Financial Modeling Real Estate: A Practical Guide to Building Winning Models

Financial Modeling Real Estate: A Practical Guide to Building Winning Models

Master financial modeling real estate with practical pro formas, waterfalls, and IRR insights to attract investors.

Domingo Valadez

Jan 27, 2026

Blog

At its core, financial modeling for real estate is about building a sophisticated forecast in a spreadsheet. It's how you project a property's potential profitability by mapping out future cash flows, layering in debt and equity, and running the numbers on key return metrics like IRR and Equity Multiple. Ultimately, this model tells you—and your investors—if a deal is worth pursuing.

Building a Bulletproof Real Estate Financial Model

Before you even think about writing a formula, remember that a powerful real estate model is built on a rock-solid foundation. The integrity of your entire analysis—every cash flow projection, every return calculation—hinges on the clarity and realism of your initial setup. I’ve seen too many people rush this part, only to face a cascade of errors and skeptical investors later.

The very first move is to structure your workbook logically. The gold standard is creating a dedicated "Assumptions" tab. Think of this sheet as the central command center for your entire model; it's where you'll house every critical input that drives the whole analysis.

A well-organized model isn't just about looking professional; it's about accuracy and auditability. When an investor asks you to tweak the exit cap rate or rental growth, you should be able to change one single cell on the assumptions tab, not go on a wild goose chase through dozens of formulas.

For any institutional-quality model, separating your inputs (assumptions) from your calculations (the model's engine) is non-negotiable. This discipline makes your work transparent, drastically reduces the chance of formula errors, and makes running different scenarios a breeze.

Establishing Core Deal Assumptions

Your assumptions tab needs to be meticulously organized. I always start by defining the high-level project timeline. For a typical multifamily syndication, you might be looking at a 10-year hold period, which sets the entire scope for your pro forma cash flow statement.

From there, you need to detail the primary acquisition and disposition assumptions. This is where your investment story starts translating into hard numbers. A critical first step in building a bulletproof real estate financial model is mastering the ability to forecast future performance, learning methods like these to how to create comprehensive financial projections to guide your predictions.

Before you go any further, you need a clear checklist of the core assumptions that will underpin the entire model.

Core Assumptions Checklist for Your Real Estate Model

These are the foundational pillars of your deal. Getting them clearly defined and documented on a single sheet is the first step toward a model that investors can trust.

The Power of a Centralized Input Sheet

Having all these variables in one spot is incredibly powerful. It allows you to instantly see how a single change ripples through the entire deal. For example, if you decide to increase the CapEx Budget, you can immediately see its impact on the total equity required and, consequently, the levered cash flows.

You can find more details and practical examples in our complete guide to building a https://www.homebasecre.com/posts/real-estate-pro-forma-template-excel. This structural discipline is what elevates a basic spreadsheet into a dynamic and trustworthy decision-making tool—one that’s ready for serious investor scrutiny.

Projecting Realistic Revenue and Expenses

Once your core assumptions are in place, we can get into the real meat of the model: the pro forma. This is where we build a detailed, month-by-month forecast of the property's operational life. It’s what separates a quick, back-of-the-napkin sketch from an institutional-quality model that gives investors real confidence.

Everything starts with revenue, which for most properties means rental income. A common but lazy approach is to just apply a single growth rate across the board. Don't do that. A truly robust model needs a detailed rent roll, breaking down revenue by unit type—studios, one-bedrooms, two-bedrooms, etc.—each with its own rental rate.

This detailed schedule allows you to model lease renewals and new leases with much greater precision. For instance, you can assume a certain growth rate for renewing tenants while projecting a different, market-based rate for vacant units you're turning over. This is the only way to accurately forecast your Gross Potential Rent (GPR).

From Potential to Reality: Modeling Income Drivers

Of course, no property is ever 100% occupied. The model has to reflect the real-world friction of tenant turnover and non-payment. This is where you’ll subtract allowances for General Vacancy and Credit Loss. I usually model this as a percentage of GPR, pulling from the property’s historicals or reliable market comps.

