2025 Commercial Real Estate Closing Checklist: 8 Essential Steps

2025 Commercial Real Estate Closing Checklist: 8 Essential Steps

Use our commercial real estate closing checklist to ensure a smooth transaction. Discover 8 key milestones for success in 2025!

Domingo Valadez

Oct 9, 2025

Blog

Closing a commercial real estate deal is the final, high-stakes sprint in a marathon transaction. The path from a signed purchase agreement to the closing table is paved with critical deadlines, complex documentation, and numerous third-party dependencies. A single misstep, an overlooked contingency, or a poorly reviewed document can unravel months of hard work, leading to costly delays, renegotiations, or even the collapse of the entire deal. For real estate syndicators, multifamily investors, and sponsors, mastering this final phase is not just a procedural formality; it is a fundamental aspect of risk management and asset acquisition.

This is where a detailed and actionable commercial real estate closing checklist becomes an indispensable tool. It transforms the overwhelming complexity of the closing process into a manageable, step-by-step roadmap. This guide is designed to be that roadmap. We will move beyond a simple list of tasks and dive into the specific actions, potential pitfalls, and strategic considerations for each of the eight critical milestones in a commercial closing.

From verifying due diligence findings and scrutinizing title commitments to finalizing loan documents and preparing the settlement statement, each item on this list is a crucial checkpoint. This comprehensive breakdown will equip you with the practical insights needed to navigate the final stretch with precision, ensuring a smooth, timely, and successful transaction. You will learn not just what to do, but why it matters and how to execute it flawlessly, protecting your investment and securing your asset with confidence.

1. Due Diligence Review and Documentation

Due diligence is the backbone of any sound commercial real estate acquisition. It’s a comprehensive investigation into every facet of the property, from its physical condition to its financial health and legal standing. This phase is your opportunity to verify the seller’s claims, uncover potential risks, and ensure the asset aligns with your investment thesis before the deal becomes final. A thorough due diligence process protects you from costly surprises post-closing and is an indispensable part of any commercial real estate closing checklist.

The Scope of Due Diligence

This process involves a deep dive into several key areas:

- Financial Verification: Scrutinize rent rolls, operating statements, and service contracts to confirm the property's net operating income (NOI).

- Physical Inspection: Engage engineers and contractors to assess the building’s structural integrity, roof, HVAC systems, and other critical infrastructure.

- Legal & Title Review: Examine the title report for liens or encumbrances and review zoning regulations to ensure compliance with your intended use.

- Tenant Analysis: Review all lease agreements and, crucially, obtain estoppel certificates from tenants to confirm lease terms and identify any disputes.

Actionable Tips for Effective Due Diligence

To maximize the value of this critical period, approach it systematically.

- Start Immediately: Kick off your investigation the moment the purchase agreement is executed to make the most of your contingency period.

- Engage Experts: Do not rely solely on seller-provided documents. Hire independent, third-party professionals such as environmental consultants, structural engineers, and legal counsel.

- Document Everything: Maintain a detailed record of all findings, communications, and reports. This documentation is vital for negotiations and serves as a legal record if you need to terminate the contract.

- Focus on Environmental Risks: Environmental issues, such as soil or groundwater contamination, can carry significant long-term liability. A Phase I Environmental Site Assessment (ESA) is standard practice, with a Phase II often necessary if risks are identified.

