers in their target city, setting up weekly calls, and getting on their "first look" list for off-market deals.

Your plan should also detail your operational checklists and financial guardrails.

- Due Diligence Checklist: What documents are non-negotiable? You’ll need rent rolls, trailing 12-month (T12) financial statements, and Phase I environmental reports, at a minimum.

- Financing Approach: Know your numbers before you even talk to a lender. What Loan-to-Value (LTV) and Debt Service Coverage Ratio (DSCR) are you targeting?

- Exit Strategy: How will you get your (and your investors') money back? Define your target hold period and map out potential exit paths, whether that's a sale, a refinance, or a 1031 exchange.

Nailing down your niche from day one creates a powerful ripple effect. It makes every subsequent step—from sourcing and underwriting to closing and asset management—infinitely more efficient.

Choosing Your Path: Direct Ownership vs. Syndication

Once your investment thesis is locked in, you’re at a fork in the road. How will you actually get deals done? In commercial real estate, there are really two main routes: buying properties all on your own (direct ownership) or teaming up with other investors to pool your money (syndication).

This isn't a minor decision. The path you choose will define your role, your financial exposure, and how quickly you can grow. It shapes everything from your daily tasks to your long-term potential as a real estate professional.

The Allure and Demands of Direct Ownership

Going it alone is the classic approach. You find the property, you get the loan, you manage the asset, and you keep all the profits. It's easy to see the appeal—you have 100% control and don't have to answer to anyone. Every decision is yours to make.

But that total control comes with a hefty price tag, and not just in dollars. The capital needed for a decent commercial property is significant, easily running into the millions for a down payment. You're not just investing money; you're taking on all the responsibility, too.

This means you’re on the hook for everything:

- Securing Debt: You’re the one personally guaranteeing the loan, which often means putting your own home and other assets on the line.

- Asset Management: A leaky roof at 2 a.m.? A dispute between tenants? That's your phone ringing. Every single operational headache lands on your desk.

- Limited Scale: Your ability to grow is tied directly to your personal bank account and the number of hours in your day. It’s tough to scale when you’re doing it all yourself.

Direct ownership can be incredibly rewarding, no doubt. But it's a high-stakes game that often keeps investors stuck playing in the minor leagues with smaller, less desirable deals.

The Power of Syndication for Scaling Your Portfolio

Syndication completely changes the game. Here, a sponsor (that's you, the General Partner) finds a great deal and then raises money from a group of passive investors (the Limited Partners) to buy it. This team approach unlocks access to deals that are simply out of reach for individuals.

Think about it. You find a fantastic, $20 million apartment complex in a booming sun-belt market. Coming up with the equity and getting that loan on your own would be a monumental feat. But through syndication, you can raise that capital from dozens of investors, making an institutional-quality deal a reality.

This strategy allows you to control institutional-grade assets without needing institutional-level capital. You leverage your expertise to create value, while your investors provide the fuel to scale.

This model has become a huge force in the industry. Multifamily, a favorite for syndicators, saw a big comeback in early 2025, with net absorption jumping by 46% to nearly 551,000 units, according to the 2025 real estate market outlook from CBRE. Syndication makes these deals accessible, allowing accredited investors to join in with as little as $50,000 and share in the upside.

Direct Investment vs. Syndication at a Glance

So, how do you decide which path is right for you? It really boils down to your goals, your capital, and your appetite for hands-on work. This table breaks down the core differences.

Ultimately, the choice between direct investment and syndication depends on what you want to build. Are you aiming for total control over a few assets, or are you trying to build a scalable business that can manage a large portfolio?

For ambitious sponsors focused on serious growth, syndication is almost always the answer. It’s a proven model for raising capital, buying bigger and better assets, and building a track record that attracts more capital and better deals down the line. It turns investing from a solo sport into a scalable, relationship-driven business.

Finding and Analyzing Profitable CRE Deals

The best commercial real estate deals almost never pop up on public listing sites. By the time an asset hits the open market, it's usually been passed over by the insiders. The real secret to successful commercial real estate investing is learning how to find opportunities before anyone else knows they exist and then underwriting them with ruthless precision.

This is where your network becomes your most valuable asset. Experienced sponsors spend years cultivating a web of relationships with brokers, property managers, and even lenders who become their personal deal pipeline. These aren't just names in a contact list; they're strategic partners who get your investment thesis and feed you opportunities that fit like a glove.

Think about it from a broker's perspective. They know hundreds of investors. To get to the top of their call list, you have to be specific, responsive, and ready to act. When they know you’re a closer, they’ll bring you the good stuff first.

Sourcing Off-Market Opportunities

Building a proprietary deal flow doesn't happen by accident. It takes a deliberate, systematic effort to consistently unearth deals that the general public will never see.

