Commercial Real Estate Market Analysis: Your Investment Guide

Commercial Real Estate Market Analysis: Your Investment Guide

Learn commercial real estate market analysis to identify profitable opportunities and make smarter investment decisions. Start optimizing today.

Domingo Valadez

Sep 8, 2025

Blog

Before you ever think about putting capital into a commercial real estate deal, you need to do your homework. That homework is what we call a commercial real estate market analysis. It's the process of digging into all the economic, demographic, and property-specific details to figure out if a market has real investment potential.

This isn't just about ticking a box; it's the fundamental due diligence that shapes your decisions, helps you dodge unnecessary risks, and builds the rock-solid case you'll need to bring investors and lenders on board.

What Commercial Real Estate Market Analysis Really Is

Forget thinking of market analysis as some dry, tedious report. It's more like your strategic map for a high-stakes treasure hunt. It's the intelligence you gather on the ground that helps you tell the difference between a calculated risk and a blind gamble. You’re essentially turning mountains of raw data into a clear, actionable investment plan.

This whole process is a deep dive into the forces that will make or break a property's future. For real estate syndicators, this analysis is the absolute bedrock of the entire deal. It’s the data-driven story you'll use to persuade investors to come along for the ride and give lenders the confidence they need to fund the purchase.

Beyond a Simple Property Evaluation

A classic rookie mistake is getting a property appraisal confused with a full-blown market analysis. An appraisal gives you a snapshot of what a property is worth right now. A market analysis, on the other hand, gives you the forecast—it tells you where that property's value is likely heading in the future.

It forces you to look beyond the four walls of the building and examine the entire ecosystem it lives in. This means you’re peeling back several layers of information:

- Economic Drivers: What’s the health of the local economy? Are new jobs popping up, and in what industries? A booming local economy is a huge green flag, signaling strong demand for commercial space.

- Demographic Shifts: Is the population growing, or are people leaving town? What do income levels and age groups look like? A surge of young professionals moving in could be a goldmine for new multifamily or trendy office developments.

- Supply and Demand Dynamics: You have to know the numbers. How much vacant space is there, and how fast are leases getting signed (the absorption rate)? Crucially, are there a ton of new construction projects on the horizon that could flood the market and drive down rents?

A thorough commercial real estate market analysis is your crystal ball. It gives you a clear view of property demand, the local economic climate, and developing trends. By understanding these pieces, investors can spot opportunities, sidestep risks, and make moves that actually grow their money.

The Role of the Analyst

A good analyst is like a seasoned detective, picking up on clues that most people would walk right past. They don't just see population growth as a statistic; they see future tenants for an apartment building. They don't just see a new highway interchange; they see a logistics hub ripe for industrial warehouses.

This kind of foresight is everything. For example, knowing that nearly $957 billion in commercial mortgages are coming due in 2025 points to both danger and massive opportunity. Owners who can't refinance could become motivated sellers, creating prime acquisition targets for investors who did their homework.

At the end of the day, a solid commercial real estate market analysis is the disciplined system that lets you move with confidence, knowing your decisions are backed by hard evidence, not just wishful thinking.

Gathering Your Essential Market Intelligence

Any powerful market analysis is built on a foundation of high-quality, reliable intelligence. Think of it like a detective building a case; your final conclusion is only as strong as the evidence you gather. This isn't about finding one magic number, but about weaving together different threads of data to see the whole story.

To get that complete picture, we break down our intelligence gathering into three core categories. Each one gives you a different lens for viewing the market. When you put them all together, you get a multi-dimensional understanding that reveals both hidden opportunities and potential risks. Skip one, and you’re flying with a major blind spot.

Macroeconomic Data: The Big Picture

First, you have to get a handle on the broad economic forces at play. This is your 30,000-foot view—the stuff that tells you which way the economic winds are blowing. These national and regional trends create the environment where your property will either sink or swim.