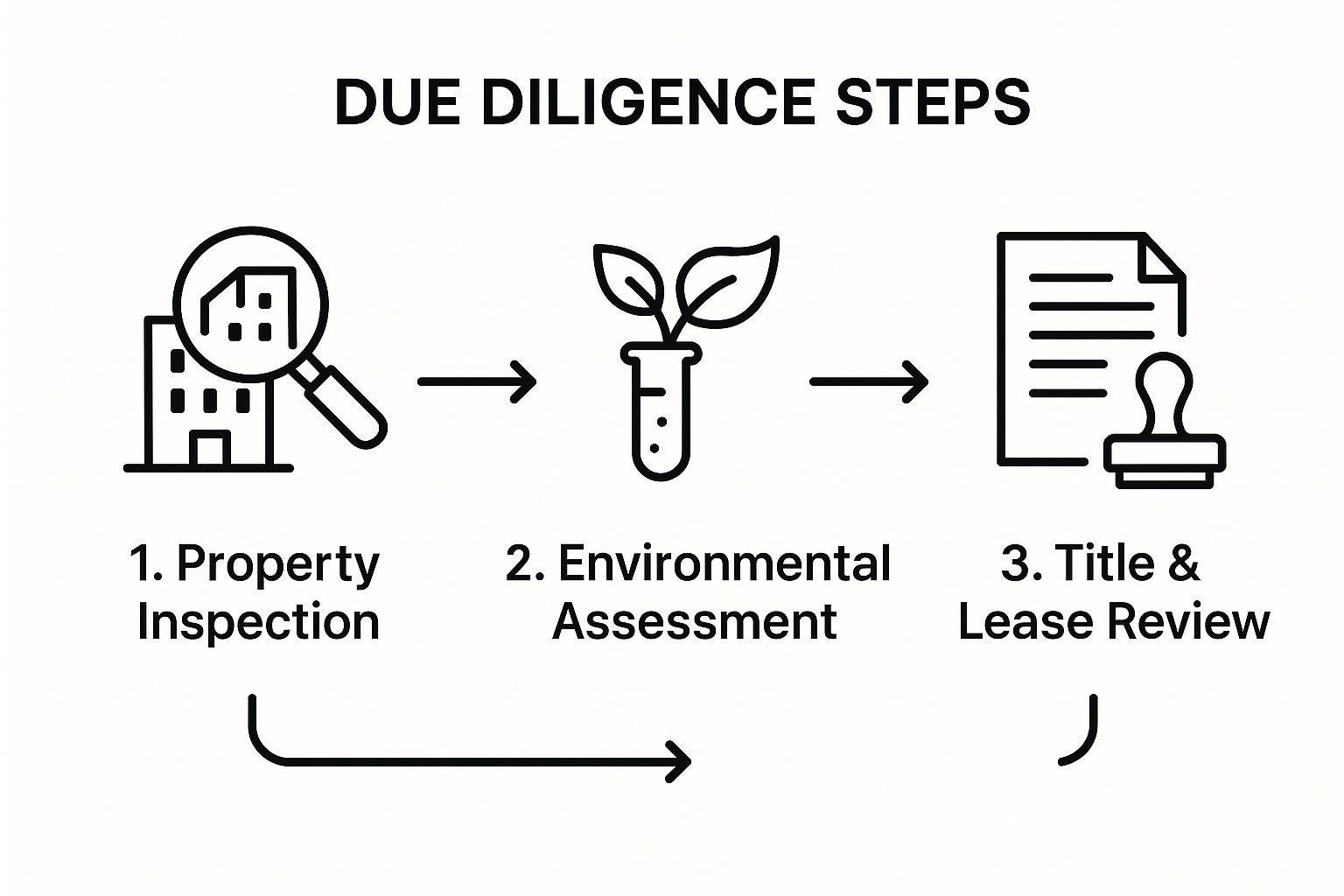

This infographic outlines the core workflow of a typical due diligence investigation, showing the logical progression from physical inspection to legal and financial review.

Each step in this process builds upon the last, providing a comprehensive picture of the property's viability and potential liabilities.

2. Title Insurance and Survey Review

Securing clean title and a precise survey are fundamental to a successful commercial real estate closing. Title insurance is a policy that protects property owners and their lenders from financial losses arising from defects in the property’s title, such as liens, encumbrances, or ownership disputes that existed before the purchase. A survey is a detailed map that defines the property's legal boundaries, identifies easements, and pinpoints the location of all improvements and potential encroachments. These two components work in tandem to guarantee that you are acquiring exactly what you agreed to buy, free from hidden claims or boundary issues.

This infographic highlights the crucial interplay between title examination and the property survey, demonstrating how they work together to provide a clear and insurable picture of the real estate asset.

Without this critical review, an investor could face significant legal challenges and financial losses long after closing.

The Scope of Title and Survey Review

The review process is designed to uncover and resolve any issues that could cloud ownership:

- Title Examination: A title company performs a detailed search of public records to create a "title commitment." This report lists all requirements to issue a policy and details any "exceptions" or items the policy will not cover, such as a recorded utility easement.

- Survey Analysis: The survey, particularly an ALTA/NSPS Land Title Survey, provides a comprehensive visual representation of the property. It confirms boundaries, locates improvements, and reveals unrecorded issues like a neighbor’s fence encroaching on the property.

- Curing Objections: Your legal counsel will review both documents and identify any unacceptable items. For example, a title examination might discover an unreleased mortgage from a previous owner that the seller must resolve before the transaction can proceed.

