Digital Transformation in Real Estate: PropTech for Syndication & Growth

Digital Transformation in Real Estate: PropTech for Syndication & Growth

Explore digital transformation in real estate and how proptech fuels fundraising, investor relations, and scalable operations.

Domingo Valadez

Jan 14, 2026

Blog

Are you still staring at a mountain of spreadsheets and chasing down signatures? For a lot of real estate sponsors and syndicators, that's just another Tuesday. When we talk about digital transformation in real estate, we're really talking about a strategic move away from that manual grind. It’s about building a business on integrated, tech-driven systems that actually speed up growth and make your investors happy.

Moving Beyond Spreadsheets in Real Estate Operations

For a long time, spreadsheets were the go-to tool for real estate syndication. They were easy to use, everyone had them, and they got the job done—for a while. But as soon as your portfolio starts to grow, that dependency on Excel turns into a serious operational bottleneck.

The "old way" is a patchwork of disconnected tools. You’ve got investor emails flying everywhere, crucial documents hiding in random folders, and a master spreadsheet for capital commitments that needs constant, manual babysitting. This chaos doesn't just waste your time; it opens the door to costly mistakes and creates a clunky, unprofessional experience for the very investors you’re trying to impress.

The Pain Points of Manual Operations

If you're still running your syndication manually, these headaches probably sound familiar. The worst part is that they feed off each other, creating a cycle of inefficiency that holds back your growth.

Here’s what that pain looks like in practice:

* Time-Consuming Fundraising: Manually sending out subscription docs, hounding investors for signatures, and then tracking down wires is a painful, slow-moving crawl that can put your entire deal timeline at risk.

* Fragmented Investor Communication: Without a single source of truth, investors are constantly emailing you for updates. This erodes the transparency and trust that are the bedrock of any solid long-term relationship.

* Data Silos and Errors: When your data is scattered across different spreadsheets, you’re practically begging for version control nightmares and data entry mistakes. With over 88% of spreadsheets containing errors, that’s a gamble you can’t afford to take.

* Inability to Scale: Every new deal or investor adds another heavy layer of administrative work. You’re left with a tough choice: either hire more people just to keep up or stop growing altogether.

From Horse-Drawn Carriage to High-Speed Train

Making the leap to a digital-first operation is like trading in a horse-drawn carriage for a high-speed train. Sure, both will get you there eventually, but the difference in speed, efficiency, and scale is night and day. The carriage is the slow, bumpy ride of manual work.

The high-speed train is your modern digital platform. It’s a fully integrated system where fundraising, investor relations, and reporting all run on the same track, propelling your business forward with incredible speed and reliability.

This isn't just about buying some new software. It’s a fundamental redesign of your business to support real, sustainable growth. It means you get to spend less time on tedious administrative tasks and more time on what actually moves the needle: finding great deals and building rock-solid investor relationships. The goal is simple: create a seamless, professional experience that wows investors and gives you the operational backbone to scale with confidence.

Why Digital Transformation Is No Longer Optional

Let's be blunt: the pressure to evolve isn't a distant storm cloud anymore. It's a seismic shift happening right under our feet in the real estate syndication world. The era of slow-moving deals and patient investors waiting for paper statements in the mail is officially over. Today, the forces pushing for change are immediate and powerful. Ignoring them isn't just about falling behind—it’s about risking irrelevance.

At the very center of this shift are today's investors. They’re used to checking their stock portfolios on an app and managing their bank accounts online in real-time. Naturally, they now expect that same level of transparency and instant access from their real estate investments. They want to see how their portfolio is doing, pull up key documents, and get updates on their own schedule, not just when you get around to it. This demand for a smooth, digital experience is the primary reason syndicators are moving to modern platforms.

At the same time, the competition has gotten fierce. Deals are closing faster than ever, and the syndicators who can raise capital, get subscription documents signed, and fund a deal most efficiently are the ones who win. If you're still emailing PDFs, chasing down wet signatures, and manually tracking wire transfers, you're operating with a serious handicap. Speed to close is the name of the game, and digital operations are the engine that gets you there.