A strong local economy, for instance, means more jobs. More jobs mean more demand for all kinds of commercial space, from offices to warehouses. Your goal is to connect these big-picture indicators to what’s actually happening on the ground.

Key sources for this intelligence include:

* Bureau of Labor Statistics (BLS): This is where you find the hard numbers on employment growth, unemployment rates, and wage trends for specific metro areas.

* Bureau of Economic Analysis (BEA): The BEA offers a look at Gross Domestic Product (GDP) growth at the local level, giving you a direct signal of the market's overall economic health.

* Federal Reserve Economic Data (FRED): A goldmine of information on interest rates, inflation, and other monetary policies that have a direct impact on financing costs and what a property is worth.

A savvy investor sees a positive jobs report not just as a headline, but as a direct signal of future leasing demand. For example, a 3.1% rise in quarterly GDP, driven by consumer spending, can be a leading indicator of a strong upcoming year for retail properties.

Property-Level Data: The Street View

Once you've got the big picture, it's time to zoom in. We need to get granular and look at the specifics of the real estate itself. This is where you analyze how actual properties in your target submarket are performing. This data is the hard evidence of what supply and demand really look like.

Without this ground-level intel, you're just investing on a hunch. These numbers tell you the true health and competitiveness of the local property market, moving you from speculation to stone-cold facts.

Essential property-level data points include:

* Vacancy Rates: What percentage of buildings are sitting empty? If vacancy is high or climbing, it could be a red flag for a weakening market.

* Rental Comps: What are similar properties actually leasing for per square foot? This is absolutely critical for underwriting your deal and projecting income.

* Absorption Rates: How quickly is the available empty space being leased up? A positive absorption rate is a clear sign of healthy demand.

* Development Pipeline: What new projects are under construction or planned? A big wave of new supply could put downward pressure on rents down the road.

This is where specialized platforms like CoStar, Reonomy, and CommercialEdge are worth their weight in gold. They provide detailed, verified data that's incredibly difficult to find on your own. They track millions of property records, giving you the specifics you need for a robust commercial real estate market analysis.

Demographic Data: The Human Element

Finally, you need to analyze the people who live and work in the market. Demographics tell the human story behind the economic numbers, revealing the real drivers of demand. After all, a market with a declining population and flat wages is a much riskier bet than one that's attracting young, growing, and affluent residents.

This data helps you see what's coming next. A surge in the millennial population, for example, often comes right before a boom in demand for multifamily apartments and trendy mixed-use developments.

Look to these sources for key demographic insights:

* U.S. Census Bureau: The definitive source for everything from population growth and household income trends to migration patterns and age breakdowns.

* Local Economic Development Agencies: These groups often publish detailed reports on their community's demographic profile as part of their effort to attract new businesses.

By combining the big-picture macroeconomic trends, the street-level property performance, and the underlying demographic shifts, you build a validated, multi-faceted analysis. This rigorous, three-pronged approach isn’t just a good idea—it’s non-negotiable for anyone serious about minimizing risk and finding truly exceptional investment opportunities.

How Economic Trends Shape Your Investment Success

Connecting the dots between Wall Street headlines and the value of a property on Main Street is a game-changing skill in commercial real estate. Think of broad economic forces as powerful ocean currents. They can lift your investment to new heights or drag it under, no matter how well you manage the property itself.

When you learn to read these currents, you move from just reacting to the market to actually predicting it. It’s how you get ahead of major shifts, giving you a serious advantage. This foresight is what separates the average investor from a truly strategic operator.

The Ripple Effect of Interest Rates and Inflation

Nothing hits a real estate deal faster or harder than the cost of money. When the Federal Reserve tweaks interest rates, it sends ripples across the entire industry, affecting everything from property valuations to your monthly loan payments. It’s one of the most fundamental levers in the real estate machine.

When rates climb, borrowing gets more expensive. This added cost puts downward pressure on property values because buyers simply can’t afford to pay as much as they could before. A deal that looked like a home run six months ago might not even make sense today with a much higher debt service.