- Policy Issuance: Once all issues are resolved, the title company issues the final owner's and lender's title insurance policies at closing, providing long-term protection.

Actionable Tips for Title and Survey

To ensure a smooth process, a proactive and detailed approach is essential.

- Order Immediately: Request the title commitment and survey as soon as the purchase agreement is signed to allow maximum time for review and resolution of any issues discovered.

- Scrutinize All Exceptions: Work closely with your attorney to review every exception listed on the title commitment. Do not assume standard exceptions are harmless; they could impact your future use of the property.

- Demand a Detailed Survey: Always require an ALTA/NSPS Land Title Survey and select relevant optional items from "Table A" to get maximum detail, including the location of utilities and zoning information.

- Negotiate Coverage: Ask the seller to pay for extended coverage on the title policy, which can offer protection against certain unrecorded risks. Also, ensure the survey meets all specific lender requirements to prevent delays.

3. Financing Documentation and Loan Approval

For nearly all leveraged acquisitions, securing and finalizing financing is one of the most critical and time-sensitive elements on the commercial real estate closing checklist. This step moves beyond preliminary approvals to obtaining a formal loan commitment, satisfying all lender conditions, and executing a comprehensive set of loan documents. The financing package establishes the legal lending relationship and perfects the lender’s security interest in the property, making it an indispensable part of a successful closing.

The Scope of Financing Documentation

This process involves a detailed review and execution of all lender-required legal documents, which can vary significantly based on the lender type and loan structure.

- Loan Commitment and Conditions: The formal loan commitment letter outlines all terms and, crucially, lists all conditions precedent that must be met before funding.

- Core Loan Documents: This package typically includes a promissory note (the promise to repay), a mortgage or deed of trust (the property collateral), and a detailed loan agreement.

- Guarantees and Covenants: Lenders may require personal or corporate guarantees, along with covenants that dictate property operations, like maintaining specific debt service coverage ratios.

- Entity and Legal Opinions: Lenders often require specific organizational structures, such as a special-purpose entity (SPE). For example, a CMBS lender might require a non-consolidation opinion letter, which can add several weeks to the closing timeline.

Actionable Tips for Securing Financing

A proactive and organized approach to financing can prevent costly delays and ensure a smooth closing.

- Engage Lenders Early: Apply for financing and obtain pre-qualification letters before you even make an offer. This strengthens your negotiating position and provides a realistic budget.

- Align Timelines: Scrutinize your purchase contract's financing contingency period and ensure it aligns with your lender's underwriting and closing timeline. Request an extension if needed.

- Prepare Documentation in Advance: Have all borrower organizational documents, financial statements, and property due diligence materials compiled and ready for lender review.

- Budget for Closing Costs: Plan for 1-3% of the total loan amount to cover lender origination fees, legal counsel, appraisals, and other third-party reports.

- Seek Legal Review: Always have experienced legal counsel review all loan documents before execution to ensure you understand every obligation, covenant, and recourse provision.

4. Lease and Tenant Documentation Review

In commercial real estate, the income stream from existing tenants is the lifeblood of the asset. A meticulous review of all lease-related documents is non-negotiable, as it ensures the buyer understands the property's true financial performance, tenant obligations, and any potential liabilities they will inherit. This process goes beyond simply reading the leases; it involves verifying their terms directly with tenants and confirming the legal standing of these agreements, making it a critical part of any commercial real estate closing checklist.

The Scope of Lease and Tenant Review

This investigation is centered on verifying the stability and accuracy of the property's income stream.

- Lease Agreement Analysis: A line-by-line review of every lease to understand all clauses, including term, rent, escalations, renewal options, expense pass-throughs, and any landlord obligations.

- Tenant Estoppel Certificates: Obtaining signed statements from tenants that confirm key lease terms, such as rent amount, security deposit, and expiration date. This is crucial for uncovering undisclosed agreements or disputes.

- Subordination Agreements (SNDAs): Reviewing or ensuring Subordination, Non-Disturbance, and Attornment agreements are in place, especially for major tenants. These agreements clarify the rights of the tenant relative to the lender.

- Financial History Review: Analyzing tenant payment histories and security deposit records to identify patterns of delinquency and confirm all funds are accounted for.

Actionable Tips for Effective Lease and Tenant Review

To protect your investment and ensure a smooth transition, adopt a systematic approach to verifying tenant information.