A huge mistake I see all the time is plugging in an overly optimistic vacancy rate. If you're planning a value-add project, you have to account for a much higher "economic vacancy" during the renovation period as you intentionally keep units offline. Forgetting this will completely throw off your cash flow projections for the first year or two.

And don’t stop at base rent. You need to account for all the ancillary income streams that can really pad the bottom line. These "other income" items are crucial.

- Parking Fees: Project this based on the number of paid spots and the going monthly rate.

- Pet Fees: That recurring monthly fee per pet adds up fast in a large multifamily building.

- Laundry Facilities: If you have common laundry, coin-op or card-based systems provide a steady stream of cash.

- Utility Reimbursements (RUBS): Make sure to model any bill-backs to tenants for water, sewer, and trash.

Each of these sources deserves its own line item and its own growth assumption, whether it's tied to inflation or a fixed annual bump. When you add your rental income (net of vacancy) and all your other income together, you get your Effective Gross Income (EGI)—a critical figure for the rest of the model.

Forecasting Operating Expenses With Precision

With the income side built, it's time to meticulously forecast your operating expenses. Being accurate here is just as important; underestimating your costs can sink a deal's profitability in a heartbeat. I always break expenses down into their core categories, each driven by its own logic.

For example, property taxes are almost never a simple percentage. They’re based on the assessed value, which will almost certainly be reassessed at your higher purchase price. You have to model that tax "pop" in year one. For insurance, go out and get actual quotes. Management fees are usually more straightforward—typically a percentage of EGI, often between 3-5% for multifamily properties.

Other costs, like repairs and maintenance, are best projected on a per-unit-per-year basis (say, $500 per unit) and then grown by an inflation factor. This granular approach is far more defensible than just throwing a random lump sum into a spreadsheet.

Getting these forecasts right is especially critical in the current market. Certain sectors, like multifamily and other living assets, are poised for strong returns in 2025-2026 models. This is largely driven by a global housing shortage and affordability issues that are pushing more people to rent. At the same time, with industrial vacancies tightening and supporting rental growth of 3-4%, a precise expense model is what lets you actually capture those gains. You can explore more of these drivers in these global real estate outlook insights.

By carefully constructing both sides of the ledger—revenue and expenses—you’ll finally arrive at the Net Operating Income (NOI). This number (EGI minus total operating expenses) is the single most important metric of a property's profitability before debt service, and it's the foundation for everything that comes next.

Modeling Your Debt and Equity Stack

Once you have your operational forecasts locked in, it's time to tackle the capital stack. This is where the deal really starts to take shape. You'll figure out how to pay for the property and any improvements, modeling the mix of debt and equity that brings the investment to life. Getting this part right is absolutely critical—it's what turns your projected Net Operating Income (NOI) into actual investor returns.

First up is the senior debt, which is almost always the biggest piece of the financing puzzle. A simple, back-of-the-envelope calculation just won’t fly with serious investors. They expect to see a dynamic, month-by-month amortization schedule that shows exactly how the loan is paid down over the entire hold period.

Your model needs to be nimble here. Many commercial loans, especially for acquisitions, have an interest-only (IO) period for the first few years. You have to build your model to handle this gracefully—calculating IO payments for a set period, and then automatically switching over to principal and interest payments for the remainder of the term.

Getting the Debt Structure Right

A solid loan amortization schedule is the foundation for forecasting your cash flow after debt service. This is the cash that's actually available to distribute to your investors, so precision is key.

For every single month, your schedule should clearly lay out:

- Beginning Balance: What you owe at the start of the period.

- Interest Payment: Calculated off the beginning balance and your interest rate.

- Principal Payment: The portion of the payment that actually chips away at the loan.

- Ending Balance: What you owe after making that month's payment.

Don't forget to account for the balloon payment. This is the entire outstanding loan balance that comes due when the loan matures, which you'll typically pay off with proceeds from the sale. It's a great idea to build your model to toggle between different leverage scenarios. See what happens to your returns with a 65% loan-to-cost (LTC) versus a 75% LTC—it's a powerful way to see the real impact of leverage.

Higher leverage can definitely juice returns, but it's a double-edged sword that adds significant risk. A well-built debt model lets you quantify that risk by stress-testing your debt service coverage ratio (DSCR) against a worst-case NOI.