The commercial real estate market is feeling this pressure right now. Interest rates for stabilized properties are often above 5%, while riskier office and retail deals face even steeper borrowing costs. With nearly a trillion dollars in commercial real estate loans coming due, many owners are stuck between refinancing at these painful rates or being forced to sell. You can find more great insights into the current commercial real estate outlook on Agorareal.com.

A great way to think about it is to picture a seesaw. On one end, you have interest rates; on the other, property values. As interest rates go up, values tend to come down to keep a new buyer's expected return in balance. This inverse relationship is a bedrock principle of real estate valuation.

Employment Growth as a Demand Indicator

Beyond the cost of capital, the health of the local job market is probably the single best predictor of future demand. Job growth isn't just an abstract number in a government report; it’s a direct signal that new tenants need places to live, work, and shop.

A booming job market means more companies are hiring, which directly translates into a need for more office or industrial space. Those new hires also need a place to live, fueling demand for multifamily apartments. And what do they do with their paychecks? They spend them, supporting local retail and restaurants.

Here’s how you can turn job data into an investment thesis:

* Growing Tech Sector: This is a clear signal of strong demand for Class A office space and modern apartments designed to attract top talent.

* Expanding Logistics Hub: Tells you there's an urgent need for more industrial and warehouse distribution centers.

* New Hospital or University Campus: This creates a super-stable demand base for medical offices, student housing, and all the retail services that pop up around them.

By looking at the types of jobs being created, you can make smarter, more targeted bets on the specific property types that are about to take off.

A Real-World Example in Action

Let’s bring this to life. Imagine a mid-sized city we'll call "Techville" that just landed a major tech company's new headquarters. A savvy analyst can see the chain reaction this will set off.

First, the direct impact is immediate. The company needs to lease hundreds of thousands of square feet of office space, sucking up supply and drastically lowering the city’s office vacancy rate. Suddenly, landlords hold all the cards and can command higher rents.

Next, the secondary effects start to roll in. The company hires thousands of well-paid engineers and managers. These new residents flood the housing market, pushing up apartment rents and occupancy rates. This influx of professionals with money to spend creates a golden opportunity for new restaurants, coffee shops, and boutique stores, giving the retail property sector a huge boost.

This simple example shows how a single economic event can lift all boats in a market. By performing a thorough commercial real estate market analysis, you can spot the next "Techville" before it hits the news, positioning your investments to ride that wave of growth.

Your Step-by-Step Market Analysis Framework

A truly great commercial real estate market analysis isn't some abstract academic exercise. It's a structured, repeatable process that turns a mountain of raw data into a clear, decisive investment thesis.

Think of this framework as your operational playbook. It's a series of logical steps that guide you from spotting a promising location to making a confident “go” or “no-go” decision. This is what provides the discipline to evaluate every deal with the same level of rigor, ensuring nothing critical ever falls through the cracks.

Ultimately, this methodology is your best defense against emotional decision-making. It’s the tool you use to build a compelling, evidence-based case for your investors, de-risking the deal by proving its viability through facts, not just gut feelings.

Let's break down the essential steps.

Step 1: Define Your Geographic Target Precisely

The first move is always to narrow your focus with surgical precision. "Investing in Texas" isn't a strategy; it's a vague wish. A professional analysis begins by defining your specific geographic market and, even more importantly, the submarket within it. A submarket is a smaller, localized area with its own unique economic and real estate character.

For example, instead of targeting the massive Dallas-Fort Worth metroplex, a savvy syndicator might zero in on the Frisco submarket. Why? Because Frisco might have a booming corporate population and a shortage of Class A office space, while another corner of DFW could be overbuilt and stagnant.

To properly define your target area, you need to answer a few key questions:

* What are the clear geographic boundaries? Use major highways, neighborhood lines, or even zoning districts to draw a firm line on the map.