Scaling Pains and Administrative Burdens

Beyond investor expectations and market pressures, there's a huge internal challenge: the crushing administrative weight of a growing portfolio. Every new property and each new investor adds another layer of complexity. Without a central system, your team can quickly drown in manual tasks—from tracking commitments and managing distributions to generating K-1s.

This administrative drag is a direct roadblock to scaling your business. You end up spending more time managing your existing assets instead of sourcing new deals. The real estate industry is experiencing a seismic shift, making a deep understanding of top real estate lead generation strategies vital as digital transformation in real estate is no longer optional. Adopting a digital framework isn't just about being more efficient; it's a strategic move to build a resilient, scalable business that can actually grow.

Manual Methods vs. Digital Solutions

To really see the difference, it helps to put the old way and the new way side-by-side. The contrast isn't just about saving time; it's about reducing risk and dramatically improving the investor experience.

Shifting from manual to digital is not just an upgrade; it’s a redefinition of your operational capacity. It empowers you to build a more professional, transparent, and scalable syndication business that inspires investor confidence and drives growth.

The table below breaks down the practical differences, making the business case for going digital incredibly clear.

Traditional vs Digital Operations in Real Estate Syndication

Here's a direct comparison of how manual processes stack up against modern digital solutions, highlighting the measurable benefits for syndicators.

As you can see, the move to a digital platform isn't about incremental improvements. It's about fundamentally changing how you operate for the better, allowing you to focus on what you do best: finding great deals and creating value for your investors.

Building Your Modern Real Estate Tech Stack

To truly bring your real estate syndication business into the modern era, you need more than just a single piece of software. You need an integrated tech stack. Think of it less like a collection of apps and more like a central command center for your entire operation. Instead of jumping between a dozen disconnected tools, each component works together, sharing data and automating tasks to create a single, reliable source of truth.

This setup puts an end to the chaos of data silos—where the investor info in your CRM doesn't match the records in your accounting software, for example. A well-built tech stack ensures every part of your business is in constant communication, from the moment an investor makes a soft commitment to the day you send out the final distribution check.