- Prioritize Major Tenants: At a minimum, mandate estoppel certificates from all tenants occupying more than 5% of the rentable space or contributing significantly to the income. For example, in a shopping center, an anchor tenant's co-tenancy clause allowing rent reduction if occupancy falls is a critical detail to uncover.

- Cross-Reference Everything: Compare the information in the estoppel certificates against the lease agreements and the seller's rent roll. Discrepancies, such as an estoppel revealing a verbal agreement for a $200,000 tenant improvement allowance not documented in the lease, are red flags.

- Look to the Future: Identify all leases with expirations or renewal options within the next 12 to 24 months. This helps you forecast future vacancy risks and potential capital expenditures for tenant improvements and leasing commissions.

- Strengthen Your Purchase Agreement: Include a clause in your purchase contract that makes receiving satisfactory estoppel certificates from a high percentage (e.g., 85%) of tenants a condition of closing. This gives you the leverage to terminate the deal if key tenants fail to comply or reveal major issues.

5. Purchase and Sale Agreement Terms Compliance

The purchase and sale agreement (PSA) is the foundational document of any commercial real estate transaction, dictating every party's rights, responsibilities, and deadlines. It serves as the legal roadmap from execution to closing. Ensuring strict compliance with every term and condition is a critical component of a commercial real estate closing checklist, as even minor deviations can jeopardize the entire deal or lead to costly post-closing disputes.

The Scope of PSA Compliance

This process involves a methodical review and execution of all contractual obligations:

- Deadline Adherence: Verify that all time-sensitive milestones, such as the due diligence period, financing contingency, and title objection deadlines, have been met or formally extended.

- Contingency Satisfaction: Confirm that all buyer contingencies (e.g., financing, inspections, zoning approval) have been either satisfied or formally waived in writing.

- Seller Deliverables: Ensure the seller has prepared all required documents, such as estoppel certificates, service contract assignments, and prorations for taxes and utilities.

- Property Condition: Verify that the property’s condition meets the requirements specified in the PSA, often stated as being "in substantially the same condition" as it was upon contract execution, accounting for normal wear and tear.

Actionable Tips for Effective PSA Compliance

To ensure a smooth path to closing, a proactive and organized approach to PSA management is essential.

- Create a Master Timeline: Immediately after execution, create a detailed calendar with all PSA deadlines. Set automated reminders at least five days in advance for each critical date to prevent any from being missed.

- Highlight All Action Items: Read the entire PSA multiple times, using a highlighter or digital annotation tool to mark every single action item, notice requirement, and deliverable for both buyer and seller.

- Document Everything in Writing: Provide all required notices, such as contingency waivers or termination notices, precisely as specified in the contract (e.g., via certified mail or specific email addresses). Keep a meticulous record of all communications. To ensure compliance with all transactional agreements, adopting effective strategies for finding contracts efficiently is paramount.

- Conduct a Final Walk-Through: Perform a final inspection of the property 24 to 48 hours before the scheduled closing. This allows you to confirm its condition and ensure no new issues, like storm damage or removal of included personal property, have arisen.

6. Closing Cost Allocation and Settlement Statement Review

The settlement statement, often a HUD-1 or ALTA statement, is the final financial report card of a commercial real estate transaction. It meticulously itemizes every dollar, detailing all credits and debits for both the buyer and seller. Proper allocation of closing costs and a thorough review of this document are crucial to ensure the financial terms of the purchase agreement are executed flawlessly. This final financial check is a non-negotiable step in any commercial real estate closing checklist, preventing costly errors and post-closing disputes.

The Scope of the Settlement Statement

This document reconciles all financial aspects of the deal, requiring a line-by-line inspection.

- Prorations and Adjustments: This includes the proration of property taxes, utilities, common area maintenance (CAM) charges, and pre-paid rents.

- Transaction Costs: All fees are listed here, such as title insurance premiums, escrow fees, attorney fees, brokerage commissions, and loan origination points.

- Credits and Debits: The statement must accurately reflect the earnest money deposit, any seller-funded repair credits, and the transfer of tenant security deposits.

- Loan Amounts: It verifies the final loan amount being funded by the lender and any associated costs.

Actionable Tips for an Accurate Review

A proactive and detailed approach to the settlement statement review can save you thousands of dollars.

- Request Early Access: Demand a preliminary settlement statement from the escrow officer or closing attorney at least three to five days before the scheduled closing. This provides ample time for review without last-minute pressure.