* What defines this submarket’s identity? Is it a logistics hub clustered around an airport, a medical district anchored by a major hospital, or a rapidly growing residential pocket?

* Who is your target tenant? Are you serving tech startups, medical professionals, or young families? This answer will dictate everything from your property type to your exact location.

Step 2: Analyze Supply and Demand Dynamics

With your submarket clearly defined, you can now measure the two most powerful forces in real estate: supply and demand. This is where you move beyond feelings and into hard numbers to get an accurate snapshot of the market’s current health.

Think of supply and demand like a scale. An oversupply of properties without enough tenants will tip the scale toward lower rents and higher vacancies. On the other hand, high demand with limited supply means rising rents and stronger investment returns. Your job is to find markets where that scale is tipping decisively in your favor.

To get a true picture, you have to investigate these core metrics:

* Current Vacancy Rate: What percentage of existing properties are sitting empty right now?

* Historical Absorption Rate: How much space has been leased up, on average, over the last 3-5 years? This tells you the real velocity of demand in the area.

* Rental Rate Trends: Are rents for comparable properties going up, down, or are they flat?

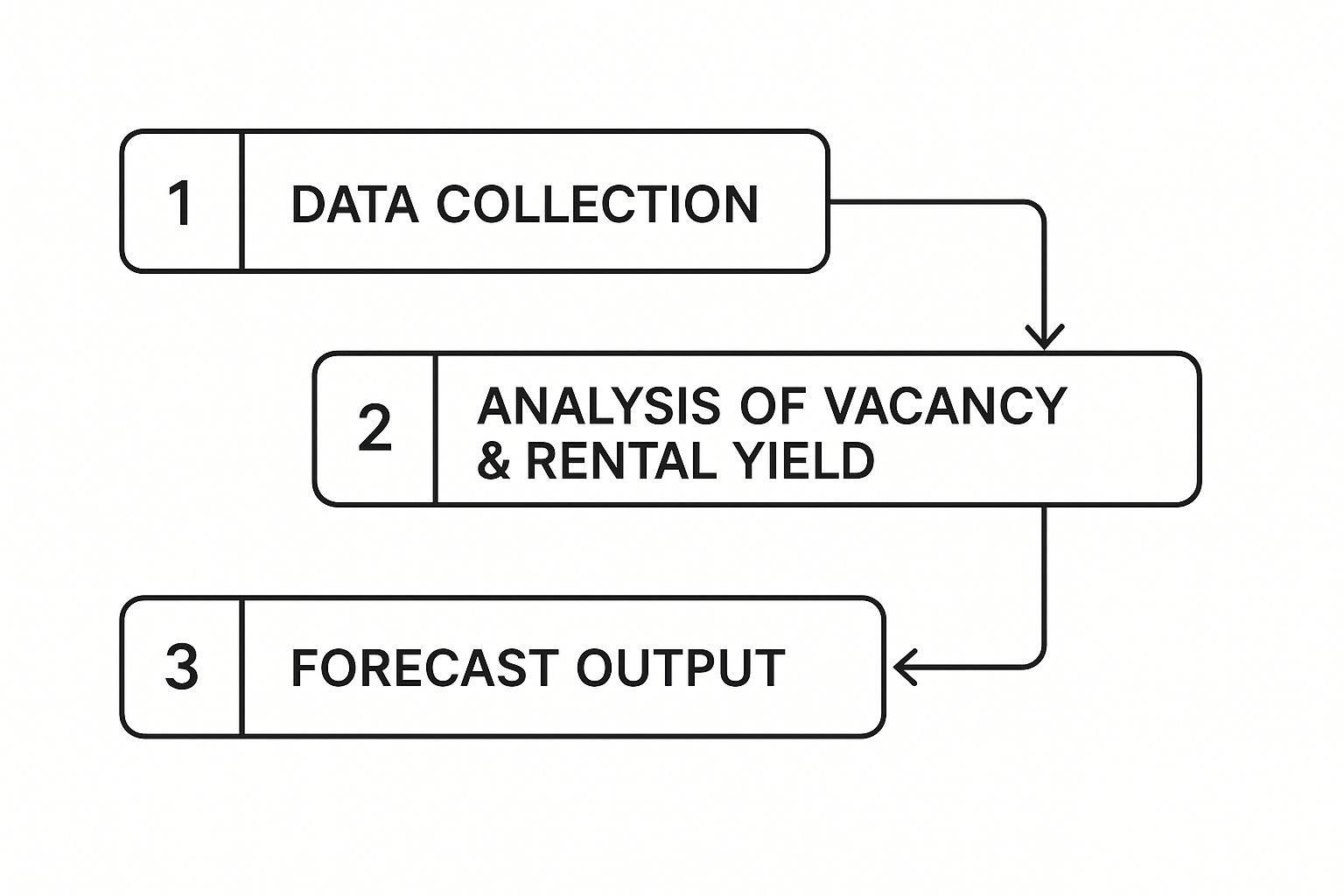

This visual workflow shows how we move from initial data gathering to a final forecast.

This sequence makes it clear that a reliable forecast isn't guesswork; it's the direct output of careful data collection and methodical analysis.

Step 3: Scrutinize the Competitive Landscape

No property exists in a vacuum. A critical piece of your analysis is understanding the competition—both what’s there today and what’s coming down the pike tomorrow. Overlooking future supply is one of the fastest ways to watch a great deal turn sour.

Start by mapping out all comparable properties in your submarket. What are their strengths and weaknesses? Are they newer? Do they offer better amenities? What are their current rental rates and vacancy levels? This gives you a clear baseline for how your potential acquisition stacks up.

Next, you absolutely must investigate the development pipeline. This means digging into local municipal records, scouring industry news, and using data platforms like CoStar or Reonomy to find out what new construction projects are planned or already underway. A massive new office tower breaking ground next door could flood the market in two years, putting serious downward pressure on your projected rents.