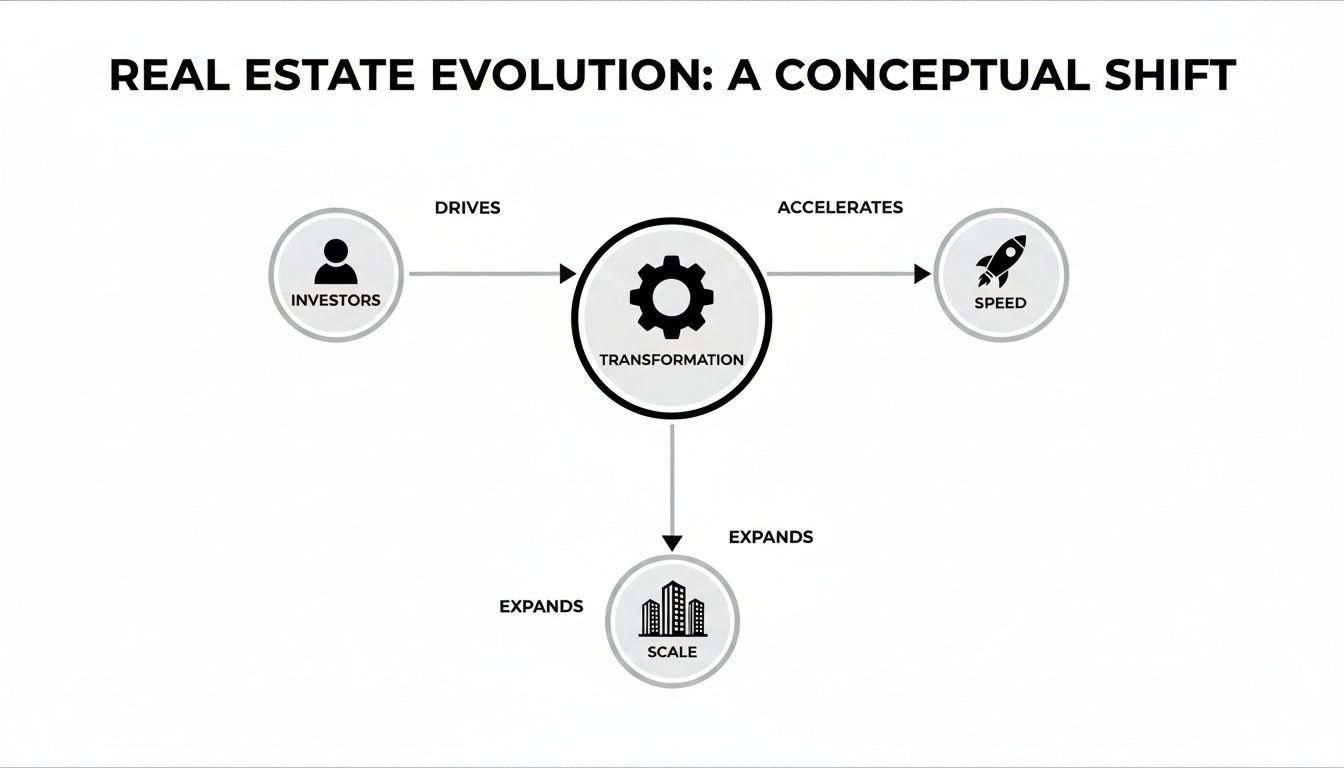

The push for this shift isn't just about efficiency; it's driven by investor demands, the need for speed, and the pressure to scale.

As you can see, today’s investors are at the heart of this evolution. They expect a seamless digital experience, which in turn pushes sponsors to adopt technology that speeds up deal cycles and allows them to manage larger, more complex portfolios.

The Core Components of Your Tech Stack

Assembling this command center means strategically choosing tools that cover every single stage of the deal lifecycle. The goal is simple: create a frictionless experience for both your internal team and your investors. While the specific software you choose might differ, the core functions are absolutely non-negotiable for any modern syndication business.

Here are the essential building blocks:

- Customer Relationship Management (CRM): This is the foundation of your investor relations. A real estate-specific CRM does more than just store contacts; it tracks interactions, helps you manage your capital-raising pipeline, and lets you segment investors based on their interests and accreditation status.

- Secure Deal Rooms: When it's time to raise capital, a professional online deal room is a game-changer. It replaces the endless, insecure email chains and gives prospective investors a secure, central hub to review offering memorandums, due diligence files, and subscription documents.

- Investor Portals: Think of this as your digital home for investor relations after a deal closes. A self-service portal gives investors 24/7 access to performance dashboards, key documents like K-1s, and investment updates. This one tool can dramatically cut down on the time you spend answering one-off emails.

- E-Signature and Compliance Tools: Nothing slows down a closing like wet-ink signatures. Integrated e-signature capabilities are crucial for getting subscription documents signed quickly. The best platforms also have built-in Know Your Customer (KYC) and Anti-Money Laundering (AML) checks to keep you compliant without all the manual legwork.

Connecting the Dots with Integrations

The real magic of a tech stack isn't in the individual tools, but in how they connect. When these core components are properly integrated, they create powerful automations that can save you and your team countless hours.

A truly integrated tech stack acts like a well-trained crew, where each member knows their role and communicates flawlessly. The deal room talks to the CRM, the CRM talks to the investor portal, and the portal handles distributions, all without you having to manually copy and paste data between systems.

This integration is what separates a random collection of software from a cohesive operational platform. It’s what really unlocks efficiency and makes it possible to scale your business. To see just how powerful this can be, our guide on workflow automation benefits dives deep into eliminating redundant tasks and freeing up your team for higher-value work.