Structuring the Equity Side

With your debt modeled out, you can turn your attention to the equity stack. In a syndication, this means spelling out where the capital is coming from—both from the General Partner (GP) (that's you, the operator) and the Limited Partners (LP), who are your investors providing most of the cash.

The best way to start is with a clean "Sources and Uses" table. It’s a simple but essential summary that shows everyone exactly where the money is coming from and where it's all going. No hiding the ball.

This little table does two big things: it confirms your deal is fully funded, and it clearly states the total equity you need to raise. With so much private capital chasing real estate deals—global transaction volumes saw a 19% year-over-year jump recently—you need a precise, professional model to stand out and earn investor confidence. You can dig into more trends in the global real estate market outlook on jll.com.

By accurately modeling both your debt obligations and the flow of equity, you've put the final foundational piece in place. Now, you have a complete picture of your capital structure, ensuring every dollar is accounted for before you move on to projecting cash flow and calculating returns.

Getting to The Numbers That Matter: Investor Cash Flows and Returns

Alright, you’ve done the heavy lifting. Your operational forecast is dialed in and the capital stack is structured. Now comes the moment of truth—this is where all your assumptions about rent growth, operating costs, and debt service come together to produce the numbers investors actually care about.

We're shifting our focus from how the property performs to how the investment performs. It all starts with the pro forma cash flow statement, which is essentially the financial story of your deal from acquisition to sale.

From Unlevered to Levered Cash Flows

First up is the unlevered cash flow. Think of this as the property's pure, raw earning power, completely stripped of any financing. The math is simple: just take your Net Operating Income (NOI) and subtract your capital expenditures for the year. This includes things like tenant improvements, leasing commissions, and any money you're setting aside in reserves.

This figure shows you what the asset itself generates. It’s a clean metric that’s perfect for making apples-to-apples comparisons between different properties, since you're not factoring in anyone's unique debt structure.

Next, we bring the loan into the picture to find the levered cash flow, which you'll often see called Cash Flow After Financing (CFAF). To get here, you take that unlevered cash flow figure and subtract your total debt service—that’s both the principal and interest payments.

This is the cash that’s actually left over for you and your investors. Getting this number right is everything. Understanding the inputs, such as how to properly value the asset's income stream, is a fundamental step. For a detailed breakdown of a key valuation metric, explore this guide on calculating cap rate for rental property.

Turning Cash Flow into Key Return Metrics

Now that you have your annual levered cash flows and the projected proceeds from the sale, you can finally calculate the headline metrics that every investor will look for. These are the ultimate scorecards for your deal.

I'll break down the big three:

- Internal Rate of Return (IRR): This is the time-sensitive metric. It answers the question, "What's my average annual return, considering when I get my money back?" An 18% IRR is worlds better than a 12% IRR because it means your capital is working harder and faster.

- Equity Multiple (EM): This one is much simpler. It answers, "How many times over will I get my initial investment back?" An Equity Multiple of 2.0x means you doubled your money. It’s a fantastic measure of total profit, but it has a blind spot—it completely ignores the time value of money. Getting 2.0x back in three years is a very different deal than getting it back in ten.

- Cash-on-Cash Return (CoC): Investors love this one for its simplicity. It’s an annual snapshot calculated by dividing the levered cash flow for the year by the total equity you put in. It answers, "For this year, what return am I getting on my cash from the property's operations?"

Pro Tip: Always show both the IRR and the Equity Multiple. A long-term hold might boast a huge Equity Multiple but have a sleepy IRR. On the flip side, a quick flip could have a monster IRR but a pretty low Equity Multiple. Investors need to see both to really understand the deal's profile.

Before we move on, let's quickly summarize the key metrics investors will be scrutinizing in your model.

Key Real Estate Return Metrics Explained

This table breaks down the essential performance indicators, what they measure, and why they're so critical for evaluating a real estate investment.

Understanding these metrics is non-negotiable. They are the language of real estate investment, and your ability to calculate and explain them builds immediate credibility.