Step 4: Evaluate Economic and Demographic Drivers

Now it's time to zoom back out and look at the underlying forces that will fuel long-term demand. A beautiful building in a weak or declining economy is a risky bet. You need to verify that the local economic and demographic trends can support a healthy investment for years to come.

Focus on getting solid answers to these questions:

1. Job Growth: Is the area adding jobs? More importantly, what kind of jobs? Diverse, high-wage job growth is a powerful indicator of a healthy market.

2. Population Trends: Is the population growing or shrinking? Is it attracting the young professionals or families that your target property needs as tenants?

3. Major Employers and Industries: Does the local economy rely on a single large employer (a huge risk), or is it diversified across multiple stable industries?

Step 5: Synthesize and Form Your Investment Thesis

The final step is to pull all your findings together. This is where you synthesize the data from the previous four steps into a clear, defensible investment thesis. This isn’t just a summary; it's your core argument for why this specific property, in this submarket, at this time, is a smart investment.

Your thesis should be a concise statement that answers the ultimate question: Go or No-Go? It must clearly articulate the opportunity you've identified, the risks you’ve acknowledged, and exactly why you believe the potential returns justify those risks. This final synthesis is the cornerstone of your entire deal package, giving you and your investors the confidence to move forward.

Decoding the Market with Performance Metrics

Metrics are the vital signs of any commercial real estate market. They’re how we translate all the complex, moving parts of an economy into a clear language we can actually use. For a syndicator, getting comfortable with these numbers is what separates a good guess from a great investment.

Think of the Vacancy Rate as the "unemployment rate" for buildings. It’s a simple but incredibly powerful health indicator. Low vacancy means a tight, in-demand market where landlords have the negotiating power.

Then you have the Absorption Rate, which is like the market's "hiring rate." This tells you how fast available space is actually being leased up. A positive absorption rate is a fantastic sign, showing that demand is outpacing the new supply coming online.