Expanding the Ecosystem with Proptech

Beyond the core tools for raising and managing capital, your tech stack should also connect with the broader property technology (Proptech) ecosystem. This means linking up with the software that helps you manage the physical assets themselves.

Integrations with property management and accounting software are vital. They allow you to pull operational data directly into your investor portal, giving your LPs transparent, real-time performance metrics. This finally closes the loop between what's happening at the property and what your investors see. As you build out your stack, a thorough Property Management Software Comparison can help you pick tools that play well together, creating a powerful, data-driven operation that supports growth at every level.

Your Practical Roadmap for Digital Implementation

Ready to make the switch? Taking your real estate firm digital can feel like a huge project, but it doesn't have to be a nightmare. The secret is breaking the journey down into a clear, manageable framework that moves you from scattered spreadsheets to a polished, professional system with confidence.

Think of this process less like a single, terrifying leap and more like a series of strategic steps. Each phase builds on the last, ensuring a smooth transition that won’t disrupt your team or—most importantly—your investors. The real goal here is to build an operational foundation that’s ready to support your growth for years to come.

Phase 1: Audit and Strategize

Before you can map out where you're going, you need to know exactly where you stand. This first phase is all about discovery and goal-setting. It starts with a brutally honest look at your current workflows to find the biggest headaches and bottlenecks.

Where is your team sinking the most time? What tedious tasks are causing the most human errors? Answering these questions is the only way to define what "success" actually looks like for your firm.

Here’s what to focus on:

- Map Current Workflows: Get it all down on paper. Document every single step, from that first investor phone call and fundraising flurry to sending out distributions and bracing for tax season.

- Identify Critical Bottlenecks: Pinpoint the exact points of friction. Is it chasing down wet signatures? Manually piecing together investor reports from five different spreadsheets?

- Define Success Metrics: Set clear, measurable Key Performance Indicators (KPIs). For instance, your goal might be to slash the time it takes to close a round by 40% or cut down on routine investor emails by 50%.

Phase 2: Pilot and Partner Selection

Once you have a clear picture of your needs, you can start looking at technology partners. This isn't just a feature-to-feature comparison; it’s about finding a platform and a team that genuinely gets your business goals. You want a provider who understands the unique world of real estate syndication.

After you’ve shortlisted a few options, run a small-scale pilot test. This is a crucial step that far too many firms skip. A pilot lets you see exactly how the software performs in a real-world scenario before you commit your entire operation.

A pilot program is your dress rehearsal. It’s your chance to work out the kinks, test the experience for your team and a handful of friendly investors, and make sure the platform delivers on its promises before the main event.

Pick a single, straightforward deal or a small group of trusted investors for your test run. This controlled experiment will give you priceless feedback and build the internal confidence you need for a full-scale rollout.

Phase 3: Migrate and Integrate

This is the part everyone dreads, but with the right partner, it can be surprisingly painless. Moving all your historical data—investor details, commitment amounts, property records—from messy spreadsheets into a clean, new system is where dedicated support becomes absolutely essential.

Don't underestimate the work involved here. A quality tech partner will offer full-service migration, taking the entire burden off your team. This is the key to ensuring data integrity and a clean slate, so you can hit the ground running without chasing legacy data problems.

In today's commercial real estate market, this pivot is already paying off. AI is becoming a go-to tool for underwriting and operations, shrinking complex analysis from days down to minutes. This frees up sponsors to focus on what matters: high-value client relationships. Properties with solid digital infrastructure, like data centers, are now top-tier opportunities, with 100% of new construction in major global markets already pre-committed. For sponsors using platforms like Homebase, integrating these tools means closing deals faster without being dragged down by old systems. You can find more insights on digital transformation and how the commercial real estate landscape is changing.