- Assemble Your Review Team: Never review the statement alone. Go through it line-by-line with your attorney and accountant to catch discrepancies a single set of eyes might miss.

- Verify Independently: Do not take the calculations at face value. Independently verify all prorations for rents, taxes, and operating expenses. For example, ensure property tax prorations are based on the most recent assessment, not an outdated one. An investor once caught an error where taxes were prorated based on the prior year's lower assessment, saving them from a significant shortfall post-closing.

- Confirm All Credits: Double-check that all agreed-upon credits are included, such as funds for negotiated repairs or tenant improvement allowances the seller was responsible for. Also, ensure your initial earnest money deposit is correctly credited to you.

- Scrutinize Security Deposits: Confirm the exact amount of tenant security deposits being held and that they are correctly transferred from the seller to you as a credit on the statement.

7. Entity Structure and Tax Planning

The legal structure used to acquire commercial real estate is far from a mere formality; it's a foundational decision with long-term consequences. This choice profoundly impacts liability protection, tax obligations, financing capabilities, and future exit strategies. Proper planning involves selecting the right entity, such as an LLC or partnership, establishing it legally, and aligning its structure with your financial goals well before the closing date. This proactive step is a critical component of any commercial real estate closing checklist, ensuring a smooth transaction and protecting your asset from day one.

The Scope of Entity and Tax Planning

This process involves strategic decisions made in concert with legal and financial advisors:

- Entity Selection: Choosing the optimal legal structure, such as a Limited Liability Company (LLC), S-Corporation, or partnership, based on liability exposure, tax implications, and investor requirements.

- Formation & Compliance: Legally forming the entity in a chosen state, obtaining a federal Employer Identification Number (EIN), opening a dedicated bank account, and qualifying to do business in the property's state.

- Tax Strategy Integration: Planning for tax efficiency through methods like a 1031 exchange to defer capital gains or commissioning a cost segregation study post-closing to accelerate depreciation.

- Ownership & Governance: Drafting a comprehensive operating agreement or partnership agreement that clearly defines ownership percentages, management roles, profit distribution, and exit procedures.

Actionable Tips for Effective Planning

To ensure your entity structure serves your investment goals, approach the process with foresight.

- Consult Experts Early: Engage your attorney and CPA at least 60 days before the projected closing date. This provides ample time to analyze options and implement the chosen structure without rushing.

- Form the Entity in Advance: Establish your legal entity at least 30 days before closing. This buffer is crucial for obtaining an EIN, opening bank accounts, and preparing the necessary resolutions to authorize the purchase.

- Isolate Liability: Use a separate, single-purpose entity (SPE) for each significant property. This strategy contains liability within that specific asset, preventing a problem at one property from jeopardizing your entire portfolio.

- Plan for the Long Term: When establishing your entity and considering long-term financial goals, it's crucial to integrate effective estate tax planning strategies to safeguard your legacy.

- Maximize Tax Benefits: If you are selling another property, engage a qualified intermediary for a 1031 exchange before closing on the relinquished asset. Immediately after acquiring the new property, order a cost segregation study to reclassify assets and accelerate depreciation, creating significant first-year tax deductions.

8. Final Walk-Through and Property Condition Verification

The final walk-through is your last line of defense before capital changes hands. Conducted 24-48 hours before closing, this inspection is the buyer's final opportunity to confirm the property's condition aligns with the purchase agreement. It’s a crucial step in any commercial real estate closing checklist, designed to verify that no new issues have arisen since the due diligence period, all agreed-upon repairs have been completed, and the property is being delivered as promised. This is not a second due diligence period but a final check to prevent last-minute, costly surprises.

The Scope of the Final Walk-Through

This final inspection is a methodical verification process, not a negotiation. It should focus on specific contractual obligations and the property's current state.

- Repair Verification: Systematically confirm that all repairs the seller agreed to make have been completed to a professional standard.

- Condition Confirmation: Ensure the property has been maintained and has not suffered any new damage, such as a roof leak or equipment failure, since your initial inspections.

- Inclusions Check: Verify that all personal property, fixtures, and equipment included in the sale are present and in the agreed-upon operational condition.

- Vacancy Status: Confirm that any units that were supposed to be delivered vacant are, in fact, empty and broom-clean.

Actionable Tips for an Effective Final Walk-Through

A disorganized walk-through can overlook significant problems. A structured approach ensures nothing is missed.