Here are a few proven strategies to get you started:

- Become a Broker's Best Friend: Pinpoint the top commercial brokers in your target market and niche. Get on their calendar for regular calls, give them your exact acquisition criteria, and provide fast feedback on every deal they send—even if it's a hard "no." They’ll appreciate the respect for their time.

- Connect with Property Managers: Property managers are the boots on the ground. They know which owners are getting tired of the business or facing operational headwinds long before a "For Sale" sign ever goes up.

- Go Direct-to-Owner: For a more surgical approach, identify specific properties you'd love to own and reach out to the owner directly. It's a slower burn, for sure, but it can lead to incredible deals with absolutely zero competition.

This kind of focused networking is a long game, but it ensures that when a fantastic opportunity surfaces, you’re the first person they think of.

The Art of Underwriting a CRE Deal

Once a potential deal lands on your desk, the real work begins. Underwriting is where you dissect a property's financial DNA to see if it’s truly a healthy investment. You’re moving from the story to the hard numbers, stress-testing every claim the seller is making.

Your analysis kicks off with two non-negotiable documents: the rent roll and the trailing 12-month (T12) operating statement. The rent roll is a snapshot of your income, detailing every tenant, their lease terms, and how reliably they pay. The T12 shows you exactly how the property has performed, warts and all, over the last year.

Underwriting isn't just about checking the seller's math. It's about building your own business plan for the asset. You’re pressure-testing assumptions and creating a realistic forecast for what you can make it do.

This deep dive is where you find the red flags. Is there a big chunk of leases all expiring at the same time? Are the operating expenses suspiciously low? You have to scrutinize every line item and plug in your own operational assumptions, not the seller's optimistic projections.

Calculating the Metrics That Matter

With your analysis done, it's time to run the numbers that tell you whether to move forward or walk away. While there are dozens of metrics you could look at, a few are absolutely essential. A critical first step is understanding how to approach calculating cap rate for rental property, as this gives you a baseline for a deal's profitability.

From there, you need to see the deal through an investor's eyes:

- Cash-on-Cash (CoC) Return: This tells you the annual pre-tax cash flow you get back relative to the total cash you put in. It’s a simple, powerful way to gauge your immediate return.

- Internal Rate of Return (IRR): This is the big one. It's the annualized rate of return over the entire life of the investment, factoring in the timing of every dollar in and out, including the final sale. It paints the most complete picture of profitability.

- Equity Multiple (EM): This metric answers a simple question: how many times did I get my money back? An equity multiple of 2.0x means for every dollar invested, two dollars were returned.

For sponsors looking to scale, the current market is full of unique opportunities. Industrial properties and niche sectors like data centers are showing incredible strength. In fact, data center demand is surging by 8.9%, and with a staggering $2.3 trillion in commercial loans set to mature by 2028, savvy investors are positioned to acquire top-tier assets at great prices. You can explore more insights about these commercial real estate trends on Resimpli. This kind of forward-looking analysis, combined with disciplined underwriting, is what separates a good deal from a truly great one.

Structuring the Deal and Raising Capital

So, you’ve put a promising property under contract. This is where the game really begins. You’ve moved from analyzing spreadsheets to executing a real-world business plan, and the clock is officially ticking. The big challenge now is assembling the capital stack—the unique blend of debt and equity needed to close the deal and fund your vision.

Structuring a deal is all about balance. You need enough debt to boost your returns, but not so much that a small dip in occupancy or an unexpected repair bill puts the whole investment in jeopardy. Getting this right is a fundamental part of learning how to invest in commercial real estate.

Mastering the Debt Component

First things first: you need to lock down your loan. This is almost always the biggest piece of the puzzle, typically covering 60-75% of the property's total cost. The terms you get on your debt will directly shape your cash flow and ultimate returns, so understanding your options here is non-negotiable.

You’ll be dealing with a few key types of lenders:

- Traditional Banks: Think local and regional players. They're often fantastic for relationship-based lending, especially if you have a strong local track record or are working on smaller deals. They can be more flexible, but they might also ask for personal guarantees.

- Agency Debt (Fannie Mae & Freddie Mac): For stabilized multifamily properties, agency debt is the gold standard. These loans often come with great interest rates and, crucially, non-recourse terms. That means if things go south, the lender can only go after the property itself, not your personal bank account.

- Bridge Loans: Taking on a major renovation or a value-add project? A bridge loan provides the short-term, flexible capital you need to get the property stabilized. The rates are higher, but they’re designed for assets in transition.

To pick the right financial tool for your deal, it’s essential to know the landscape of commercial loans for investment property.

Raising Equity and Building Your Investor Base

Once the debt is lined up, your focus has to shift to equity—the cash you and your investors contribute. At this stage, your ability to tell a compelling story becomes just as important as your underwriting. You’re not just selling a building; you’re selling a business plan and the promise of future returns.