Phase 4: Train and Track

Great technology is worthless if your team doesn't know how to use it. This final phase is all about solid training and tracking your performance over time. Your chosen partner should provide thorough onboarding to get everyone on your team comfortable and up to speed.

Set aside dedicated time for training sessions and create simple internal guides for your new standard operating procedures. It’s also a great idea to empower a "champion" on your team—someone who can be the go-to expert for everyday questions.

Finally, bring it all back to the KPIs you set in Phase 1. Keep a close eye on your progress against those metrics. This data-driven approach will not only prove the ROI of your investment but will also shine a light on new opportunities for improvement as your business grows.

Measuring the Real-World ROI of Going Digital

It’s one thing to talk about the theory of digital transformation, but what really matters are the tangible results. Moving your real estate syndication from a mess of spreadsheets to an integrated platform isn’t just about looking modern. It’s about generating a clear, measurable return on investment—one you can see in your deal timelines, your bottom line, and the strength of your investor relationships.

The first place you’ll feel the impact is in fundraising. Think about the old way: a sponsor might spend two months chasing down subscription documents, manually tracking wire transfers, and constantly updating a master spreadsheet. With a proper digital deal room, that whole process can shrink to just three weeks. That's not a small adjustment; it’s a massive acceleration that frees you up to win competitive deals and put capital to work faster.

Quantifying the Gains in Time and Efficiency

Beyond the speed of fundraising, the daily operational savings really start to pile up. A huge headache for most syndicators is the endless drip of investor questions about performance, K-1s, and distribution schedules. This is where a self-service investor portal becomes your best friend.

One syndicator I know saw a 70% drop in routine investor emails practically overnight after launching their portal. This simple change gave investors 24/7 access to everything they needed, which made them happier and, more importantly, freed up dozens of hours for the sponsor's team every single month. That time doesn’t just disappear; it gets poured back into high-value work like sourcing new deals and building relationships with key partners.

The real return on investment isn’t just about cost savings. It’s about creating operational leverage, allowing you to manage a larger, more complex portfolio with the same lean, effective core team.

This efficiency also trickles down to asset performance. The broader digital transformation in real estate includes smart home tech and other digital amenities that directly increase tenant retention and, ultimately, property values. Buildings that offer online rent payments and digital maintenance requests are simply more attractive. They command higher rents and draw better tenants, which for you as a sponsor means stronger, more predictable cash flow. You can read more about these key real estate trends and their impact.

Case Study: A New Level of Professionalism

Let’s get practical with an example. A growing multifamily syndication firm was juggling five properties and over 100 investors with a clumsy system of spreadsheets, email, and Dropbox. Their quarterly reporting was a two-week marathon of manual data entry, creating PDFs one by one, and sending out mass emails that half the time went to spam.

Then they moved to an all-in-one platform like Homebase. The change was night and day.

- Before: Two full weeks of manual work just to get quarterly reports out the door.

- After: Reports were generated and sent to every investor in under two hours.

But it wasn't just about saving time. The firm instantly looked more professional and buttoned-up. Investors logged into a secure, branded portal that made them feel confident and connected to their investment. The result? When they launched their next deal, capital commitments came in 30% faster than any of their previous offerings. That’s a direct consequence of building trust and making it incredibly easy for people to invest with them.

Wrapping It Up: Your Next Move

Thinking about "digital transformation" can feel huge and overwhelming, but it's not about flipping a switch overnight. It's really about a shift in mindset—a commitment to constantly finding better ways to do what you already do well. The whole point is to use smart technology to find great deals and build rock-solid investor relationships, just more efficiently.

The journey starts with one simple, honest question: What’s the single biggest headache in your business right now? Is it the fundraising scramble? The constant back-and-forth on investor emails? Or the soul-crushing, manual grind of quarterly reports? Find that one thing, and you've found your starting point.