- Strategic Timing: Schedule the walk-through 24-48 hours before closing. This provides enough time to address any discrepancies without causing a last-minute closing day crisis.

- Bring Your Team: Involve your property manager or a trusted contractor. Their expert eyes can spot issues with HVAC, plumbing, or electrical systems that you might miss.

- Document Meticulously: Take extensive photos and videos to create a clear record of the property's condition just before closing. This visual evidence is invaluable if a dispute arises.

- Create a Punch List: As you inspect, create a detailed punch list of any issues. For example, a failed HVAC unit in a tenant space or water damage from a recent storm.

- Consider an Escrow Holdback: If minor repairs are not completed, rather than delaying the closing, negotiate an escrow holdback from the seller’s proceeds to cover the cost of the work post-closing.

This final check ensures the asset you're acquiring is the asset you agreed to buy. For a more exhaustive guide on what to look for, you can learn more about developing a commercial property inspection checklist.

Commercial Real Estate Closing Checklist Comparison

Closing the Deal and Opening the Door to Opportunity

Successfully navigating a commercial real estate closing is a testament to meticulous planning, exhaustive diligence, and disciplined execution. The process, as detailed throughout this guide, is far more than a simple sequence of tasks; it is a complex symphony of legal, financial, and operational components that must be perfectly harmonized. From the initial due diligence deep dive to the final signature on the settlement statement, each step is a critical building block forming the foundation of your investment. A comprehensive commercial real estate closing checklist is not just a tool for organization; it is your strategic roadmap to mitigating risk and maximizing value from day one.

By treating this guide not as a passive list but as an active, dynamic project plan, you transform a potentially overwhelming undertaking into a structured, manageable, and ultimately successful transaction. Each item, from verifying tenant estoppels to scrutinizing the final survey, represents a crucial checkpoint that safeguards your capital and the interests of your investors.

From Checklist to Confidence: Key Takeaways

Mastering the closing process means internalizing several core principles that extend beyond simply checking boxes. The most successful investors, syndicators, and sponsors understand these nuances implicitly.

- Proactive Management is Paramount: The closing period is not a time for passive waiting. It demands constant communication, follow-up, and anticipation of potential roadblocks. Whether it’s chasing a lender for final loan documents or coordinating with the title company on a complex exception, your active involvement is the engine that drives the transaction forward.

- Details Determine Destiny: A seemingly minor oversight, such as a miscalculation on a pro-rata tax allocation or an unaddressed survey encroachment, can blossom into a significant financial or legal liability post-closing. The discipline to scrutinize every line item on the settlement statement and every clause in the title commitment is what separates seasoned professionals from novices.

- The Team is Your Greatest Asset: No commercial real estate transaction is a solo endeavor. Your success is directly tied to the expertise and responsiveness of your legal counsel, title agent, lender, and other advisors. Cultivating these relationships and leveraging their specialized knowledge is a critical component of a smooth closing process.

Your Next Steps: Building on a Solid Foundation

With the keys in hand and the deal officially closed, the real work of asset management and value creation begins. The diligence you invested in the closing process now pays dividends, providing you with a clear and accurate understanding of the asset you own. The final walk-through confirms the property's condition, the reviewed leases establish your income stream, and the clean title policy ensures your ownership is secure. This solid foundation is what enables you to execute your business plan with confidence.

Ultimately, a flawlessly executed close does more than just transfer ownership; it sets the tone for the entire investment lifecycle. It builds credibility with your partners, reassures your investors, and positions you to unlock the property's true potential. By embracing the complexity and applying a systematic approach guided by a robust commercial real estate closing checklist, you are not just acquiring a property; you are opening the door to a new and promising opportunity.

Tired of juggling spreadsheets and disconnected systems to manage your deals and investors? Homebase is an all-in-one platform designed for real estate sponsors and syndicators to streamline their entire workflow, from capital raising to investor relations. Organize your closing documents, manage investor communication, and simplify distributions all in one place by visiting Homebase.

Share On Linkedin

Share On Twitter

Share On Linkedin

Share On Twitter

DOMINGO VALADEZ is the co-founder at Homebase and a former product strategy manager at Google.

What To Read Next

A Syndicator's Guide to Commercial Real Estate Valuation

Blog

Master commercial real estate valuation with our syndicator's guide. Learn the income, sales, and cost approaches to build investor confidence.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

Sign up for the newsletter

If you want relevant updates from our team at Homebase, sign up! Your email is never shared.

© 2026 Homebase. All rights reserved.