The market's recent rebound really drives home how important these projections are. Global private real estate values have been climbing for five straight quarters, and major market transaction volumes have hit $739 billion—a 19% jump from the previous year. For syndicators, this means that a sophisticated, well-built model is your ticket to attracting capital in a very competitive field. You can dig into these market shifts in these real estate trend insights from nuveen.com.

Ultimately, your job is to funnel these crucial metrics into a clean, easy-to-digest summary page right at the front of your model. This dashboard becomes the star of your pitch deck, giving potential LPs a compelling snapshot of the opportunity in seconds.

Getting the Investor Payouts Right: Modeling Advanced Distribution Waterfalls

If you're a syndicator, a simple IRR calculation just won't cut it when you're trying to raise serious capital. The real magic—and where you prove your sophistication—is in the distribution waterfall. This is the cascading structure that dictates exactly how and when cash gets split between your Limited Partners (LPs) and you, the General Partner (GP).

Mastering the waterfall is what separates a basic projection from a powerful fundraising tool. It answers the one question every investor cares about most: "After all is said and done, what's my take, and what's yours?"

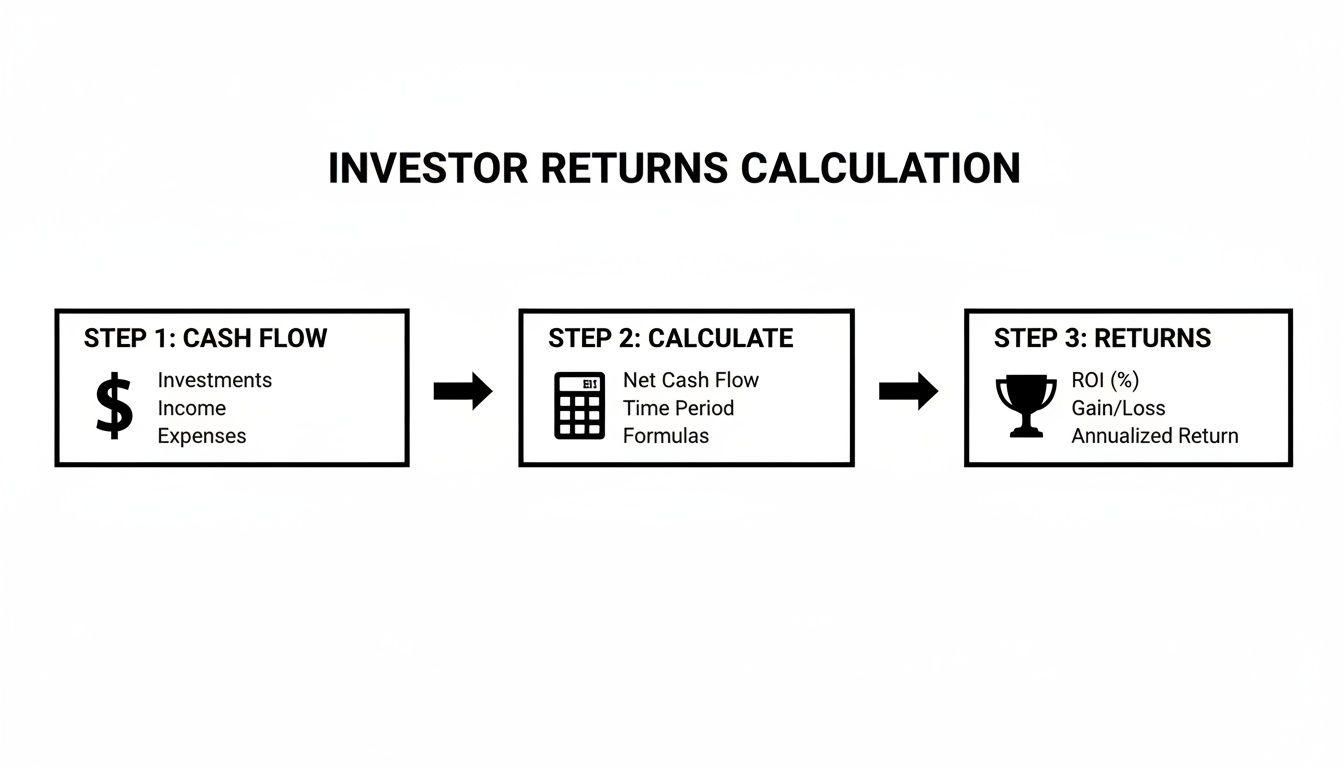

This flowchart gives you a bird's-eye view of how raw cash flow gets processed through the various calculations to spit out the final returns for investors.