A professional investment package is your best friend here. This document, often called an investment summary or a private placement memorandum (PPM), needs to clearly lay out the opportunity, the potential risks, and the projected profits.

For syndicators, this isn't just about raising money. It's about navigating a maze of legal requirements to protect both you and your investors. For a deeper look into this process, our guide on funding for real estate syndication is a great resource.

A well-structured deal aligns the interests of both the sponsor and the investors. Your success should be directly tied to their success, creating a powerful partnership built on trust and shared goals.

This alignment is usually built into the deal's waterfall structure. A common approach gives investors a preferred return—say, the first 8% of all profits—before the sponsor starts earning a significant share of the upside.

Navigating Securities and Compliance

The moment you start raising money from private investors, you’re dealing in securities. This puts you directly under the watch of the Securities and Exchange Commission (SEC). Following the rules isn't optional; it's essential for building a legitimate, sustainable business.

Most syndicators use exemptions under SEC Regulation D to raise capital legally. The two most common paths are:

- Rule 506(b): This lets you raise an unlimited amount of capital from an unlimited number of accredited investors plus up to 35 non-accredited (but still sophisticated) investors. The key restriction? You absolutely must have a pre-existing, substantive relationship with every single person you pitch.

- Rule 506(c): This rule allows you to advertise your deal to the public—on social media, at conferences, you name it. The trade-off is that you can only accept money from accredited investors, and you have to take concrete steps to verify their status.

Thankfully, modern investment platforms have made this entire workflow much easier. They offer tools for building professional online deal rooms, handling subscription documents with e-signatures, and managing critical compliance checks like KYC (Know Your Customer) and accreditation verification. This automation frees you from administrative headaches so you can focus on building strong investor relationships and getting the deal closed.

Executing Your Business Plan Through Asset Management

Closing the deal isn't the finish line; it's the starting gun. The real work—and where you truly create value—kicks in the moment you get the keys. Think of disciplined asset management as the engine that powers your entire business plan. It's what turns a well-underwritten property into a profitable investment that actually hits or, even better, exceeds your projections.

This is a hands-on, strategic process. You're constantly working to maximize income, get a handle on expenses, and ultimately enhance the property's physical and financial health. This active oversight is exactly how sponsors earn their fees. It’s a nonstop cycle of tracking performance against your pro forma, making smart adjustments on the fly, and keeping both your property management team and your investors in the loop.

For anyone serious about building a portfolio, mastering asset management is the skill that separates the one-deal wonders from the long-term pros.

Optimizing Operations and Managing Renovations

Your first move after closing should be getting the right property management team in place. And I don’t just mean hiring a company to collect rent. You need a true strategic partner who buys into your business plan and has the operational chops to execute it.

From day one, establish clear Key Performance Indicators (KPIs). These are your non-negotiables—things like target lease-up velocity, tenant renewal rates, and specific operating expense ratios.

If you're running a value-add play, overseeing renovations becomes your immediate priority. This demands tight project management to keep everything on schedule and, more importantly, on budget.

- Weekly Check-ins: I make weekly meetings with my general contractor and property manager mandatory. We review progress, tackle roadblocks, and sign off on any change orders. No surprises.

- Budget vs. Actual Tracking: Keep a meticulous spreadsheet tracking every single dollar spent against the renovation budget. This is the only way to prevent small overages from snowballing into a major problem.

- Quality Control: Walk the site yourself, and do it often. You need to inspect the quality of the work firsthand. Do the finishes and fixtures match the specs in your business plan? Are they the quality needed to attract your ideal tenant?

A poorly managed renovation can poison a deal's returns before you've even leased up a single unit. Meticulous oversight is simply not optional.

Enhancing Net Operating Income

At the end of the day, asset management is all about one thing: relentlessly driving up the property’s Net Operating Income (NOI). Why? Because NOI directly dictates the value of your asset. It's a two-front war: you have to increase revenue while intelligently managing expenses.

On the revenue side, you’re always hunting for opportunities. This means methodically pushing rents to market rates and sniffing out ancillary income streams. Maybe it's adding covered parking, implementing a Ratio Utility Billing System (RUBS) to pass through utility costs, or installing smart-home tech packages that tenants will happily pay a premium for.

On the expense side, the goal isn't just to slash costs—it's to optimize them. This means bidding out major service contracts every year, appealing your property taxes, and investing in capital projects with a clear ROI, like swapping out old fixtures for energy-efficient LEDs to lower the electricity bill.

Asset management is the relentless pursuit of operational excellence. Every decision, from renewing a lease to replacing a boiler, should be made with one question in mind: "How does this increase the value of the property?"