Reading the Story Behind the Numbers

Here’s where experience really comes into play: these metrics almost never tell the whole story on their own. The real insight comes from seeing how they interact with each other.

For example, a market might have an incredibly low vacancy rate of 5%. On the surface, that looks amazing. But what if the absorption rate for the last quarter was negative? That's a huge red flag.

This combination paints a crucial picture: even though the market is nearly full, tenants are actually leaving faster than new ones are signing leases. This could be an early warning of an economic slowdown or a sign that a flood of new, more appealing properties is about to pull tenants away. This is exactly the kind of risk a deep commercial real estate market analysis is designed to uncover.

Combining vacancy rates with absorption trends lets you move beyond a simple snapshot of the market. You start to understand its momentum and trajectory, which is absolutely critical for making smart, forward-looking decisions.

Differentiating Between Asset Classes

Metrics get even more interesting when you start slicing the data by property class—typically labeled Class A, B, and C. These aren't just arbitrary labels; they represent a clear spectrum of quality, from brand-new, premium buildings (Class A) to older, functional properties that might need a little love (Class C).

Looking at these classes separately can reveal powerful trends, like a "flight to quality." When the economy gets shaky, you'll often see tenants consolidate into higher-quality Class A spaces. They might downsize, but they want better amenities and locations. This can cause vacancy rates in Class B and C properties to spike, while Class A buildings hold their own.

We’re seeing a classic example of this play out right now in the U.S. office sector. The national office vacancy rate has hit a record high of 19.6%, but that pain isn’t spread evenly. In a major hub like San Francisco, Class A office vacancies have shot past 20%, but a lot of that is due to new supply hitting a soft market. Meanwhile, older Class B and C buildings are struggling even more to keep the tenants they have.

The Cap Rate: Your Ultimate Value Indicator

If there's one metric that gets the most attention, it's the Capitalization Rate, or Cap Rate. You calculate it by dividing a property's Net Operating Income (NOI) by its current market value. In essence, it’s the unleveraged annual return you could expect from the property.

- Low Cap Rates (say, 3-5%) usually point to a lower-risk, highly desirable asset in a top-tier market. Investors are willing to pay a premium for each dollar of income, which signals their confidence in the property's stability and future.

- High Cap Rates (maybe 7-10% or more) often signal higher risk. This could be due to a weaker location, an older asset with deferred maintenance, or other operational hurdles. That higher potential return is your compensation for taking on more uncertainty.

The cap rate is so much more than a simple calculation; it’s a direct reflection of market sentiment. Watching whether cap rates are compressing (going down) or expanding (going up) gives you powerful clues about investor confidence and which way property values are heading. For a more detailed breakdown, check out our guide on commercial real estate investment analysis.

Once you’ve put all these performance metrics on the table, the real work begins. The next step is to use these insights to build effective strategies for market opportunity identification. When you can speak the language of metrics fluently, you’re in a much stronger position to spot undervalued assets and make the kind of data-driven decisions that build a truly resilient portfolio.

How to Analyze Different Commercial Property Types

Any seasoned investor knows a fundamental truth in commercial real estate: you can't analyze a warehouse the same way you analyze an apartment complex. The forces that make a logistics center profitable are a world away from what drives success in a retail strip mall. Applying a one-size-fits-all market analysis is a classic rookie mistake, and it's one that can cost you dearly.

To get it right, you have to dig deeper than general market trends. You need to zero in on the specific economic drivers, demographic shifts, and infrastructure realities that matter for your chosen asset class. This means asking the right questions and focusing on the right data for the property type you're targeting.

Multifamily: It's All About People

When you're analyzing a multifamily property, you're really making a bet on people—where they're moving, how they're living, and what they can afford. The core of your analysis should be demographics. Is the population growing? Are new households being formed faster than new apartments are being built?

Ask yourself these critical questions:

- What's the average household income, and more importantly, is it on the rise?