Think of Technology as a Partner, Not Just a Tool

The best platforms out there aren't just pieces of software; they're designed to be your strategic partner. Their job is to get you out of the weeds so you can focus on what actually moves the needle. When you find the right fit, you can finally escape the quicksand of spreadsheets and clunky, outdated systems.

A digital-first operation is about buying back your most valuable asset: time. It’s about reallocating all those hours you sink into manual tasks and putting them toward what really grows the business—nurturing relationships, underwriting deals, and getting more capital in the door.

A real partner gets that it’s not just about handing you a login and wishing you luck. They should be in the trenches with you, helping you move your data over without a hitch and making sure your team feels comfortable and ready to go.

Taking the First Step

You don’t have to boil the ocean here. The syndicators who really succeed with this stuff are the ones who start small. They pick one problem, prove the value of solving it, and then build from that win.

By focusing on your most critical operational bottleneck first, you lay the groundwork for growth that you can actually manage. It's how you build a solid foundation that lets you scale with confidence, knowing the back-end of your business can handle whatever you throw at it. This is how you move from just managing a portfolio to truly growing one.

Frequently Asked Questions

When you're thinking about moving your real estate syndication business from spreadsheets to a modern, all-in-one platform, a lot of questions come up. It’s a big step, so let’s get straight to the practical answers for the things sponsors and syndicators worry about most.

Do I Need to Be a Tech Whiz to Use This?

This is easily the most common concern we hear, and the answer is a resounding no. Modern investor platforms are built for real estate people, not software engineers. If you can use LinkedIn or your online banking app, you've got this.

The whole point of this technology is to make your life simpler, not to give you another complex system to learn. The best software providers do all the heavy lifting in the background, offering clean dashboards and intuitive steps for everything you need to do. They handle the tech so you can focus on deals and investors.

Is This Kind of Software Affordable for a Smaller Firm?

Definitely. There's a lingering myth that powerful real estate software is only for the giant institutional players. That’s just not true anymore. Many of the best platforms today offer simple, flat-rate pricing that doesn't punish you as you grow. This is a huge change from older models that took a percentage of your assets under management (AUM), which could get painfully expensive fast.

Today’s technology is designed to be a growth engine, not a cost center. A fixed-cost structure means you can manage unlimited deals, investors, and team members without watching your software bill climb. This makes it a smart, scalable investment for firms of any size.

How Can I Be Sure My Investor Data Is Secure?

Security is everything, and any platform worth its salt treats it that way. You should expect nothing less than bank-level security measures to protect your investors' sensitive personal and financial information.

Here’s what that looks like in practice:

* Data Encryption: All your data—whether it's sitting on a server or being sent over the internet—should be fully encrypted to keep it unreadable to anyone without authorization.

* Secure Infrastructure: Platforms are typically built on major cloud services like Amazon Web Services (AWS), which come with world-class security baked in.

* Regular Audits: Reputable companies constantly run security audits and hire ethical hackers for penetration testing to find and fix potential weak spots before they become a problem.

What's the Single Biggest Mistake to Avoid?

The biggest pitfall by far is overlooking the data migration process. It's easy to get excited about all the new features and forget about the critical first step: getting all your historical deal and investor info out of scattered spreadsheets and into the new system. A botched migration creates a huge mess—inaccurate K-1s, confused investors, and a frustrating start with your new tool.

The best way to sidestep this is to partner with a provider that offers full-service, white-glove migration support. Let their expert team handle the tedious work of cleaning, organizing, and importing your data. It ensures everything is accurate and properly structured from day one, so you can actually start using and benefiting from your new platform right away.

Ready to leave the busywork of spreadsheets behind? Homebase is the all-in-one platform built by syndicators, for syndicators. We handle your migration and provide unlimited support so you can focus on what matters—closing deals and building investor trust. Learn more about Homebase and see how we can help you scale.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Unlocking Your Deal's Value with Commercial Property Appraisal

Blog

A syndicator's guide to commercial property appraisal. Learn to decode reports, master valuation methods, and leverage findings for successful fundraising.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.