As you can see, there's a lot of number-crunching that happens between the property generating cash and an investor seeing a return metric on their statement. The waterfall is the engine for that process.

Building a Multi-Tiered Waterfall

Think of a distribution waterfall as a series of buckets. The first bucket has to be completely full before any cash can spill over into the second, and so on down the line. Each "bucket" is a hurdle that must be cleared.

The most common starting point is the preferred return, or "pref." This is a bedrock feature in syndication agreements. It promises LPs the first cut of the profits up to a certain threshold—say, an 8% annual return on their invested capital—before the GP gets to share in the upside.

After the pref is paid, the next major hurdle is usually the return of capital. This tier ensures that every LP gets their initial investment back in full. Only after LPs have received their preferred return and their original capital does the GP really start to participate in the profits beyond their own co-invest.

Modeling the Sponsor Promote

That GP share of the profits is what we call the carried interest or, more commonly, the promote. This is your reward for finding the deal, executing the business plan, and making everyone money. Your financial model has to nail this calculation with absolute precision.

A classic waterfall structure might break down like this:

- Tier 1 (The Pref): First, 100% of all distributable cash goes to the LPs until they’ve hit an 8% cumulative, non-compounded return.

- Tier 2 (Capital Return): Next, 100% of the remaining cash continues to go to the LPs until their initial investment is paid back in full.

- Tier 3 (First Promote): After that, the split changes. Cash might be divided 70% to the LPs and 30% to the GP until the LPs have achieved a total 15% IRR.

- Tier 4 (The Final Split): From here on out, all remaining cash is split 50/50 between the LPs and the GP.

Getting this logic right in Excel is tricky. It involves a careful combination of IF, AND, MIN, and MAX functions to make sure cash is allocated correctly in each tier without accidentally over-distributing. It’s a complex but non-negotiable part of any institutional-grade model.

I once reviewed a model where the promote was calculated on a simple cash-out basis, completely ignoring the cumulative nature of the preferred return. It was a subtle mistake, but it overstated the GP's promote by nearly $250,000 on a $5 million equity raise. A sharp investor would have caught that in minutes, and all credibility would have been lost.

What If? Stress-Testing With Sensitivity and Scenario Analysis

A static model is a fragile one. The real world is messy, and smart investors know it. They will always ask, "What happens if...?" Your model needs to provide the answers instantly.

This is where sensitivity and scenario analysis comes into play. Instead of hard-coding your key assumptions, build them as input cells or toggles on a separate assumptions tab. This lets you stress-test the deal against different market conditions and immediately see the impact on investor returns and your own promote.

You absolutely need to build sensitivities for these key variables:

- Exit Cap Rate: What happens if the exit cap rate is 50 basis points higher than you’re projecting?

- Rental Growth: How do the returns look if annual rent growth comes in at 1.5% instead of 3.0%?

- Interest Rates: If you have floating-rate debt, what does a 1% jump in the base rate do to your cash flow?

- Occupancy Rates: What’s the breakeven occupancy where the deal stops hitting its preferred return?

By setting up a data table in Excel, you can create a clean sensitivity matrix showing how the LP IRR and Equity Multiple wiggle based on shifts in your two most critical assumptions—which are usually the exit cap rate and average rental growth. Having this ready demonstrates incredible foresight. It shows investors you’ve thought through both the good and the bad, which builds a ton of trust.

Bringing Your Model to Life with Your Syndication Platform

Let's be honest, even the most sophisticated financial model is useless if it just sits in a folder on your computer. The real power comes from making that model work for you—turning all that detailed analysis into a clear, compelling story for your investors and a practical tool for managing your deal.