- Are major local employers hiring? New jobs today mean new tenants tomorrow.

- How does the current housing supply stack up against projected demand? An undersupplied market is a landlord's best friend.

Right now, multifamily is a fascinating space. We've seen net absorption jump 20% year-over-year to 531,000 units, which signals incredibly strong demand. At the same time, new construction is finally starting to cool off, which could give rental rates a chance to stabilize. You can dive deeper into these trends with these commercial real estate market insights from NAR.realtor.

Industrial and Office: The Big Picture vs. The New Reality

The conversation changes completely when you look at industrial properties. Here, it’s all about logistics, infrastructure, and the flow of goods. Your analysis needs to be centered on things like proximity to major highways, ports, and airports. The unstoppable growth of e-commerce is the wind in the sails of this sector, so understanding supply chain trends is non-negotiable.

Office properties, on the other hand, are navigating a whole new world. The rise of remote and hybrid work has thrown the old playbook out the window.

Today, a sharp office analysis has to account for the "flight to quality." Companies are ditching their tired, older buildings for brand-new, amenity-packed Class A spaces to lure their employees back. This is creating a massive performance gap between the best buildings and everything else.

Retail: Follow the Money (and the Footsteps)

Finally, for retail, it all comes down to the consumer. You need a rock-solid grasp of the local economy. Are retail sales up? Is consumer confidence strong? These are the vital signs of a healthy retail market.

Beyond that, you have to look at foot traffic and the tenant mix. A shopping center anchored by a busy grocery store is a world apart from one filled with niche, discretionary shops that are vulnerable to economic downturns. By breaking down your analysis for each property type, you move from a generic, high-level view to a precise, actionable investment strategy that actually works.

Frequently Asked Questions

When you're deep in the trenches of commercial real estate, a lot of practical questions pop up, especially when you're a syndicator trying to get every detail right. Let's tackle a few of the most common ones we hear.

How Often Should I Update My Market Analysis?

Think of your market analysis as a living document, not a one-and-done report you file away. For a property you’re actively trying to acquire, you should be refreshing crucial data like rental comps and vacancy rates at least quarterly.

For assets already in your portfolio, a deep-dive annual review is a good rule of thumb. This keeps you on top of emerging trends before they become major problems or missed opportunities.

Of course, some events demand an immediate re-evaluation.

- Big economic news: If the Fed makes a major move on interest rates or local unemployment numbers suddenly jump, it's time to pull up your data.

- New competition: A shiny new development getting announced down the street? You need to understand its impact on your property yesterday.

What Is the Most Common Mistake to Avoid?

The biggest pitfall we see is relying on a single source of information. Pulling all your comps from one platform or basing your economic forecast on a single report leaves huge blind spots in your underwriting. It’s a recipe for unwelcome surprises.

Real confidence in a market analysis is built on triangulation. You know you’re on solid ground when multiple, independent sources—like CoStar, the Bureau of Labor Statistics, and reports from local brokers—all point in the same direction. That's when you shift from a guess to a truly validated investment thesis.

How Granular Should My Submarket Analysis Be?

You need to get hyper-local. I'm talking granular. Analyzing a whole city is way too broad; you have to drill down to the specific neighborhood or even a few-block radius where your property is located.

A submarket isn't just a zip code. It could be the five-block area surrounding a major hospital, a specific industrial park with great highway access, or the retail corridor along a single busy street. The tighter your geographic focus, the clearer your picture of the real supply and demand dynamics will be.

Ready to stop juggling spreadsheets and start closing deals more efficiently? Homebase is the all-in-one platform built by syndicators, for syndicators, to manage your fundraising, investor relations, and deal pipeline seamlessly. Learn more about how Homebase simplifies syndication.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

Real estate debt funds: A Beginner's Guide to Smarter Real Estate Financing

Blog

Explore how real estate debt funds work, from capital structure to returns, and learn how they fit into a diversified investing strategy.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.