Managing Investor Relations and Exit Strategies

Keeping your investors happy and informed is just as critical as managing the property itself. Proactive, transparent communication is what builds trust and gives them the confidence to back you on the next deal. Set up a regular reporting schedule—quarterly is the standard—and deliver professional, easy-to-digest updates.

Your reports should always cover these three bases:

- Financial Performance: Give them a clear snapshot of how the property is performing against the pro forma. Include key metrics like NOI and cash-on-cash return.

- Operational Updates: Share the highlights from the quarter—leasing wins, renovation progress, and any challenges you've had to navigate.

- Distributions: Be crystal clear about any cash distributions being made. This is what they're waiting for.

While you're deep in the weeds of executing the plan, you also need to keep one eye on the exit. Market data is your best friend here. For instance, knowing that Phoenix has a 22.4M sq. ft. industrial pipeline or that Orange County is sitting on a tight 4.2% vacancy rate helps you time your exit for maximum profit. This kind of market intelligence is invaluable, especially as the U.S. commercial real estate market continues to expand. You can dig into more of these kinds of commercial real estate statistics on Resimpli.

Ultimately, your exit will come down to a few choices: sell the property outright, execute a cash-out refinance to return capital to investors while holding the asset, or roll the proceeds into a bigger deal using a 1031 exchange to defer taxes. The right move depends entirely on market conditions at the time and fulfilling the promises you made in your original business plan.

Answering Your Top Questions About CRE Syndication

If you're looking to become a syndicator, you're probably bumping into a lot of new terms and concepts. Legal setups, pay structures, investor hurdles—it can feel like a steep learning curve.

Let's cut through the noise. Here are the real-world, practical questions that every new sponsor asks, along with the straightforward answers you need to structure deals that build trust and last.

What’s the Go-To Legal Structure for a Syndication?

Nearly every time, the answer is a Limited Liability Company (LLC). It's the cleanest, most efficient vehicle for pooling capital to buy real estate.

The setup is simple: you, the sponsor, form a brand-new LLC for the specific property you’re buying. You then serve as the Manager or Managing Member, making you the one responsible for all the day-to-day decisions and executing the business plan.

Your investors join as passive Members. Their role is to contribute capital, not manage the property. This structure is a win-win, giving everyone involved crucial liability protection and enabling pass-through taxation—a huge benefit for real estate investors.

How Do I Actually Get Paid as a Sponsor?

Transparency is everything here. Your investors need to know exactly how you’re compensated, and a well-structured deal rewards you for both finding the opportunity and making it successful.

Sponsor pay typically breaks down into a few key components:

- Acquisition Fee: This is a one-time fee you earn at closing. It covers the immense work of finding, vetting, and closing the deal. Expect it to be 1-3% of the purchase price.

- Asset Management Fee: For the ongoing work of overseeing the property, managing contractors, and keeping investors updated, you’ll earn a recurring fee. This is usually 1-2% of the property’s gross annual revenue.

- The Promote (Profit Split): This is the big one—your share of the profits, often called "carried interest." Crucially, you only earn this after your investors have gotten their entire initial investment back, plus a preferred return.

This model makes sure you're paid for your upfront effort but ties your biggest financial win to the success of your investors.

What Exactly Is a Preferred Return?

The preferred return, or "pref," is a foundational concept in syndication. It’s a hurdle rate that puts investors first. Essentially, it dictates that investors must receive a minimum annual return on their capital before the sponsor can start sharing in any profits.

Imagine a deal has an 8% preferred return. This means the investors get the first 8% of all profits the property generates each year.

If the property only cash flows at 6% one year, the investors get all of it. That unpaid 2% usually accrues (like a running tab) and gets paid out from the profits of future, better years before you, the sponsor, see a dime of the profit split.

The "pref" is the ultimate tool for aligning your interests with your investors'. It forces you to focus on what matters: delivering solid, consistent returns. Your payday from the profit split only happens after you've hit that benchmark for them.

This single feature gives investors tremendous confidence that their money is working for them. It’s a non-negotiable in most institutional-quality deals and a critical piece to understand when learning how to invest in commercial real estate.

The market itself reinforces the need for high-quality, well-managed assets. According to CBRE's mid-year outlook, investment volume is projected to climb 10% in 2025 to $437 billion. Even as the market finds its footing, prime assets are showing incredible stability, and with less new construction coming online, existing properties are in a great position to perform. You can get the full analysis in their 2025 US Real Estate Market Outlook.

At Homebase, we're built to make the entire syndication process easier. Our platform helps you manage your fundraising pipeline, investor communications, and distributions from a single dashboard. Stop wrestling with spreadsheets and start focusing on what you do best: finding great deals. Learn how Homebase can help you scale your real estate business.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

What Is a Real Estate Trust: what is a real estate trust and asset protection

Blog

Explore what is a real estate trust and how it can protect assets, simplify investments, and unlock tax-efficient real estate opportunities.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.