The best way to start is by creating a dedicated "Returns Summary" or "Deal Dashboard" tab right in your Excel or Google Sheets model. Think of this as your deal's executive summary. It should neatly display all the headline numbers: total equity needed, target IRR, projected Equity Multiple, and the minimum investment you'll accept. This one page becomes the bedrock for all your investor-facing materials.

From Spreadsheet to Investor Portal

A solid spreadsheet is your foundation, but modern syndication runs on specialized platforms that handle the heavy lifting of investor relations. Tools like Homebase are built to take the key outputs from your model and create a professional, streamlined experience for your limited partners.

The numbers from your summary tab are exactly what you'll plug into your deal room setup. This isn't about re-entering data; it's about a direct, clean handoff from your underwriting to your fundraising efforts.

Take a look at how this plays out in a live deal room:

You can see how the platform presents the target raise, minimum investment, and key return metrics in a way that’s easy for potential LPs to digest. It looks professional and builds immediate trust because it’s a direct reflection of the hard work you put into your model.

This is where you start saving serious time. Instead of manually updating a PowerPoint deck or fielding endless one-off questions about returns, the data flows directly from your model to the investor portal.

Here's the key takeaway: Your model’s outputs, like the total equity required, aren't just an internal goal. They become the live fundraising target in your portal. That distribution schedule you painstakingly built? It can later be used to set up automated ACH payments to investors, ensuring everyone gets paid correctly and on time without you spending hours on manual transfers.

By connecting your model to your platform, you create a cohesive system. It ensures the numbers you underwrote are the same numbers your investors see, and the same numbers you report on for years to come. Your model stops being just a static file and becomes the dynamic engine driving your entire syndication business.

Answering the Tough Questions in Real Estate Modeling

Even the sharpest model is going to spark a few questions. Let's tackle some of the most common ones that pop up from both syndicators and investors. Getting these right will build confidence in your deal.

What’s the Single Biggest Mistake You See in Models?

Hands down, it's garbage in, garbage out. The most frequent and dangerous mistake is plugging in overly optimistic assumptions. I’ve seen countless models that look amazing on paper but are completely disconnected from reality.

They project aggressive rent growth that the market can't support, assume impossibly low vacancy rates, or forecast an exit cap rate that's just a fantasy. A professional model has to be built on a foundation of conservative, market-backed data. Always stress-test your numbers. What happens to your returns if rents only grow at 1% instead of 3%? What if the exit cap rate expands by 50 basis points? If your deal still works, you've got something solid.

How Should I Approach Modeling a Value-Add Deal?

Modeling a value-add strategy is all about the details. You need a granular capital expenditure (CapEx) budget and a realistic timeline for getting the work done. I recommend creating a separate schedule that breaks down every renovation cost, whether it's per-unit or a larger project like a new roof. This budget needs to flow directly into your sources and uses table.

Then, you have to model the "rent premium" you'll get from those renovated units in your revenue forecast.

Here's what most people forget: you must account for the units that will be offline during construction. Modeling a period of higher vacancy or "down units" is crucial. Missing this step is a guaranteed way to blow up your year-one cash flow projections and start off on the wrong foot with your investors.

Can You Explain the Difference Between IRR and Equity Multiple?

Absolutely. Both metrics are vital for telling the full story of an investment, but they measure performance from completely different angles.

- Equity Multiple is simple: it tells you how much money you got back compared to what you put in. A 2.0x multiple means you doubled your money. It's straightforward, but it completely ignores how long it took to get that return.

- Internal Rate of Return (IRR), on the other hand, is all about time. It calculates your annualized rate of return, factoring in when the cash flows are received.

A deal held for ten years might have a fantastic Equity Multiple but a pretty average IRR. In contrast, a quick one-year flip could post a sky-high IRR but a relatively low Equity Multiple. Your investors need to see both to truly grasp the deal's return profile.

Ready to streamline your syndication process? With Homebase, you can manage your deals, investors, and distributions all in one place. Stop wrestling with spreadsheets and start closing more capital. Learn more and book a demo today.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Cost Approach Real Estate Explained for Syndicators

Blog

Master the cost approach real estate valuation method. Learn how to calculate value, avoid common pitfalls, and leverage it for your next syndication deal.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.